I want to proclaim to the Canadian oil industry that the pity party is now officially over and it is time to get up and get back to work.

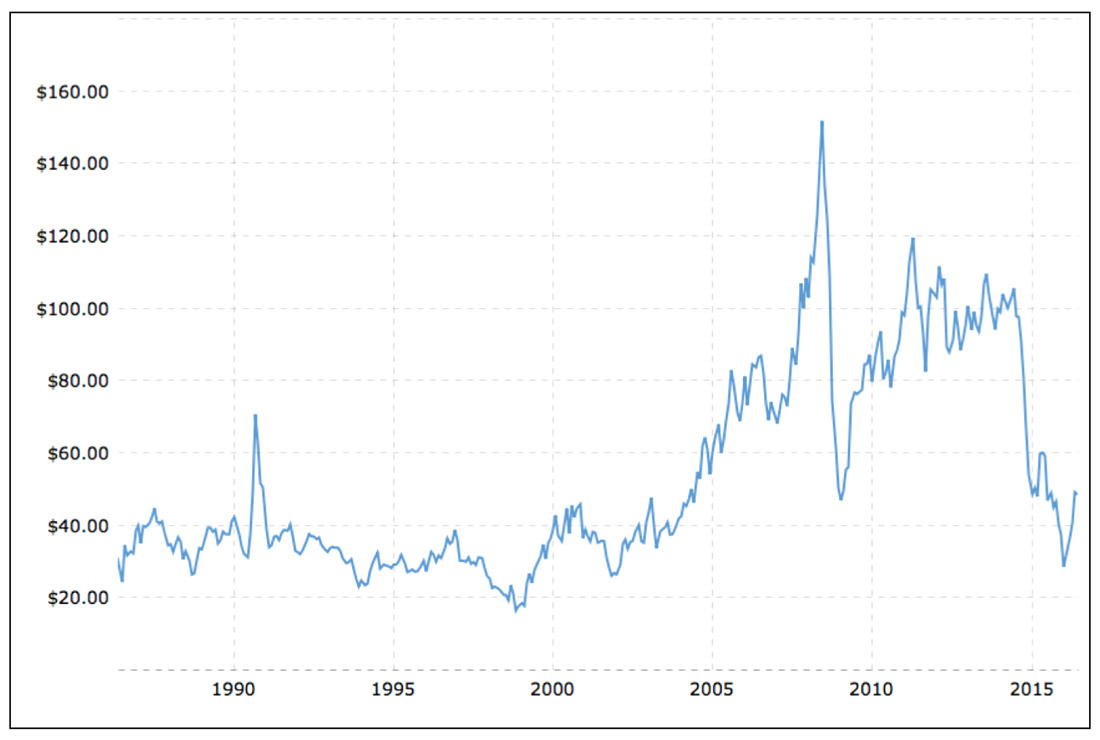

The chart in Figure 1 is taken from the www.macrotrends.net/1369/crude-oil-price-history-chart website and shows the inflation adjusted price of crude oil for the past thirty years, up to the end of May 2016.

The main thing I want to point out on this chart is that the current price of crude, the price that all of the “experts” now proclaim is the new floor for the foreseeable future, is around the same as what the industry enjoyed from 1986 until 2004. For some of us, that was the sweet spot of our petroleum industry careers. A lot of people made a lot of money during those years. There was a definite “can-do” attitude within the industry and many of the current companies that are now teetering on the verge of being majors, such as CNRL began as start-ups during this period.

When I look at this chart, I see cause for optimism for the industry. So, my big question is: Why hasn’t the oil industry woken up from its self-imposed hibernation of the last 18 months?

“We can’t get our product to market.” “Production costs are too high.” “Lack of investor confidence.” I can hear the whining from the executive suites in my quiet home office. I have one word for the people who come up with such excuses. Bullsh*t!

Our infrastructure wasn’t any better in the 1990’s than it is today. In fact, with increased railway transportation capacity today, it is now even better. Maybe a pipeline or two could end up getting built, but only a fool would sit around and wait for that train to arrive any time soon.

Production costs are too high because the industry has been spending all of its time focused on the low hanging fruit of high cost heavy oil and oil shale plays. Look for something that flows more easily and your costs per barrel will come down. We did it in the 90’s without all of the present technology.

Lack of investor confidence has been around since the beginning of capitalism. These guys are fickle and more skittish than a cat in a room full of rocking chairs. They behave like a bunch of lemmings, following each other around with very few of them having a clue about where they are going. If your present investors are not confident in you, change out your management team and/or get new investors. There are some savvy investors currently making a move on the market right now when the opportunities are wide open. Public lands are going for bargain prices; in fact, the lack of landsale activity is shocking and won’t last forever. Companies are selling off lands to stay solvent, creating building opportunity for those prepared to seize them. Snooze and you’ll lose out on the tremendous building opportunity available now, for a limited time only.

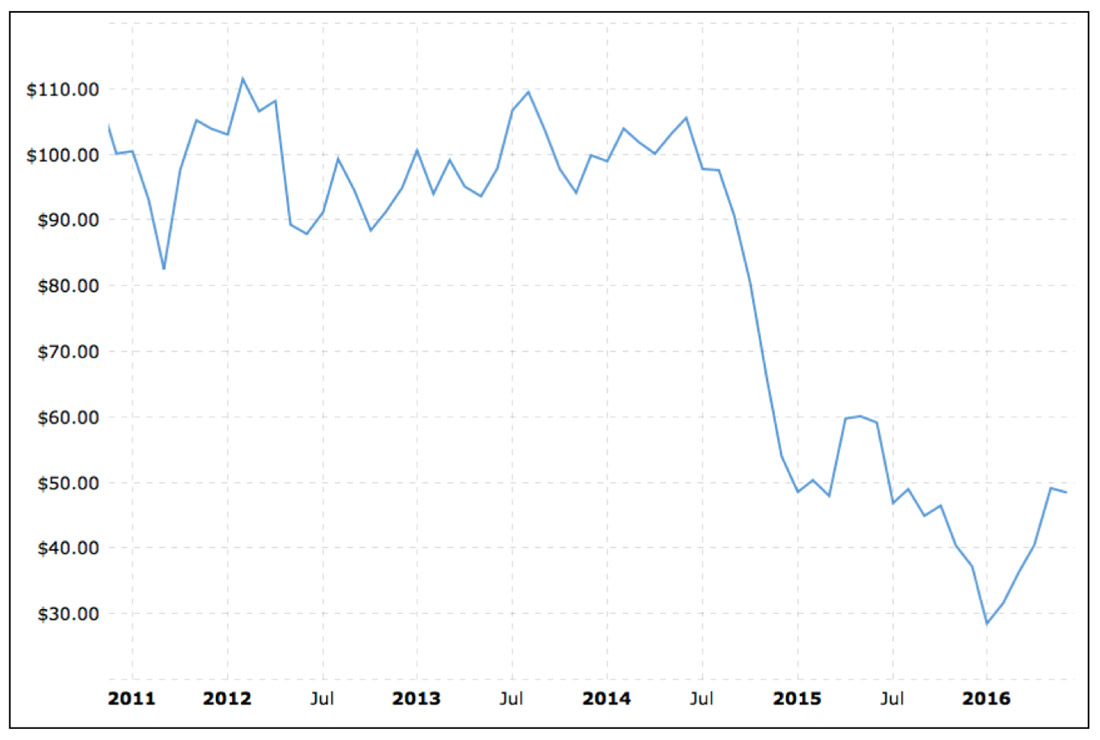

Maybe I shouldn’t be so hard on the panic stricken executive teams with the deer-in-the-headlights look they are all running around with. After all, they are not used to living outside of recent history. They, and other industry naysayers and doomsayers are all used to looking at only the recent history of the oil price chart, shown in Figure 2.

When you look at this chart, there indeed might be cause for panic and reason for several highly paid senior executives and account managers to contemplate jumping out of their thirtieth floor offices onto their Porches and Lamborghinis parked below. This chart would scare anyone whose career in the corner office has spanned the last ten years. In this chart, it looks like the bottom has fallen out of the market and we should all be looking for Tim Hortons and Starbucks franchise opportunities to limp our way into retirement.

WAKE UP, PEOPLE!

A lot of money was made when the price of crude was at or even below the $48 equivalent it sits at today. A lot of oil and gas can be found yet at this price; and if you are not currently planning for that kind of a future, and, instead, hunkering down and awaiting a price recovery, you are doomed. Get your boxes packed and move out of the corner office, because, while you may have been an acceptable choice as CEO when oil was at $100, you are going to suck in the new oil economy.

Back in the late ’80s and ’90s, heavy oil was an anomaly for most of the industry, and the concept of getting production out of tombstone quality rock was laughable. Technology and obscenely high oil prices made such plays possible to do profitably and engineers and investors were happy because they seemingly had gotten rid of the big risk factor of exploring for the conventional stuff: finding porous and permeable rocks for adequate delivery rates to vertical wells. Everybody laughed at the poor dinosaur geologists and geophysicists as the industry fracked their way to success at $100 oil with no end in sight.

Well, we all know how that turned out, don’t we? Now fracking is an increasingly dirty word and heavy oil is demonized by the environmental movement. Right or wrong is immaterial. Public relations was the war being fought, and our industry got trounced. But that isn’t the only problem with resource type plays.

Statistically, most resource plays owe the bulk of their productivity to a few wells that happened to find porous and permeable reservoir, usually by accident. Imagine how much money would have been saved if geoscience was used in the first place to locate the real reservoir. All of the marginal to poor/null productive drilling could have been avoided. Imagine how much could be made if you looked for actual quality rock in quality plays. It would be just like back when oil was at $40 per barrel a few decades ago.

Much of the ongoing problem in developing momentum is a lack of experience looking for conventional reservoirs in the current company executive teams. A change of attitude and expectations must occur in order for the industry to move forward into the new reality.

I won’t kid you. Looking for conventional petroleum is a lot harder than working a heavy oil or oil shale play. The risks are completely different, but we did it successfully in the past and we will do it again. Geoscience skills, like geophysics, once thought best mothballed must now be called into play in order to give a company the technical edge needed to pick the best places to drill where nobody else has yet sunk a well. That takes courage and vision, two things our industry has been lacking over the last number of years. We must get out of the resource play mentality and back into conventional exploration thinking. With the new technologies developed over the past twenty years in drilling and completion, I think that the best is yet to come for our industry if we use all of our assets and knowledge. There are still a lot of us out there that know how to look for oil, but there is only a ten year window before many are retired and the knowledge base vanishes with them.

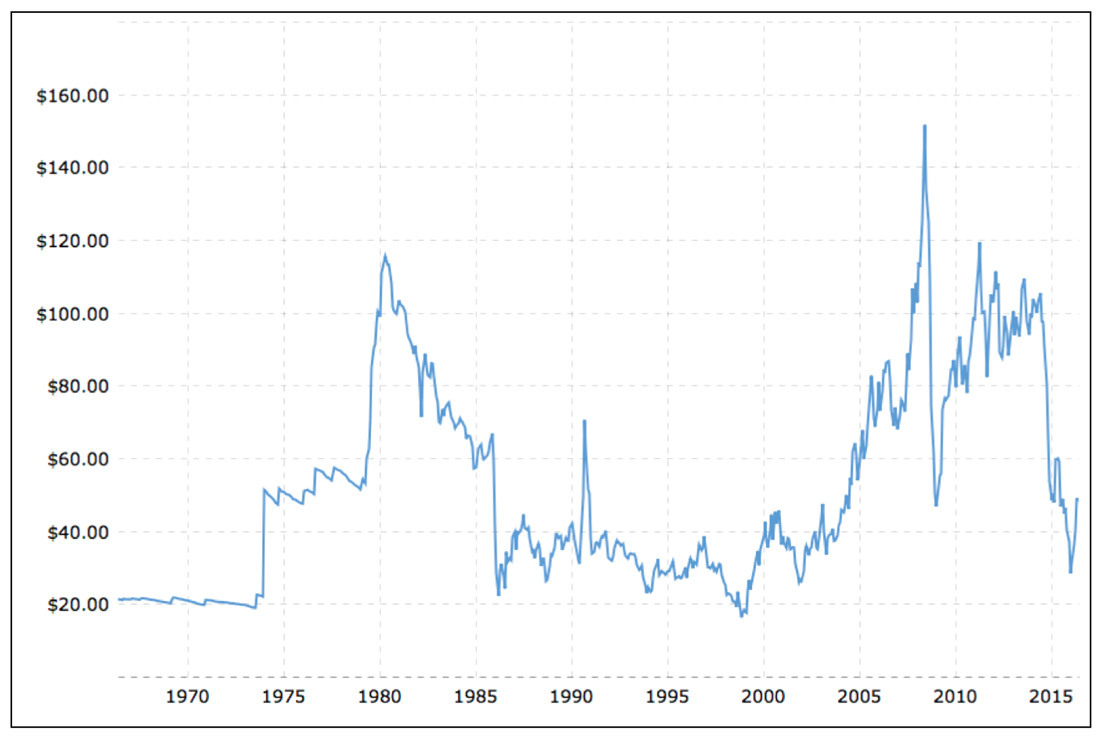

There is one more chart I want to draw your attention to – Figure 3. This chart shows the inflation adjusted price of crude oil since the mid 1960’s. Notice what happened at the end of 1985. Does it look familiar?

The industry survived the precipitous price drop of 1986 and went on to generate an entire generation of new companies and technologies prepared to take advantage of the new price regime. History will repeat itself again. The question that remains to be answered is: who will be the visionaries that act first and position themselves for success over the next decade?

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article