Introduction

In 2000 Talisman Energy Inc. began a project to drill and produce gas in the northern Appalachian Basin of the United States. In particular, it evaluated and entered into operations in the states of New York and Pennsylvania, with ongoing consideration given to the neighbouring states, like Ohio and West Virginia.

After five years of research, meetings, corporate purchases, deal-making, data acquisition, and drilling, Talisman Energy, through it’s subsidiary Fortuna Energy, reached a peak of about 120 mmcf/d gas production from southwestern New York State. The following describes how Fortuna/Talisman accomplished this feat.

History

Talisman, including it’s preceding form of BP Canada, has experience in the Appalachian Basin going back to 1986. As BP Canada, it operated a joint venture in Ontario, southwest of London. After changing to Talisman, and later purchasing Pembina Exploration Ltd. in 1997, it re-entered Ontario, becoming that province’s largest onshore oil and offshore gas operator.

In 2000, following the reports of high rate gas discoveries in the Trenton/Black River Ordovician Formation in New York, Talisman decided to expand it’s operations into the U.S. side of the basin. The first major step took the form of a farm-in of Seneca Resources Corp’s large land holdings in NW Pennsylvania and SW New York (Figure 2).

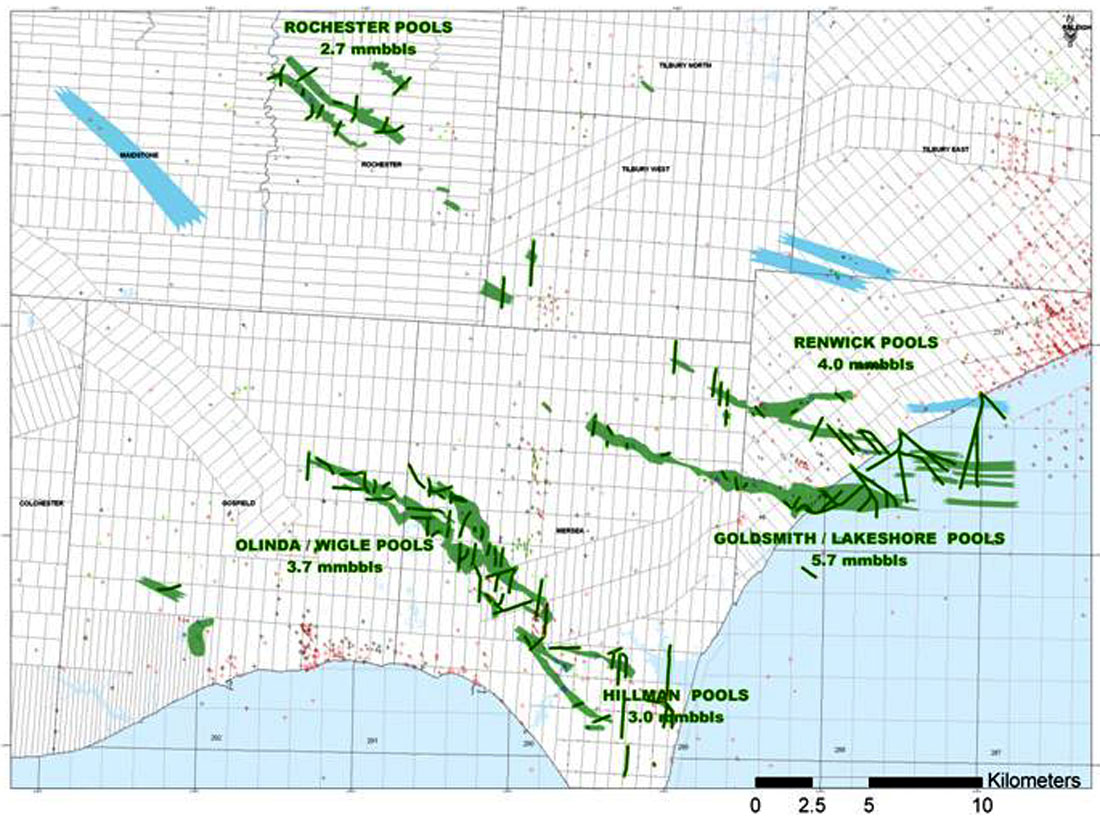

Following two unsuccessful exploratory wells, Talisman’s subsidiary, Fortuna Energy Inc., purchased two major gas operations in the southern Finger Lakes region of New York. All four fields involved in the purchase produce from the Black River Formation. This made Fortuna Energy Inc. the largest gas producer in New York. Since the initial purchase, from a relatively small local operator, Fortuna has drilled over 40 horizontal wells, participated in several other non-operated wells, and raised it’s production to a peak of 120 mmcf/d in 2005 ( Figure 3).

This accomplishment was the result of a large commitment and the employment of a large, experienced, multidisciplinary team, many members of which started with the Ontario properties. The following discussion summarizes some of the challenges, and the techniques used to achieve the current operation.

Geological setting

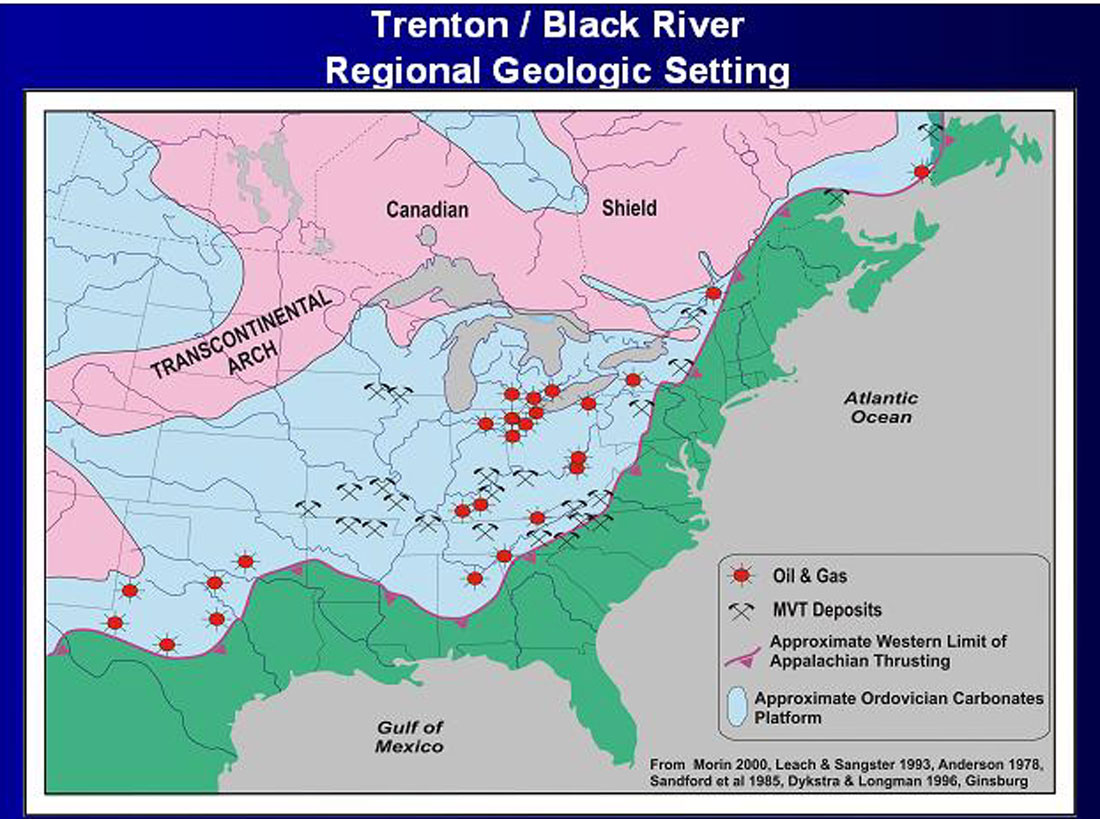

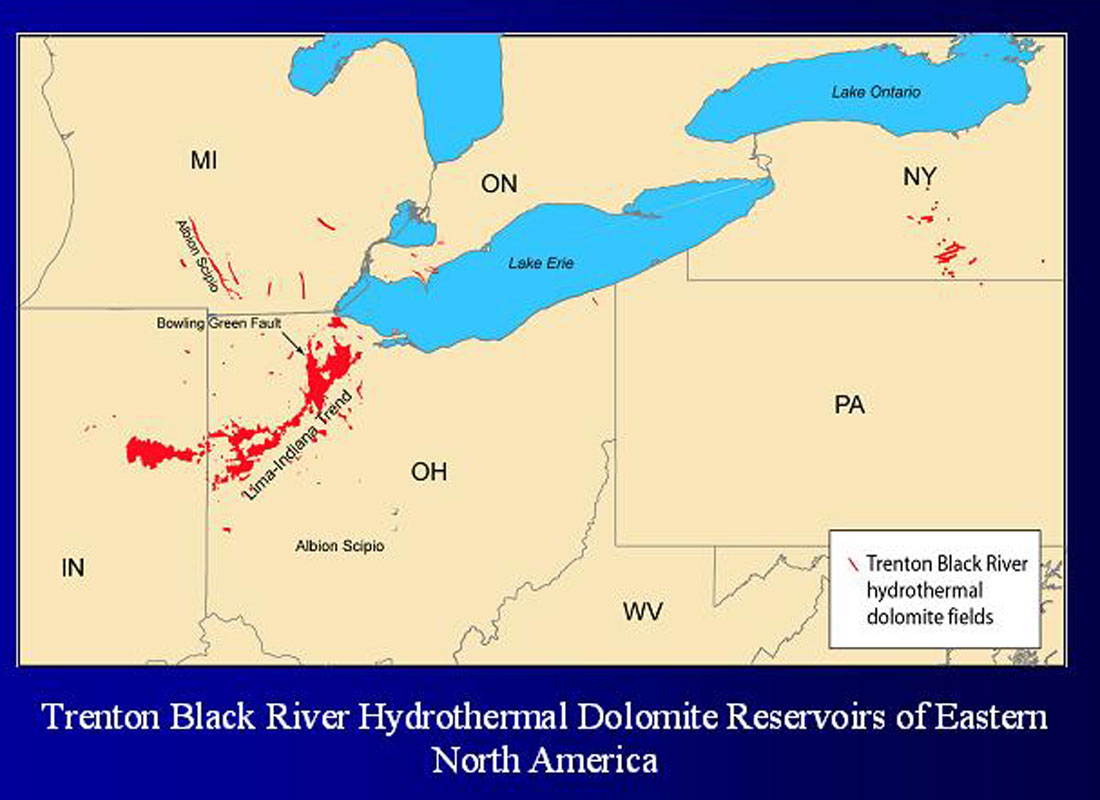

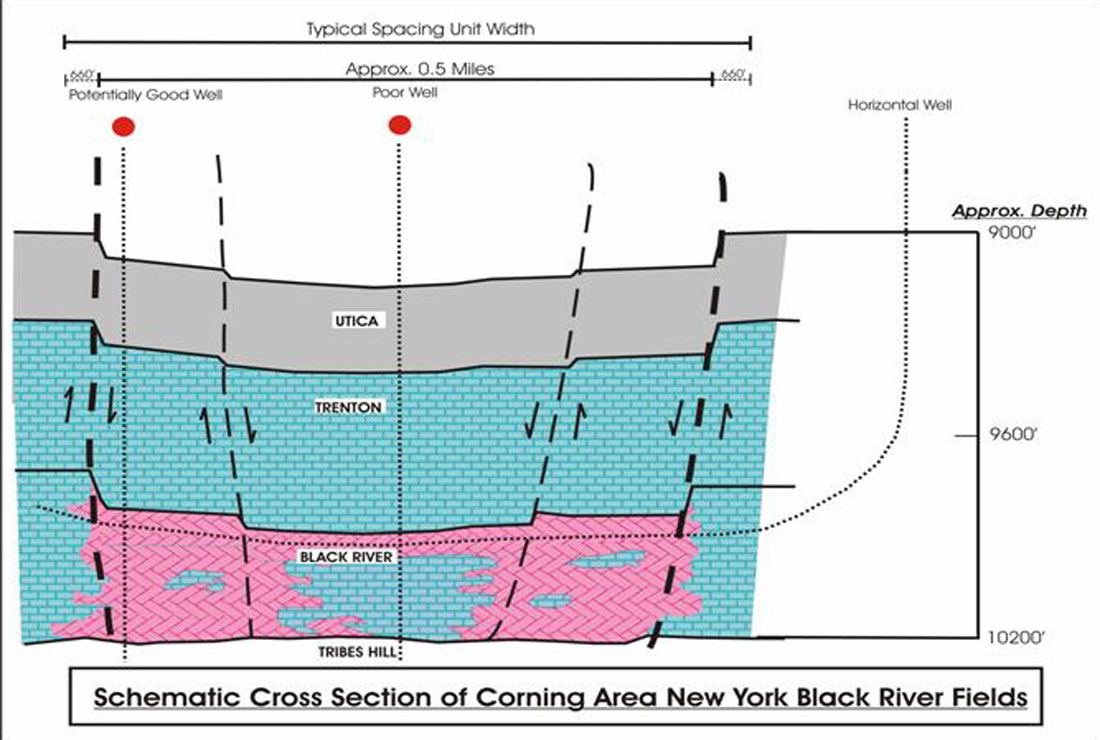

Talisman’s primary target in the Appalachian Basin has been the Ordovician aged Trenton & Black River Formations. These two formations make up the very extensive carbonate platform that extends from Texas to Newfoundland. In Ontario and New York, the two limestone formations produce hydrocarbons from reservoirs formed by hydrothermal alteration of the originally tight limestone to more porous and permeable dolomite, along a series of normal faults.

The Trenton and Black River carbonates have produced oil and gas from several fields in the northeastern U.S., dating as far back as the late 1800’s. Notable examples are the Lima- Indiana trend in western Ohio, and the Albion-Scipio field in southern Michigan.

In SW Ontario, Talisman produces light oil from five of the six main Trenton Fm. fields; reserves totaling approximately 19 mmbo.

The geological model is one of major fault events, interpreted as strike-slip, having fractured and triggered localized alteration of the tight limestone into porous, permeable dolomite.

The history of the Appalachian Basin includes a series of compressional events: the Taconic Orogeny of the Middle Ordovician, the Acadian Orogeny of the Devonian, and the Alleghenian Orogeny of the Pennsylvanian Period. The first two events created a southeastward thickening wedge of carbonates, deep-water shales, and clastics that overlies the original Cambrian aged Rome Trough. The Rome Trough is seen as a failed rift trending southwest through Pennsylvania into eastern Kentucky. The Trenton and Black River carbonates of exploration interest lie on the northwestern side of the trough. The compression events appear to have re-activated the underlying Cambrian fault block to varying degrees. As well, we interpret them as the cause of the faults that control the hydrothermal reservoir development.

The third event, the Alleghenian Orogeny, impacts more the overlying Silurian and Devonian sediments, within the area of our activity. In southwestern New York and northwestern Pennsylvania the preserved Silurian salt section and overlying Devonian section show compressive thin skin deformation, resulting in many large, gas productive, antiformal structures. Where good reservoir rock is present, these structures have made excellent gas storage pools, supporting an excellent pipeline infrastructure.

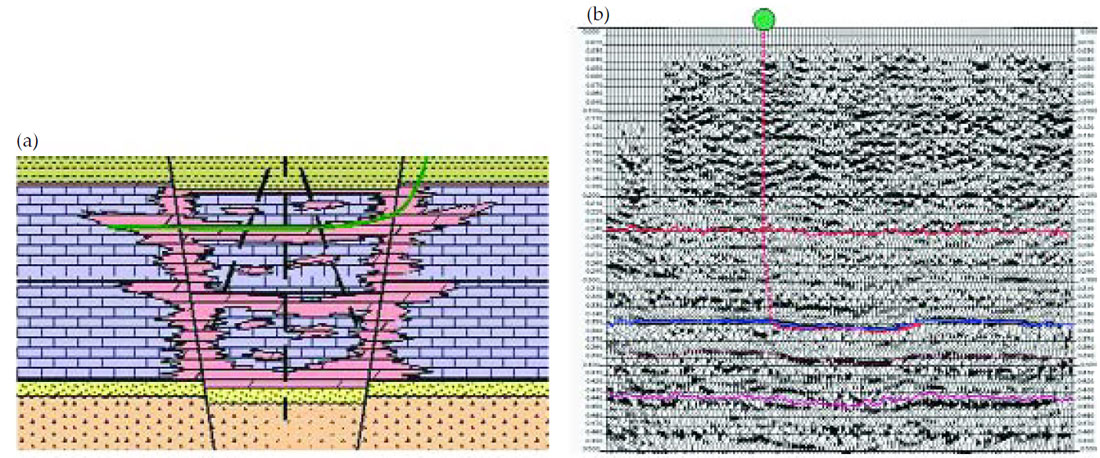

As figure 4 shows, the reservoir is contained within a fault-bounded graben. These grabens have up to 30 meters (10 m. in Ontario) of fault throw and can extend for several kilometers. The hydrothermal alteration and reservoirs occur primarily along the down dropped side of the faults, and inside the graben, within relatively permeable limestone layers like the top of the Black River Formation (New York) and the Sherman Fall Unit of the upper Trenton (Ontario).

Figure 4a. shows dolomite (purple) distributions within the limestone formation, overlain by Ordovician shale, underlain by Cambrian sands.

Figure 4b. seismic line showing a Trenton graben with an oil producing horizontal well drilled within the upper Trenton Fm. section.

Talisman, through it’s subsidiary Fortuna, brought to the New York property considerable horizontal drilling experience. It’s longest Ontario horizontal well extends more than 4,000 meters under Lake Erie. From this activity we concluded horizontal wells more than doubled the success rate (to ~80%). Reserves per well increased by about 50%, with almost double the initial productivity, but with steeper decline rates. We found that the unpredictable nature of fractured reservoirs promoted horizontal drilling, both for pushing the margins of an existing pool and for more conclusive testing of new grabens.

Ontario also showed us that 3D seismic data have greater (economic) value as a development tool than for exploration. The high cost of surface access, caused by the need for full leasing of the privately held mineral rights, makes seismic data relatively expensive in a small lot, freehold land ownership regime.

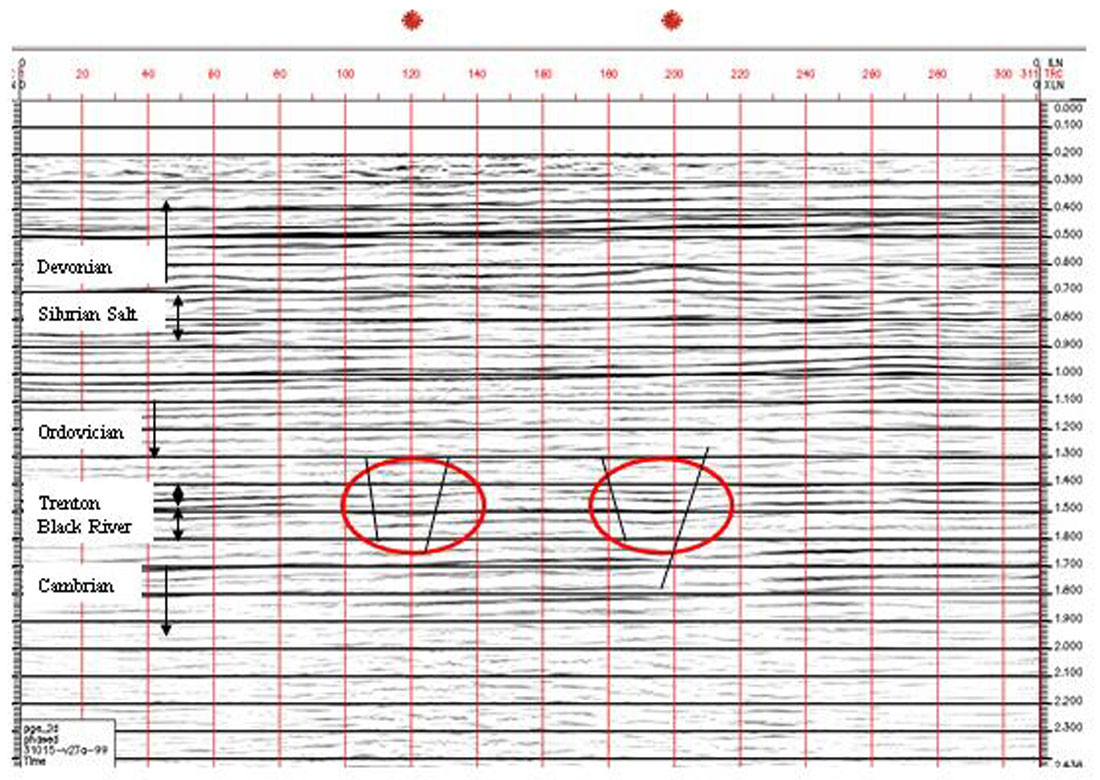

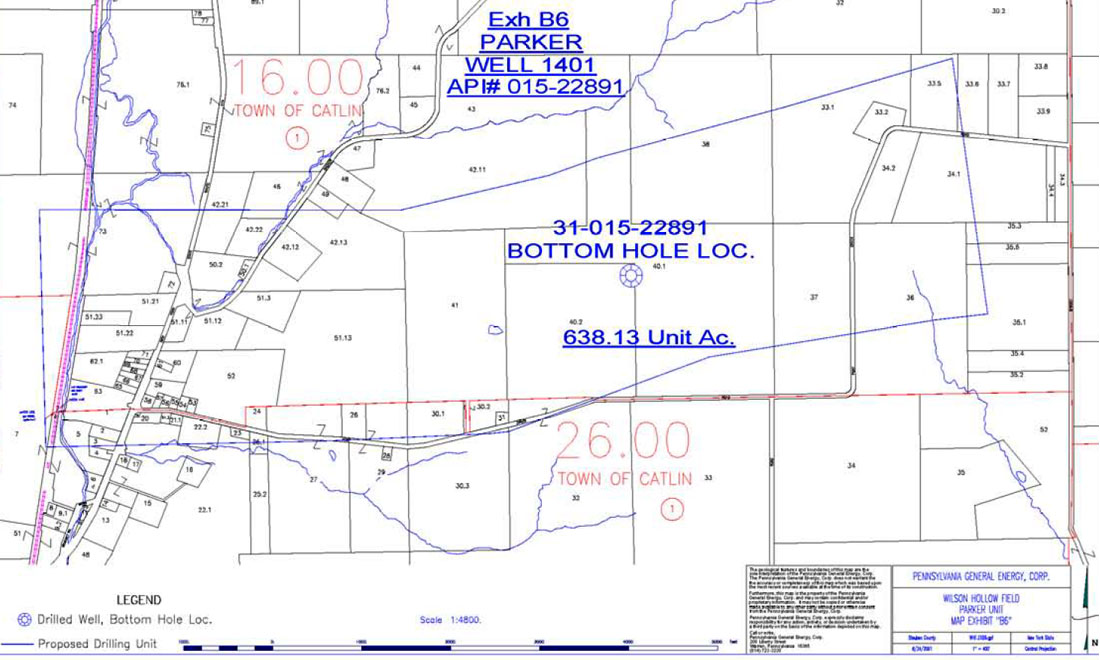

The grabens and associated faults make relatively easy targets for seismic data mapping (see Figures 4 and 5). Recent exploration and development drilling in New York has been based on 2D and 3D seismic data. The New York State Department of Environmental Conservation (DEC), the NY regulator of oil & gas activity, views seismic data as so definitive in mapping the reservoir, that it requires that recent Trenton/Black River production spacing units be based on bounding faults defined by seismic data (Figure 6).

The Challenges

As one can easily imagine, there are numerous differences between operations in Alberta and the eastern U.S. states. I have found much of the difference comes from the short, relatively modern history of settlement in Alberta, as compared to the much older settlement history of a state like New York. Population density plays a large role, as does gas exploration’s relatively small, unevenly distributed economic impact, in hindering smooth operations in New York. The following will outline some of the larger technical and operational challenges our team faces in developing a deep carbonate play in New York.

1. Seismic Data Quality and Interpretation

In Ontario the principal challenges to seismic operations and interpretation are surface access, cost relative to the shallow drilling, and data quality. The target is shallow (800 meters) and source coupling can be quite poor. Close group spacing and very small dynamite charges are preferred. In places the thin soil and glacial deposits are underlain by Devonian carbonates, making a “ringy” processed section. 3D data have been used successfully, but are considered too expensive, in many cases, for the shallow target.

In New York, the data quality is better, and the targets deeper. Surface access and cost remain factors inhibiting rapid operations. New drilling and spacing regulations in New York have made 3D seismic almost essential for effective development and semi-exploratory drilling. The 3,000 meter target depth allows for coarser bin sizes and the imperfect source spacing caused by the increased population density and rougher terrain.

For the data interpreter, the various orientations and ages of faulting appear as key factors in mapping the Ordovician carbonates. The Appalachian Basin has had several episodes of compression and extension, dating back to the original Cambrian aged failed rift event. The Appalachian Mountains to the east and southeast represent the culmination of at least three major compression events. Thin skin, compressive deformation of the Silurian (salt) and Devonian section overlies the more strike-slip type deformation of the older Ordovician section. The later events can distort, reactivate, and mask the relatively small east-west oriented grabens that form the drilling targets.

2. Data and Equipment Resources

The Appalachian states were the home of United States’ original oil industry of the 1800’s. The shallow Mississippian and Devonian aged section was densely drilled in many areas, supporting local industry centers for over a century. Even today, there is an active shallow exploration and production industry, producing from a large area of shale, sandstone and carbonate reservoirs.

The region has a very well developed pipeline and gas storage infrastructure, and a well-established “industry practice”. Enhanced product prices, particularly for gas, due to the large local market, makes the region economically attractive. The long history of exploration and production has kept the regulatory environment relatively “industry friendly” in many of the Appalachian states. This helps overcome the high effort needed to establish a land position.

Deeper drilling, such as for the Trenton/Black River, has been much less common, however. Large companies, like Amoco, Texaco, and Arco, left the basin by the 1980’s. Low product prices left the region quite depleted of modern equipment, particularly for deeper drilling. As well, the regulations and fragmented land/mineral titles favour shallow, lower rate production.

The absence of modern equipment impacts drilling more than seismic operations. Fortuna has had little trouble contracting with seismic crews meeting Alberta standards for safety and technical quality. The U.S. and eastern Canadian crews, like Veritas, Trace, and GAPS, are quite willing to mobilize for larger scale projects. The more locally sourced crews from Ohio and Michigan have also maintained and added modern equipment, particularly in the last few of years of increased activity.

Fortuna, and the property’s preceding operators, recorded many high quality 2D lines and 3D’s in the past five years. This happened despite the rough terrain, dense tree and human population, large permit effort, and potentially very wet and short recording season. Upstate New York winters make Calgary’s look easy, despite the presence of a local wine industry!

Scattered throughout states like Ohio, Michigan, W. Virginia, and Pennsylvania, are various geotechnical consultants. With operational rules varying by state and even by county, it pays to have local contractors at hand to help with the details. This is particularly true for leasing/title work, but also applies to well and seismic permits and operations.

In some states, mineral rights extend under public roads, making seismic trespass a large issue. This adds to the need for upfront leasing. Putting together a large play position, or even a 3D program, can become prohibitively expensive or time-consuming, in a competitive leasing environment. Establishing a good core land position for exploration often requires a mix of acquisitions and joint ventures, essentially sharing the play with local players.

One can purchase seismic data, particularly from the large regional data sets recorded by the majors in the 1970’s and from a few “spec” shoots. Data from the more local players may also be available, but more likely as part of larger joint venture. Licensing agreements are generally similar to those in Alberta, but we found value in careful review of the wording. Tape copying services, data integrity, and the small number of data brokers leave something to be desired, however, when compared to Calgary’s very efficient, service oriented industry.

Despite the generally manageable environment for acquiring new data, putting together a package of well and trade seismic data was difficult. Someone expecting an organized system of public and commercial data will be disappointed.

Various universities and government departments have varying amounts of log, core, and even production data. Reporting requirements vary by state. Enforcement and record keeping have been spotty; not surprising given that little oil & gas revenue reaches the governments directly. In that regard, we found New York State more proactive with a relatively good store of industry data. Much research and data gathering occurs as a result of industry, university, and government consortiums. Through project funding and data contribution Fortuna has formed effective relations with various state and university staff.

Fortuna also benefited from the experience of a long term, pipeline related player, Seneca’s parent company, National Fuel Gas. After five years of working in New York, Fortuna now has a comfortable level of well data and research at hand. Patience is a virtue.

3. Positioning

It quickly became very clear to Talisman staff that care would be needed in handling survey data from New York and surrounding states. Compared to Alberta, Ontario has a more complex and variable grid of privately held surface and mineral rights (rectangular lots and concessions). New York and Pennsylvania posed an even greater challenge.

The eastern states use a County and Township system for local governance. The land parcels are irregularly shaped, surveyed using metes and bounds, and usually include privately held, attached mineral rights. No formal reference grid exists to assist with the survey. The local tax maps make up the fundamental source of property boundaries. The quality of these maps can vary by County, as does the quality of ownership records. When relating the tax maps to the modern topographic maps, one needs to think of the tax map as a rubber sheet, stretched irregularly to fit the modern survey.

Talisman has a large technical services group able to assist with the detailed quality control of the survey data. Consistency of positioning is vital to locating wells and land boundaries in relation to the seismic data. Well sites, in particular, often need repeated surveys to make the modern map co-ordinates match those measured in the field and filed with the well permit documents.

Up to now, we have established a standard practice of using NAD 27 – UTM 18, expressed in US feet, for New York and Pennsylvania. This suits our GeoFrame seismic workstation software and has fitted with our overall operation. Recent legislative changes, involving a shift to NAD 83, may change this standard, however.

Talisman has set tight standards for it’s data processors in order to maintain unit consistency. The variety of projections (NAD 27 vs. 83, various state planes and zones) and conversion values may startle an Albertan, used to a uniform, metric based system. Confusion can easily occur when a different rounding of the conversion from meters to US feet: metric to U.S. foot conversion value of 0.304800609601219 is not the same as the 0.3048 conversion to international foot. Minor rounding inconsistencies are greatly magnified when applied to large UTM values. It pays to check the processed line position against the original survey notes and winding road the line may have followed.

Talisman’s preference for horizontal drilling helps overcome some of the potential positioning errors. From our experience in Ontario, where errors on the order of 100 feet are not unusual, drilling across the entire target does reduce the need for pinpoint accuracy. However, our team needs vigilance, given the litigious nature of the U.S. working environment.

4. Land, Regulations

One of the first things we found upon entering the eastern U.S. was the complexity of leasing and recording mineral rights. By far the largest staff requirement for maintaining the Fortuna Energy properties (now approaching 1 mm gross acres) in New York has been in the “land” department. Land title verification, the large number of smaller holdings (10 acres +/-), non-standard lease forms and royalties, legal challenges, and changing regulations have all posed challenges. Thanks to a serious corporate commitment, high product prices, and cooperative NY State regulatory staff, these challenges are being met.

New York State is somewhat different than other states in the Appalachian Basin in taking a more active role in regulating drilling and production. It seeks to balance access to the resource with restriction of surface disturbance, all the while ensuring equitable assignment of royalties. Other states like Pennsylvania take a reduced role, allowing the operators greater freedom in determining well spacing. New York avoids the potential excesses of “competitive drainage”, but adds time and effort to the well permit process.

This subject could make a suitable MBA, legal, or political science thesis, so I will confine the discussion to specific items impacting Fortuna’s seismic operations in New York.

Figure 7 shows a standard exhibit attached to a producing Black River Formation field called Wilson Hollow. This field, purchased by Fortuna Energy, went through the full regulatory process to receive an order to allow production. The map shows the land parcels included in the Parker well’s spacing unit. The unit boundaries, defined by the 2D seismic lines used to position the well, are drawn 660 feet out from the interpreted graben bounding faults.

Each parcel of land included in the unit has it’s share of that unit measured for royalty assignment. In most cases, the royalty is 12.5% of the gross production, marketed by the well’s operator, with no deductions. The unit boundaries are straight lines between the controlling 2D lines. Considerable effort is expended to produce accurate, precise values to proportion the royalty payments.

New legislation, recently enacted, has provided a clearer process for obtaining state approval to drill and, eventually, produce a well. Wells drilled to any formation, but the Trenton/Black River, have standard spacing rules, subject to depth and lithology. Wells targeting the Trenton/Black River grabens also have depth-varying spacing, but require the unit shape to be based on the graben shape, implying seismic data input.

If a well meets the newly defined Statewide Spacing requirements, there is a 21 day notification period if any land holders within the expected spacing unit remain unleased by the operator. So-called uncontrolled leaseholders are given three choices: accept a 1/8th royalty, participate, or become an “integrated non-participating owner” (with an approximate 300% penalty). Following a hearing to finalize the compulsory integration the unit is accepted as suitable for drilling and producing. It is possible to drill a well that may not receive timely permission to produce, however.

Statewide spacing rules list standard unit sizes and well setbacks for various horizons and depths. When the well operator proposes a non-standard spacing unit additional scrutiny by the state will occur. Prior to the integration hearing the DEC geological staff will review and possibly change the proposed unit based on the operators technical justification. Following public notification, objecting parties may present technical challenges to the proposed unit, but require “acceptable scientific data” to make their case.

This apparently cumbersome process replaced the prior process late last year. DEC staff are working out the details, but appear to provide permits for wells involving standard spacing units within 30 days. The new process minimizes the number of technical justification submissions and revisions that burdened many previous well permit requests. This limits the scrutiny of the geophysicist’s fault mapping by the DEC staff to exceptional cases, but does require more overall work packaging the well and spacing unit submission.

Despite the forgoing relaxation, a well permit application needs to have most of the mineral lease and title work done in advance of drilling the well. Previously, the detailed title verification, often going back more than one hundred years, would be done upon success of the well. Now, that time consuming and expensive work precedes the well permit. This adds more to the risked cost of a well and can delay by months the preparation of the permit application.

In contrast to this detailed process, states like Pennsylvania and West Virginia have relaxed rules for well spacing and permits. Tu r n - a round times are less than a month and require little beyond some lease and drilling information. However, other issues like title failure, state and county lands, hunting season, local archeological and environmental sensitivities can easily add months to a well’s timeline. Also, competitive drainage and aggressive leasing can make a development program very difficult.

Multidisciplinary team-work

For various reasons Talisman Energy chose to create a subsidiary called Fortuna Energy Inc. to own and operate the U.S. Appalachian properties. This led to a structure where by Talisman technical staff in Calgary provide services to Fortuna, based in Horseheads, NY (near Corning – Elmira, south of the Finger Lakes). Fortuna’s own staff are mainly related to land, administrative, and operational functions. This created a Calgary based team of various disciplines assisting Fortuna with much of the prospect generation and well drilling activity.

The relatively demanding New York well permit process forced an integration of many disciplines to find the best compromises needed to have a well drilled. Along checklist of necessary activities developed out of the weekly team meetings. Some twenty staff commonly attend these meetings, underlining the need for good communications. Shared awareness of the various issues proved essential as issues could linger past the eventual tie-in of successful wells.

Foremost for the geophysicist are: designing the well spacing unit to DEC’s specifications, and finding the best well path, given several surface access constraints. Topography, lease access issues, setbacks from unleased parcels, spacing boundaries, and other wells, and ultimately, the pipeline route, all work against optimum well positioning.

Many of the earlier well permit submissions required detailed geotechnical descriptions justifying the well and spacing unit design. DEC staff would challenge some of the fault interpretations, making design iterations a normal activity. At times, the regulatory process brought normal prospect work to a halt, despite a G&G team of over ten professionals. With management expectations of keeping two rigs busy with over 12 wells a year, our well permit inventory often became “just in time”. The current situation has not improved, tempering our expectations of how fast we can proceed.

Conclusion

Compared to many jurisdictions, New York poses several regulatory and access challenges. Despite the high staff effort needed to manage an aggressive development schedule, the prize has been worthwhile. Our weekly meetings often end with an upbeat report from our marketer. We have a choice of high and low capacity pipelines, and receive “NYMEX plus” pricing for our dry gas.

Establishing a large enough scale of operation, in time for the recent high gas prices, proved very worthwhile. It took a good sense of risk and commitment to provide the time and resources needed to discover, understand, and overcome the hurdles. Having a solid team, working closely together prevented oversights and allowed for a more compact time line.

As one of the original team members, I have gained greatly in understanding various disciplines, from land leasing and title searching, to well production. Working in as competitive and complex an environment as New York has demanded much of the staff. Our project makes a good training assignment for staff in various disciplines wanting to experience something different. However, after months of struggling with failing land titles, uncertain well surface surveys, and detailed well permit applications we often long for established regulations, regular spacing, regular land sales, and desktop accessible logs.

At the personal level, I truly appreciate the remark made by our head leasing agent, “Don’t worry about the things you can’t control”.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article