Introduction

Natural gas has an eclectic mix of interest groups promoting its increased utilization. Environmentalists are focused on the reductions in CO2 and particulate emissions relative to coal for base electricity generation. North American based gas suppliers stress the increased energy security of using domestic energy sources and the potential to remove the geopolitical leverage of oil exporting regions. Political representatives from gas producing provinces and states promote increased usage for the trickle-down economic benefits. Regardless of the biases and vested interests of third parties and consumers, industry has delivered technical and conceptual changes in the past decade that have entirely changed the fundamentals of natural gas supply in North America.

Underpinning the step change in natural gas reserves and market ready supplies has been the change in the perception of fine-grained, organic rich rocks (i.e. shales – although of course not all shales are organic rich). No longer are such rocks viewed only as source and seal candidates, but also as reservoir rocks. These “shale gas” plays, as they are ubiquitously known, can be produced economically through a combination of horizontal drilling and hydraulic-fracture stimulation. Shale gas is often referred to as a “resource play” due to the perceived (and actual) reduction in geologic risk associated with development. Geological variations, complexities and heterogeneities within shale gas plays are exaggerated and downplayed in almost equal measure.

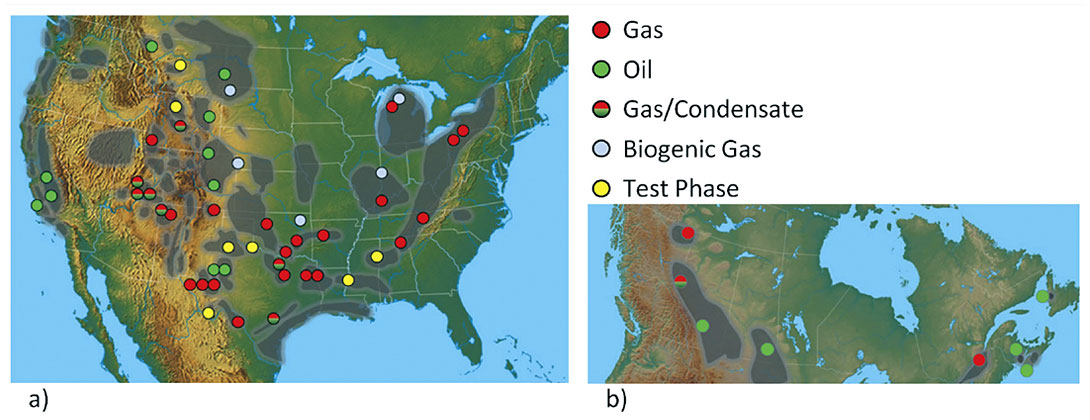

The focus in the mainstream media and in technical conferences on shale gas, and other resource plays, is understandable when the magnitude of the recoverable gas is considered. Projections of this range from 420 tcf to 870 tcf (MITei, 2010), and this number is in constant flux as more resources are identified. In Figure 1, the geographical diversity of shale gas (and indeed shale oil) plays is illustrated. Although these plays differ in detail they share much in common, primarily that to be economically viable the scale of the resource must be such that lifting costs can be driven down through fit-for-purpose technology and operational efficiency gains during initial development stages and that subsequent exploitation takes advantage of realized cost reductions.

The Shale Gas Production Line

Arguably, the development of shale gas resembles a production line more than any other upstream activity. The large number of wells required to get the financially necessary economies of scale ensures a strong emphasis on logistics, supply chain management and operational efficiency. This is true for both service companies, that are typically responsible for ensuring the timely arrival of large amounts of steel, horsepower and proppant; and for operators, that are often running multiple pads (each with multiple horizontal legs) simultaneously and constantly drilling and/or completing different legs.

The number of drilling days per horizontal well tends to decrease drastically as shale gas plays mature and operators and drillers come to terms with challenges unique to the play. Drilling costs decrease commensurate with the decrease in time to drill, but typically as this is occurring the lengths of the laterals are increased and the number of fracture stimulation stages also increased. A play can be considered to have reached ‘operational maturity’ when the completion and stimulation costs are greater than the drilling costs. Multi-stage fracture stimulations allow more of the reservoir to be contacted and therefore increase gas production. In addition to optimizing the number of stages, operators attempt to optimize the size of the stages. Upwards of 100 tonnes of proppant

and 100s of cubic metres of fluid are pumped per stage, and wells today can commonly have more than 10 stages – that is obviously a very large and expensive volume of sand and water. Figure 2 illustrates the large amount of infrastructure required for multiwell, multi-stage fracture stimulations.

The high cost of stimulation, which is driven by both product costs (i.e. sand, water, additives) and service costs (pumps and tanks – horsepower, and personnel), create an intensively competitive environment for service companies. This is particularly true where slickwater fracture stimulations are most common, which is true of most large shale plays in North America (slickwater is simply water with some friction inhibitors added – a commodity that is difficult for any given service company to differentiate from a competitor).

Historically, in plays where cost control is critical to profitability, smaller companies with less overhead have tended to proliferate. Although this may have been true only five to ten years ago the profile of operators active in shale gas plays has diversified over the last two to three years. With Shell, BP and Statoil all either purchasing major land tracts or partnering with domestic American firms in Joint-Venture agreements and the acquisition of XTO by Exxon there is now a significant presence of international and super-majors in North American shale gas. The challenge for all operators, big or small, is to find technological advantages and apply these to maximise profitability and minimise costs.

Role of Technology

Although the geological continuity and consistency (in relative terms at least) of shale gas has in part led to the production-line style operations seen across North America today, the low price of natural gas for an extended period1 has focused operators on cost reduction as a means of maintaining profits. However, it is not efficiency improvements in isolation that allow the economic exploitation of shale gas – it is also the plethora of fit-for-purpose technologies (or at least ‘adapted-for-purpose’) introduced by shale gas operators and their service company partners. Technological advances are unlikely to contribute materially to the discovery of shale gas resources in mature basins, however, technologies that assist in maximizing recovery with less impact and effort will continue to be of fundamental importance in unconventional gas development.

The `technological advances` that led to the initial exploitation of the Barnett Shale in and around Dallas and Fort-Worth, namely horizontal drilling and multi-stage fracture stimulations, were not entirely new to the industry. This supports the notion that technological advances must be partnered with in-depth knowledge and understanding of a problem or challenge for maximal impact. To those that have entered the industry since the concept of shale gas was a given it is almost inconceivable that these technologies would not be routinely applied. Similarly, the increased application of micro-seismic monitoring in the field seems like an obvious technology to complement fracture stimulation treatments – however, such hindsight glosses over the deep expertise, foresight and understanding of the early proponents and adopters of this technology that has fundamentally changed the way fracture treatments are assessed.

The condition that geological understanding is critical to identifying, applying and advancing appropriate technology in any given shale gas play ensures that much effort is spent in gaining knowledge about the formation(s) of interest. This is particularly vital as all shales are not created equal and there are chemical and physical distinctions that differentiate shale gas reservoirs. For instance the Barnett Shale is mostly mudstone, the Bakken Shale is a combination of dolomite and quartz sand and silt grains, and the Marcellus Shale is up to 60% quartz.

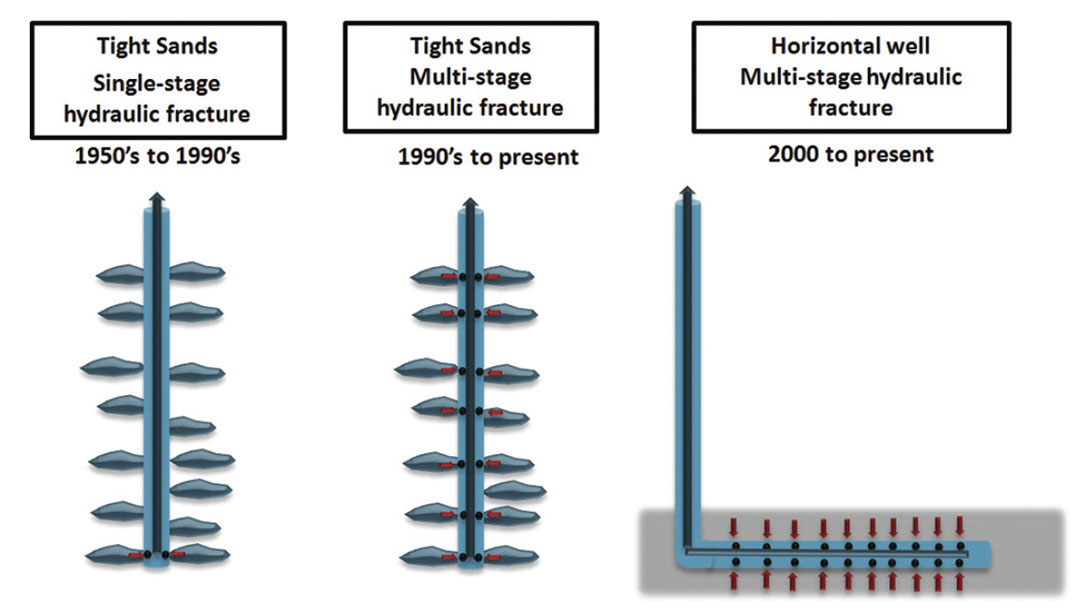

The importance of hydraulic fracturing to producing shale gas can not be overstated. It is the network of fractures created by pumping a slurry of fluids and proppant (typically well sorted sand), which are held open by the proppant after the fluids flow back, that allow the reservoir to produce at economic rates. Hydraulic fracture technology has existed since the mid-twentieth century (Figure 3) and the technology remains effectively unchanged. The scale of treatments has, however, continued to increase and the ability to monitor fracture creation has increased immensely.

Although slickwater is by far the most common fluid used in fracture treatments of shale gas plays in North America, other alternative fluids are also used in certain environments. Diesel based fluids are often used where there may be fluid compatibility issues. Also, carbon-dioxide or nitrogen energised foam fluids are utilised where specific compatibility or leak-off conditions exist. The choice of fluid can be critical to success. However, it is the utilization of hydraulic fractures in long-reach horizontal wells that underpins the economics of shale gas. Figure 4 illustrates schematically how hydraulic fracture technology and geometry has evolved over time.

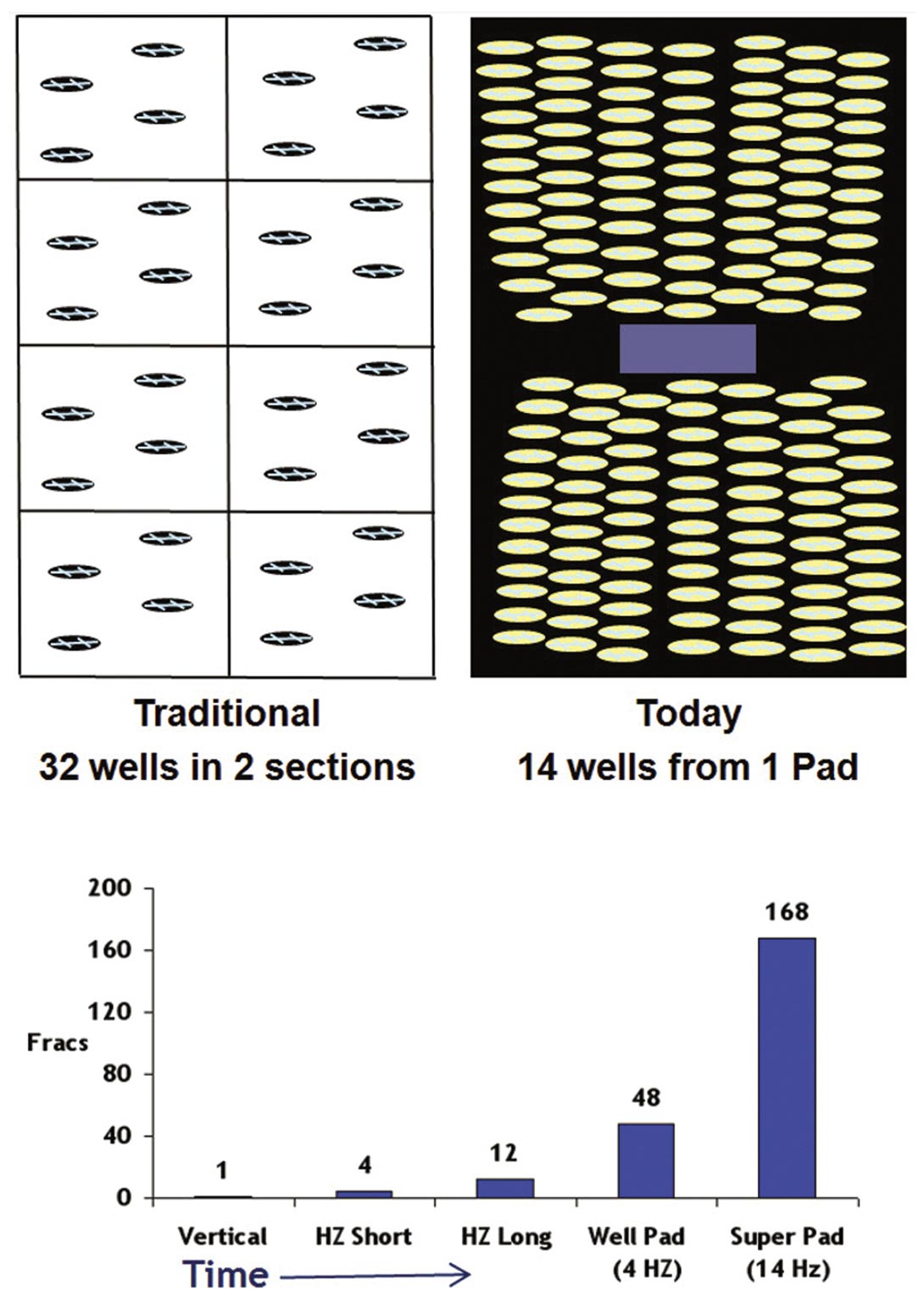

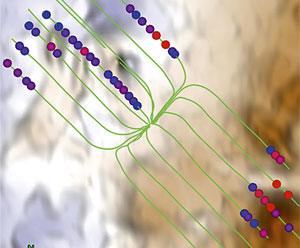

In addition to the utilization of long-reach lateral wells, pad drilling has increased the amount of reservoir contacted by a single surface location, this improves reservoir drainage and increases reserves. Pad drilling also has the added benefit of decreasing the surface footprint of drilling operations. Figure 5 illustrates the change in drilling patterns associated with the pad drilling of multiple long-reach wells from a single surface location.

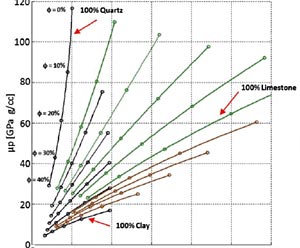

The intense focus on induced fracture networks has increased the attention paid to the rock physics or geomechanics within the reservoir. Whereas in conventional plays geomechanics studies were typically focused on wellbore stability or sand production, in shale gas plays it is the moduli of the rock (and any anisotropy in these moduli) and how the rock responds to fracture treatments that is of greatest interest. For this purpose extensive full core and core plug studies are often incorporated into the initial development stages of a shale gas play, as any small increment in efficiency extracted from the core analysis data can have substantial economic impact over the life of the play. To optimize the collection of core plug data, cluster analysis can be utilized in real-time to ensure that a representative range of lithologies are cored.

The need to understand induced fracture geometries (i.e. height growth, half-wing length, asymmetry) has increased the utilization of microseismic surveying in shale gas plays. This does not indicate that engineers have a new found love for seismic surveying and geophysics – rather it indicates that vital information can be gained from microseismic surveying. That microseismic data are of interest to completion engineers as much as geophysicists is attested to by the various groups (including completion engineers, geomechanical engineers, geophysicists) that ‘own’ the process within different operating companies.

1Average well head price for the 12 months to August 2010 in the USA was $3.86 – http://www.eia.doe.gov/

Role of Seismic

The role of seismic has evolved to be far more than simply a tool for mapping major structures and looking for closure, these are not critical to prospectivity in shale gas. As 3D seismic data are often the only far-field data available pre-drilling, these data remain important to optimizing field development. The conventional uses of seismic data as a tool to avoid hazards, geosteer (optimizing in-zone drilling and minimizing porpoising that can create completion issues) with long reach horizontals remains important. However, it is the integration of seismic data with engineering and rock physics data that is providing new avenues of data exploitation. Seismic data are being used to predict closure stress and stress anisotropy, which can be calibrated with data and analysis from hydraulic fracturing. Additionally, the integration of surface seismic data with microseismic provides a means of fine-tuning the estimation of stimulated rock volume.

The traditional role of seismic will continue to be important for mapping horizons of interest and mapping major faults and more subtle structural trends that may impact drilling and/or completion and production. In general, major faults are avoided during horizontal drilling (where possible) as the behaviour of faults during stimulation is difficult to predict, as is the stress field around some faults. Standard seismic attributes such as coherence and curvature are being successfully utilized to map major and subtle faults and structural trends.

Advanced seismic studies, typically involving pre-stack AVO inversion are becoming common place at many operating companies. In addition to the standard angle variance in seismic amplitude being analysed, increased importance is being placed on the azimuthal variance in seismic amplitude. The combination of AVO analysis with amplitude versus azimuth (AVAZ) and velocity versus azimuth (VVAZ) analyses is providing new means of using existing and newly acquired data.

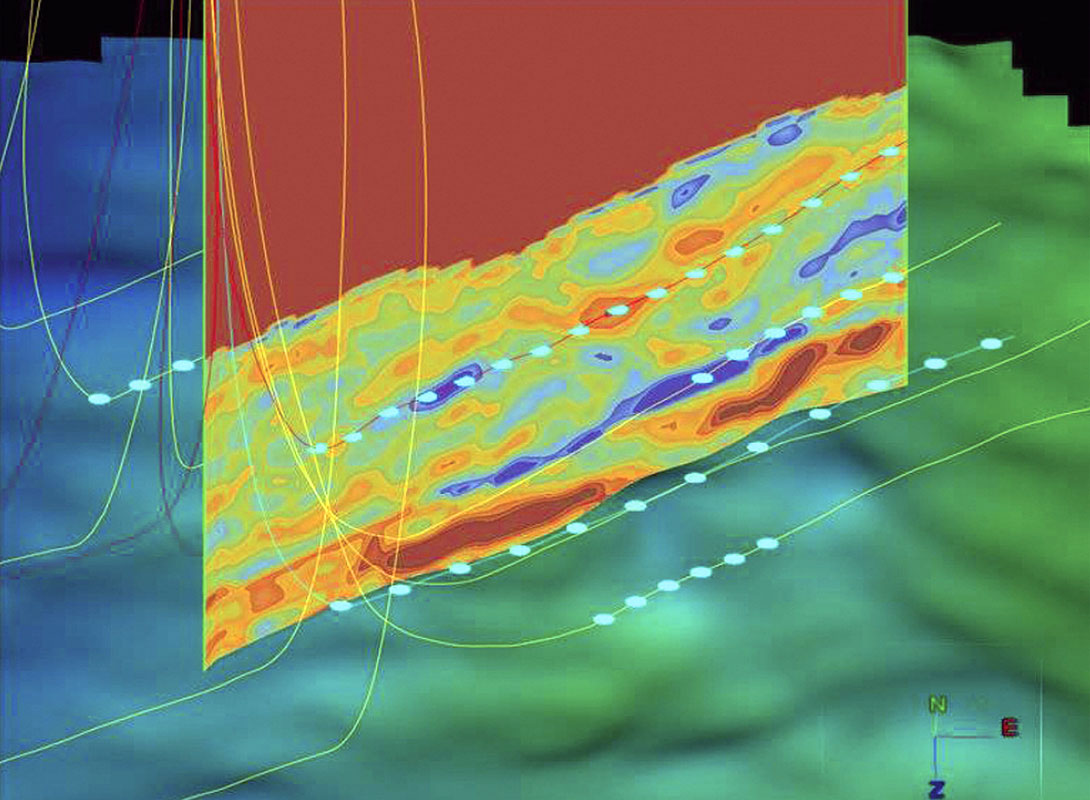

AVO techniques exploit relative changes in seismic reflection amplitudes at varying incident angles to quantify changes in elastic properties at reflection boundaries. These elastic properties are a function of the rock properties that are of interest – which we measure in terms of sonic velocity and density (by virtue of seismic surveying techniques). Through AVO inversion it is possible to derive an earth model that is consistent with measured seismic reflection data. The properties that are typically directly inverted for are acoustic impedance (AI), shear impedance (SI) and density. These properties can be transformed into elastic properties including: Young’s Modulus, Poisson’s Ratio, Bulk Modulus, Shear Modulus and Lamé constants (l and m). It is these elastic properties that are of great interest to drilling and completions engineers. Closure stress estimates (Figure 6) based on these data (Goodway et al., 2010) are of great interest to completions engineers, as this stress is defined as the minimum pressure required to open a preexisting fracture or plane of weakness.

AVAZ and VVAZ techniques rely on amplitude and velocity variation with offset and azimuth, respectively. Horizontal transverse isotropy (HTI) is the assumed model when amplitude and velocity variations are observed. HTI is a reasonable equivalent for vertically aligned fractures. Many advances have been made to characterize the azimuthally dependent signature and ascribe physical significance to distinct seismic responses. These include fracture density, fracture fill (gas vs. water), normal and tangential compliances of the fractures and Thomsen’s anisotropy parameters (Thomsen, 1986, 1988) which relate compressional and shear velocities in vertical and horizontal directions. Advanced techniques also attempt to characterize potential dispersion effects (fluid flow within fracture at seismic frequencies). These methods are all heavily dependent on the model used and although they are simplistic in comparison to subsurface reality, they can provide useful information. In conjunction with models which account for randomly oriented cracks, AVAZ and VVAZ analysis provides bounds on seismic fracture responses.

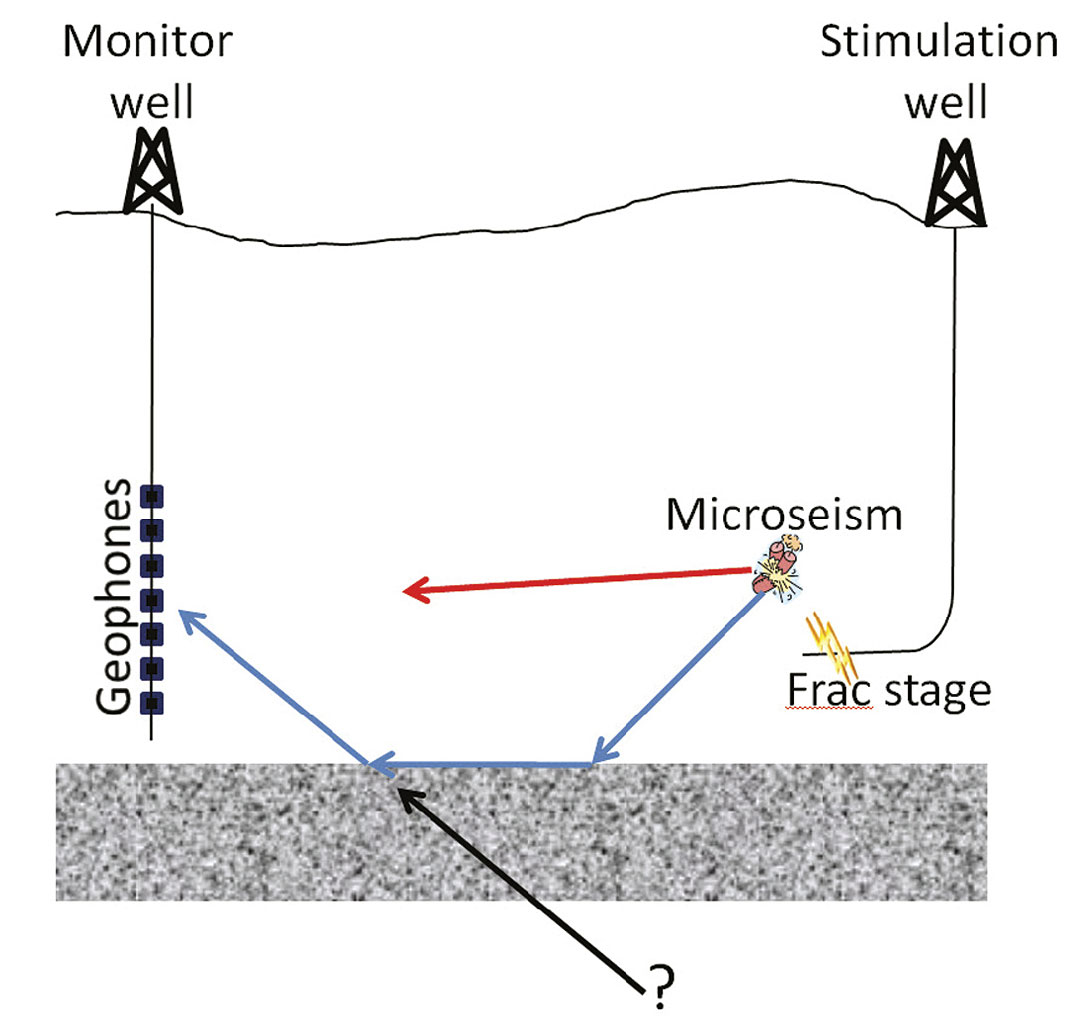

Microseismic monitoring of fracture stimulations has seen huge growth in the past decade, in line with the increase in shale gas activity. Although the technology is not new, monitoring of microseisms has been used in mine safety monitoring for many years, it is still a relatively new technique in the oilfield and in some ways an immature technology. Although it is a relatively simple process to detect microseisms, to locate them correctly in the subsurface is not trivial. In very simplistic terms the location of a microseismic event requires hodogram analysis to estimate direction (relative to a string of geophones), moveout across the string of geophones to estimate depth, and delay of the shear wave arrival relative to the compressional wave arrival at the geophones to estimate distance. To turn these non-dimensional or time-based measurements to distances requires a velocity model, and building an accurate velocity model away from the well control that captures any lateral changes is very difficult. Also, reflected and refracted events could easily be mapped to an incorrect position of a well-constrained velocity model is not utilized in event location estimation (Maxwell, 2009), as illustrated in Figure 7.

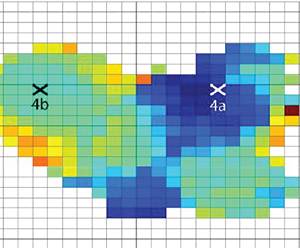

The goal of many current advanced seismic studies is to use the clustering of microseismic events, and their character/attributes, to estimate the volume of stimulated rock and compare it to the volume of pumped fluids and proppants. These volumes, and how they vary between stimulation stages, are then compared back to seismically predicted rock properties and analysed for relationships and correlations – thus integrating the surface seismic and microseismic data with stimulation engineering data (e.g. Close et al., 2010; Simon, 2005).

Time-lapse or 4D seismic may yet prove to be a useful technology for assessing where reservoir has or has not been effectively stimulated. There is evidence from the limited 4D data available in shale gas plays that the effect of stimulation sufficiently alters the rock properties to see changes between baseline and monitor surveys. It seems unlikely, however, that 4D surveying will become common place in shale gas due to the intense focus on costs. The use of 4D surveying could become cost-effective if re-stimulation efforts become more common and uncontacted reservoir can not be predicted through other means (most likely using micro seismic data or production logs).

Technological advances will continue to be focused on optimizing stimulation efficacy. For geophysics to remain relevant in shale gas plays, efforts to illustrate the uplift associated with advanced seismic studies must continue. In the absence of solid results that manifestly impact operations it is possible that geophysics will become a luxury rather than a necessity.

Conclusions

The economic exploitation of gas from organic-rich, fine-grained rocks (colloquially “Shale”) has fundamentally altered the natural gas industry in North America, and may do so globally. The disruptive effect of this to industry cannot be overstated. For professionals typically involved in the finding of gas reservoirs there has been a paradigm shift in focus from exploration led by geologists and geophysicists to exploitation led by engineers. This has posed and continues to pose many challenges to geophysicists, such as how to stay relevant in what is seen by many as more akin to a manufacturing process than typical upstream exploration and development. Geophysicists, however, have found that the rock properties that underpin the seismic response of rocks are the same as the properties of interest to the stimulation engineers. This has opened the door for innovations in advanced seismic studies that not only enforce the relevance of geophysics in shale gas, but provide the opportunity for companies to gain material competitive advantage through geophysical technological innovation.

Acknowledgements

We would like to acknowledge Apache Corp. and Apache Canada Ltd. for allowing the presentation of data at the SEG 2010 and herein.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article