April 2007

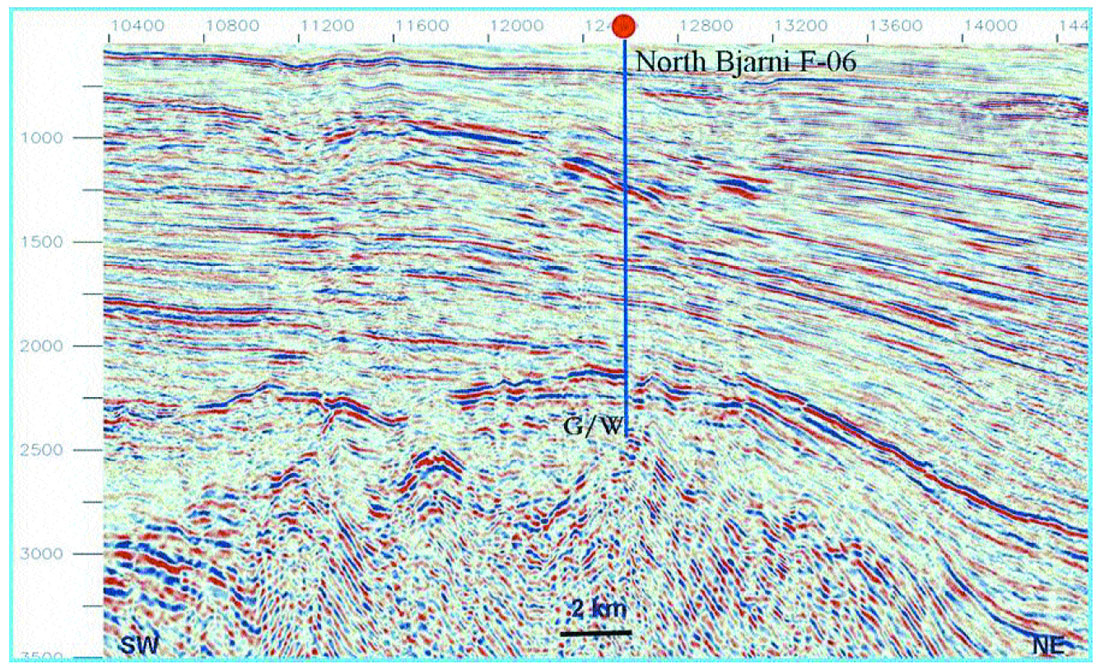

From the Georges Bank Basin at the Canada/USA border in the South, to the tip of the Labrador Peninsula in the North, an impressive area of over 600,000 square kilometers offshore Atlantic Canada has potential for petroleum exploration. Only about 360 exploration and delineation wells have been drilled in this area, a number approximately equally divided between the provinces of Nova Scotia and Newfoundland and Labrador. Drilling an expensive exploratory well offshore Atlantic Canada may cost as much as $30 to $150 million dollars, depending on rig availability, drilling depth, water depth, distance from shore and ocean conditions (wind, ice, currents, etc.). Prior to drilling and committing large offshore expenditures, a detailed imaging of the subsurface must be made, geological risks must be assessed, economic hydrocarbon volume must be computed and a precise drilling target has to be selected. The well may be placed in water depths between 50 to 2,500 m and may target hydrocarbon reservoirs 3-4 km beneath the seafloor. Most of the pertinent subsurface information related to execution of a hydrocarbon offshore well is provided by the seismic refraction method.

Using newly acquired seismic data – starting first with large regional two-dimensional (2D) seismic surveys and followed by more focused high quality three-dimensional (3D) seismic surveys – is the essential component of exploring for oil and gas resources in Atlantic Canada.*

*NOTE: As this article is intended to reach a large audience of petroleum explorationists, academics and students, young geoscience graduates, seismic contractors and brokers, government managers and policy makers, regulators and public at large, certain sections may sound trivial for some reader groups.

Seismic reflection method

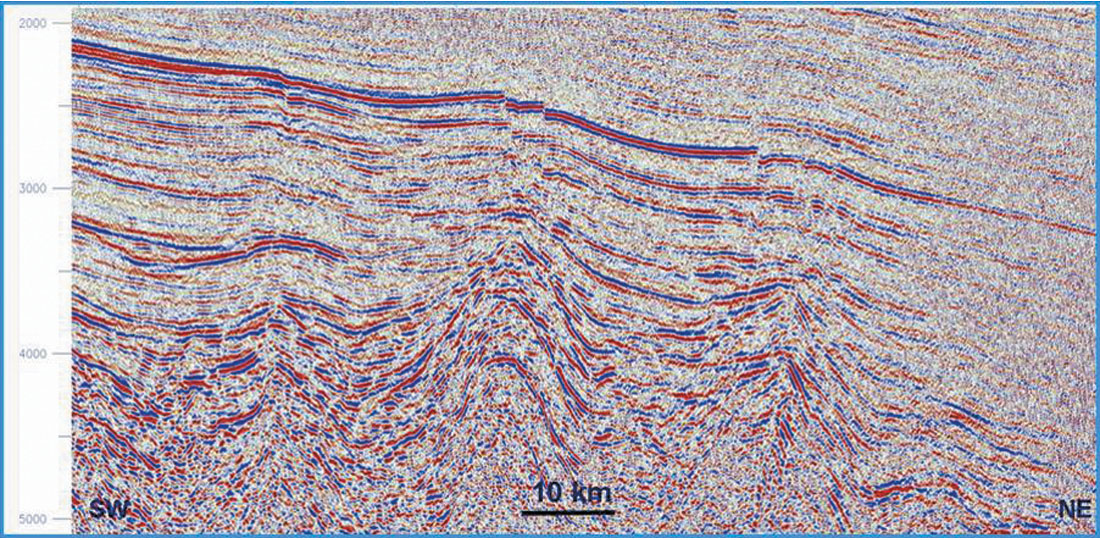

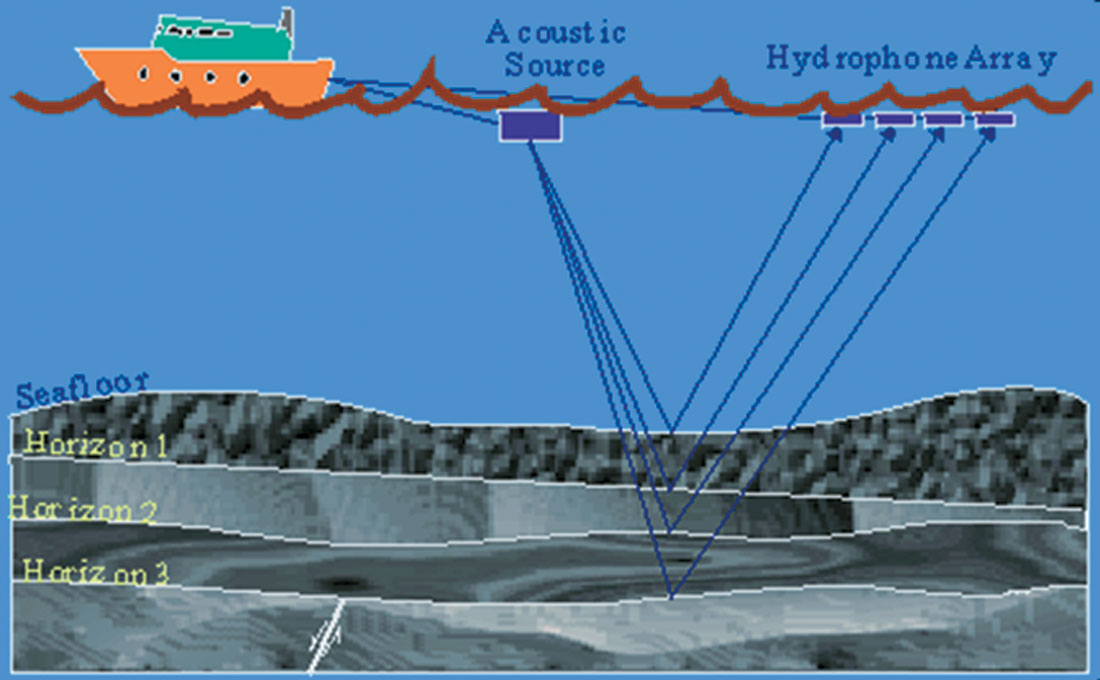

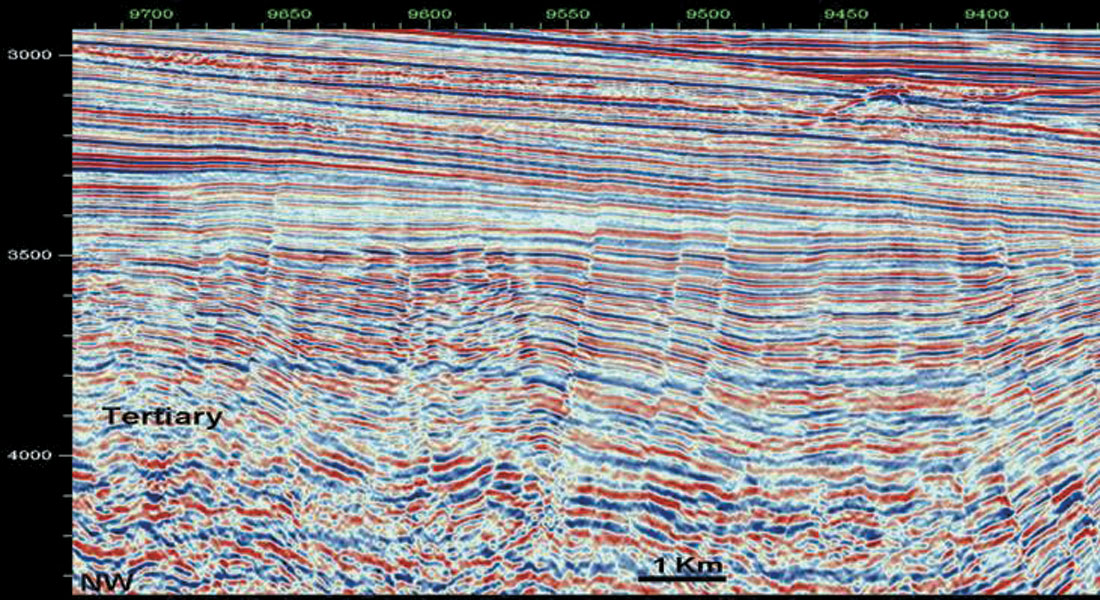

The main purpose of seismic exploration is to most accurately provide the graphic representation of specific portions of the Earth’s subsurface geologic structure and stratigraphy and the seismic reflection method is the most important method in the tool kit of an offshore petroleum explorationist. The seismic method is a remote sensing technique that allows us to record at sea surface the response of complicated subsurface geology. The technique is based on the theory and application of propagation of sound waves through rock layers. This propagation depends on rock physical properties such as their density and seismic velocities and of the complex underground layer configurations. If high quality seismic data is recorded, in some geological settings, the porosity and fluid content (water, gas, oil) of rocks can also be determined and offshore petroleum reservoirs can be assessed.

Similar technologies are utilized to produce images of babies in a mother’s womb (sonogram), identify schools of fish (sonar) or image a sunken ship on the seabed (side-scan sonar). The seismic profiles recorded at sea show the acoustic boundaries of successive rock layers below the subsurface and is approximately similar to a view of the rock layers that might be seen in the side of a canyon or in a river bank cut.

However, due to the overlap of the density and seismic velocity ranges of most of the rocks found in sedimentary basins where petroleum is found (sandstone, shale, limestone, etc.), the method provides only indirect indicators of possible oil and gas accumulations. Complex methods of interpreting the data are needed including advanced computer processing and display algorithms, workstation and PC based interpretation software, and not in the least the employment of well educated and trained geophysicists with a strong knowledge of offshore geology!

Several steps have to occur to obtain seismic maps and volume displays and to allow the selection of drilling targets. Thus, seismic data is:

- Collected at sea by seismic vessels that use acquisition sources (tuned airsource arrays) and recorders (hydrophone) positioned at equal intervals along 4 to 8 km long seismic streamers towed behind the ship;

- Edited and processed in processing centers having powerful computer networks and ingenious proprietary and licensed software, built from mathematical equations of sound wave propagation through the earth’s layers;

- Interpreted on seismic workstations, personal computers or paper by expert geophysicists and geologists; and

- Displayed and animated in three-dimensions in visualization halls where prospects are technically evaluated and drilling locations are selected for further complex economic consideration, taking into account commodity prices, taxes, royalties, well costs and future development costs.

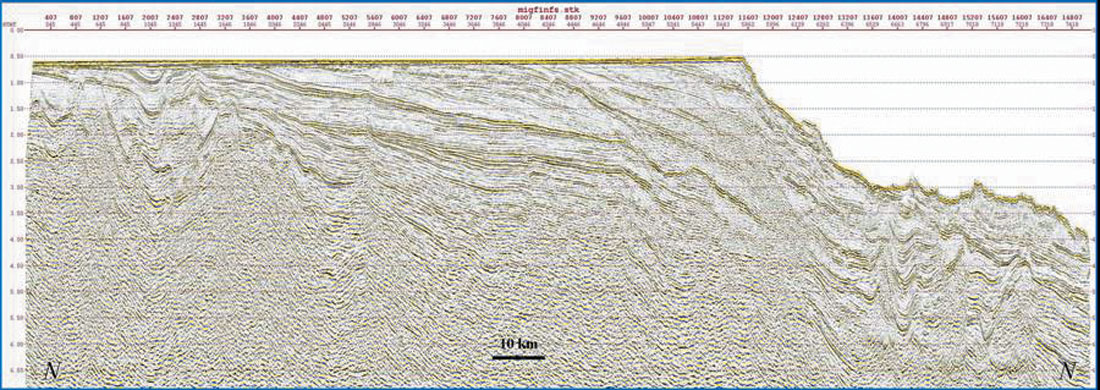

2D versus 3D seismic surveys

When seismic data is recorded on largely spaced grids with profiles up to several kilometers apart, a two-dimensional or 2D grid is collected for the purpose of structural reconnaissance and deciphering the regional geology and petroleum potential of a basin or parts of a basin. Lines may be from kilometers to hundreds of kms long. A checkerboard grid including perpendicular profiles (dip and strike cross-sections) is usually recorded. Dip lines are usually in a direction perpendicular to the shore line and continental shelf edge and strike lines are long lines parallel to the shore line or continental shelf edge.

The Nova Scotia and Newfoundland and Labrador shelf, slope and deepwater areas are now covered by numerous 2D seismic surveys acquired in the past by companies such as Geophysical Service Incorporated (GSI), WesternGeco, TGSNOPEC, Veritas, Compagnie Générale de Géophysique (CGG), Petroleum Geo-Services (PGS), GX-Technologies and their predecessors or by the numerous oil and gas companies active in the area (ExxonMobil, Shell, Husky Energy, Petro-Canada, Chevron, Total, etc.).

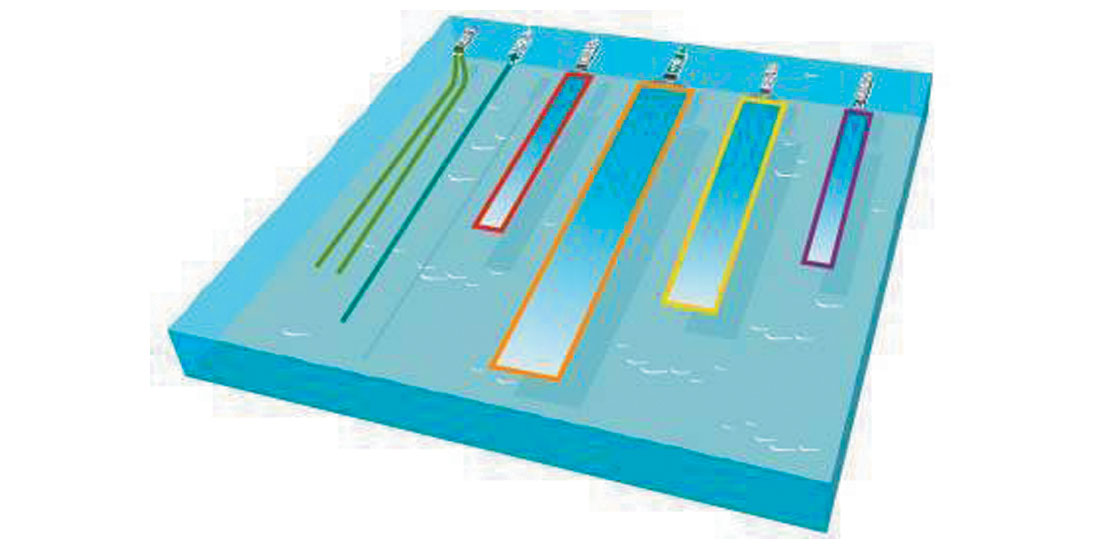

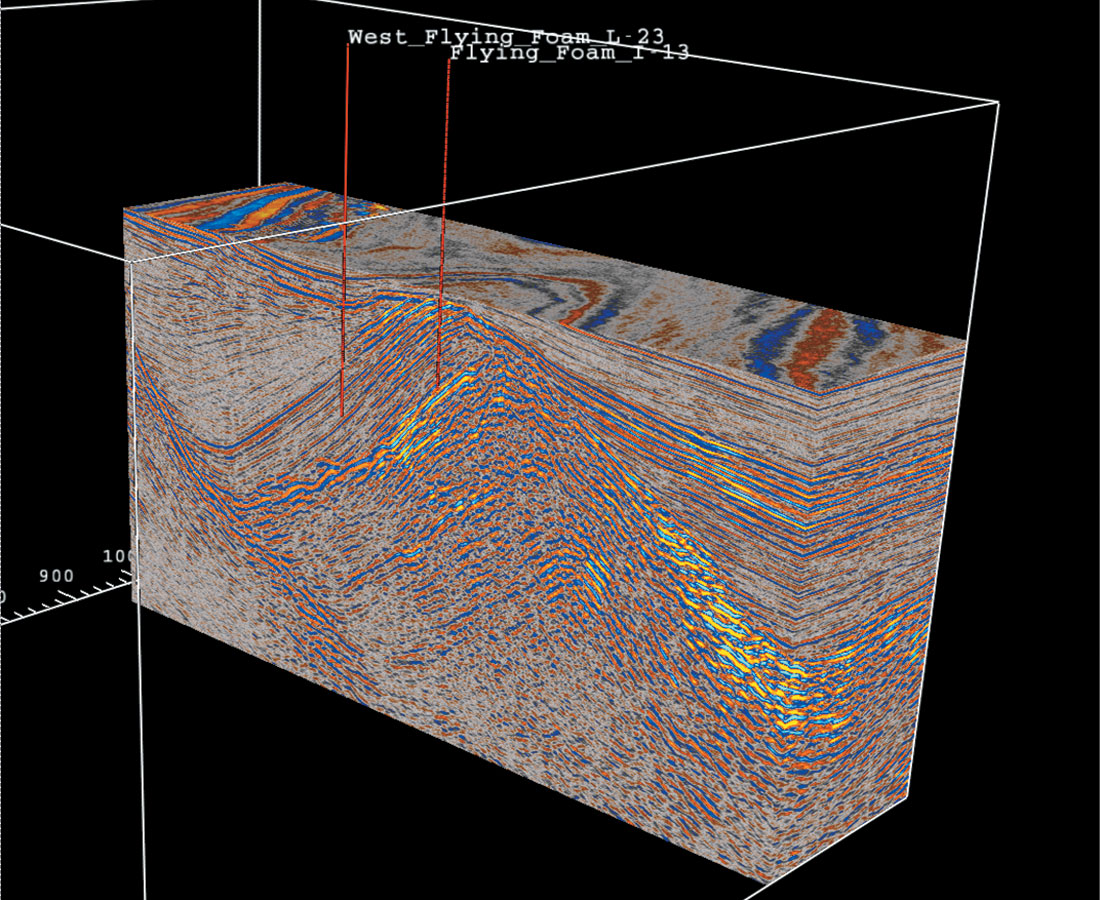

When data is recorded on a much closer spaced grid, say 25 or 50 m between the seismic lines, a three-dimensional or 3D seismic volume is created for the purpose of mapping oil and gas prospects and selecting drilling targets in an exploration block. Perspective views and volumetric attribute displays are feasible with 3D data; less biased interpretation of fracture zones and sedimentary features are possible with 3D data, a clear advantage over 2D data when drilling expensive offshore exploration wells. At sea the 3D surveys are recorded by seismic vessels towing multiple recording streamers behind the ship. Up to 12 streamers and two sources have been deployed in the Canadian offshore allowing the recording of 24 seismic lines at a pass and covering a surface footprint of 2.6 square kilometers (Figure 4). The productivity of 3D acquisition is high. With multi-streamer vessels large blocks of 2000 to 3000 square kilometers can be surveyed during the short summer months in the Canadian offshore. Because of the high cost and detailed imaging provided by 3D surveys this method is generally used after exploratory 2D data identifies the basin extent and regional distribution of promising geologic structures that can contain hydrocarbons. Many 3D surveys were conducted in the past by companies such as Mobil, Chevron, ExxonMobil, Petro-Canada, Husky, EnCana, Marathon, Anadarko, Conoco Phillips, etc.

Who acquires the seismic data?

Several types of seismic acquisition programs are permitted by the offshore petroleum boards (CNSOPB and CNLOPB respectively) regulate all petroleum related operations in their areas of jurisdiction. These are:

- “Company, exclusive or proprietary” seismic programs, when data acquisition is operated and paid for by a company or group of companies that usually own an offshore Exploration Licence (EL). Company surveys are also acquired on Significant Discovery Licences (SDLs), Production Licences (PLs) or on crown land. The cost of the seismic program is part of the work commitment promised by the licencees when the EL was obtained through the annual Call for Bids process (e.g. http://www.cnlopb.nl.ca/ and http://www.cnsopb.ns.ca). The survey might be conducted as a reconnaissance/ prospect inventory program with use of data restricted to companies sharing the cost of the program.

- “Multi-client, non-exclusive or speculative (spec)” seismic programs, when the cost of survey is either partially or totally covered by the investment from a seismic company or in rare cases other offshore entities (oil companies, government agency, investor group, etc.). These programs are collected for the purpose of providing the data to multiple exploration companies in the form of a license to use the survey data, recovering the cost and hopefully turning a future profit for the company that risked the initial investment. The data is licensed usually to oil companies active in the area or, very important for the health of the petroleum industry, promoted to new oil companies currently not operating in the area or not aware of its petroleum potential. The value of spec surveys is that they reduce the investment costs and the risk associated with exploration prior to drilling very expensive wells.

- Government seismic programs, when data is contracted and paid by government agencies such as the Geological Survey of Canada, research consortia (e.g. LITHOPROBE) and provincial governments for either investigating the geological structure of specific offshore basins resource assessment, or for improving geologic knowledge and promoting exploration in a certain area.

The most common survey types conducted in Canadian waters are “company” surveys, usually collected during the first years of a new Exploration Licence or prior to field development and “non-exclusive” surveys collected before landsales in a new basin (e.g. GSI Labrador Basin 2003-2006 surveys) or for the purpose of regional studies (e.g. GX Technology NOVASPAN survey). Government programs are rare and are performed either for scientific investigation (e.g. LITHOPROBE) or to gain insights into basins overlooked by the explorers or subjected to moratoria (e.g. GSC mid-1980s Laurentian Basin survey).

Cost of seismic data

With seismic data there is always a dilemma: should a company acquire on its own or license available data? What many people may not realize is that cost of data collection is not trivial. Just to start a program, a significant mobilization/demobilization cost is incurred that can be anywhere from US $1 million to about $5 million dollars depending on vessel size and type (2D versus 3D vessel), if it has up-to-date technology and the distance where the seismic ship is mobilized from (all dollar quotes in this article are in US dollars). In addition, a lengthy Environmental Assessment process must be conducted before every seismic survey, even in areas where previous assessments were conducted and successful seismic surveys were acquired. This process can take between 6 to 18 months.

The cost to purchase of off-the-shelf 2D seismic lines can vary between $80 to $400 per kilometer depending on the age, quantity and quality of data to be acquired by a purchaser via a license. A sliding price scale is used to lower the unit cost for large surveys that might cost several million dollars so that as the amount of data licensed increases, the per unit cost decreases.

Multi-streamer 3D ships can cost a quarter of a million dollars per day on a standby basis and probably $400,000 a day fully deployed. A 2D single streamer ship may cost $75,000 per day to operate. The size of a crew varies from about 60 on the larger 3D vessels to about 30 on smaller 2D seismic ships. The 3D surveys are usually done at the request of companies or groups of companies owning Exploration Licences and might cost anywhere from $10 to $30 million dollars per acquisition block.

In spite of significant costs associated with 2D and 3D seismic data acquisition and processing, it is noteworthy to mention that compared to the cost of drilling an exploration well this represents less than 1-2% in the case of 2D, and 10% in the case of 3D, of the cost of drilling an exploration well. The location of the well is based on the interpretation of the seismic data. The seismic data is the primary method that is proven to increase the probability of drilling success and reduces the chance of a costly dry well! Obviously as the costs for labour, fuel, ships, and expensive recording equipment has increased, licensing seismic data already-available from an existing spec program rather than executing a new company acquisition survey are very economical solutions to acquire the needed information in a timely manner. The benefit of multi-client surveys is that the oil companies do not have to pay the full cost of the data acquisition and data processing. They usually license the data for a percentage of the survey cost (anywhere from 90-10% of the original cost) depending upon the area, number of potential licensees and other factors. Usually this payment represents in average 30% in the case of 2D and 30-50% for 3D data, depending on the size of the block. This provides a significant savings that allow oil companies to evaluate large offshore areas at a fraction of the cost if this was done as a company or exclusive survey with the company paying all the costs. Spec data and the improvement of the technology by seismic companies are some of the most important factors that has reduced exploration and development costs and increased drilling success for oil companies.

Geophysical program regulations and guidelines

Geophysical programs in the Canadian waters are regulated and overseen by the joint federal-provincial offshore petroleum boards in Nova Scotia (CNSOPB) and in Newfoundland and Labrador (C-NLOPB). Strict guidelines are in place that state what kind of seismic information must be provided to the Board, what data is confidential and when seismic data can be released to other companies or to the public. All technical programs executed in the Canadian offshore including company and non-exclusive seismic surveys have to be properly reported and documented. A full technical report must be submitted to the Boards within a year from work completion with data provided as print copies and requested more recently, as PDF files on CD-ROM (e.g. http://www.cnlopb.nl.ca).

The following is a comprehensive list of seismic data currently required that must to be deposited with the C-NLOPB after each exclusive seismic program is performed in its jurisdiction:

- Seismic source point maps, a digital copy of the source point location data and a mylar copy of the source point map, referenced to the NAD83 datum and the appropriate UTM zone;

- One copy on pre-folded paper and one mylar (film) copy of each migrated seismic section;

- For 3-D surveys copies of both lines and cross-lines are required. The spacing for lines should be 1,000 metres, for crosslines 1, 500 metres. Also Time Slices constructed at 200 ms interval are to be submitted;

- For 2-D data the lines should be displayed at approximately 1:100,000 for a horizontal scale and either 2 and 1/2 inches per second or 5 cm per second for vertical scale;

- The digital data should be in the industry standard SEG-Y format. For 3-D data, line and trace location information must be provided such that the data grid can be reproduced in workstation format;

- Data should be submitted on 8mm tapes, maximum size 5 GB, or DLT;

- If several processing variants were attempted, copies of various versions of the processed seismic data may be requested;

- Interpretative maps appropriate to the type of survey; all maps displaying time structure, depth structure, isopach, isochron, velocity, seismic amplitude and other attribute maps and analyses;

- Any other information used or produced during the data interpretation such as synthetic seismograms, seismic inversion, seismic modeling or attribute analyses displays and explanations;

- Written discussion of the maps and sections including the correlation between the geophysical and geological events, correlations between gravity, magnetic and seismic data, details of corrections or adjustments applied to the data during interpretation;

- Example seismic sections with tied and correlated markers which illustrate the interpretative technique for structural and stratigraphic interpretation, and any velocity information used for time-to-depth conversion.

Operators of “non-exclusive” geophysical surveys, where the data has been acquired with the intention of licensing it to the oil companies and the public, are obliged to submit a similar report covering details of the execution and technical specifications of the survey in addition to the source point maps, films, and digital SEG Y format processed data.

Hardcopy (Analog) versus Digital seismic data

In the past, seismic data was processed digitally, plotted and stored in hardcopy or analog format, as sepia, film, mylar or simple black and white folded paper copies of seismic sections. Most of the modern seismic data recorded and processed for exploration or development of petroleum fields and mineral accumulations are now stored and maintained entirely in digital format on some form of magnetic media. Digital storage has evolved in the past 30 years toward miniaturization from the large 9 track tapes of the early 1980s to the present use of small 8mm tapes, DLT, CD-ROM and optical discs capable of storing many GB of information and external 1 TB+ hardrives. The evolution allows for more storage per unit and better use of space. Storage is not a trivial problem when dealing with reduced space on seismic ships, or large government or private seismic data libraries. To illustrate the storage space problem, for a 50 by 70 sq km area (equivalent to the Terra Nova oil field 3D coverage) the seismic survey will generate about 20 Terabytes of field and processed seismic data.

Nowadays, once licensed, digital seismic data can be quickly transferred from the seismic spec companies to licensees’ offices, via direct internet link, ftp sites, satellite transfer, CD-ROM, DVD recordings, etc., making data transfer straightforward and allowing easy data copying. Nonetheless, copying on-line has the potential to provide easy access of seismic information to the un-licensed hands, either through innocent misuse or, worst of all cases, intentionally. Worldwide digital information theft is increasing, while at the same time federal and provincial governments are increasingly asking seismic companies to release at least “samples or testers” of seismic lines or various seismic grids in digital form, to be used for exploration assessment by companies that are either contemplating or actively bidding on new exploration areas in the Canadian offshore.

IAGC and Data licensing

What is the industry code of practice for the use of speculative (non-exclusive or multi-client) seismic data? The reputable International Association of Geophysical Contractors (IAGC*), an association that includes most of world’s leading seismic companies has a simple seven-point guideline governing the business of recording and trading seismic data paid for by private investors. The main tenet of the trade is that companies investing their money in a seismic venture own that seismic data in perpetuity, and they can license that data for use to other groups (oil companies, service companies, brokers, etc.) for the purpose of turning a profit on their investment. There is nothing much different here from investing in land properties or intellectual property like an old book, software, artwork and enjoying the property rights to license, sell or rent them out to a second party as is common with intellectual property and copyright works in a market based economy.

An Industry Code of Practice for the Use of Licensed Geophysical Data was produced a long time ago produced by the members of the IAGC and is widely respected as the foundation of the non-exclusive industry. The “non-exclusive” business practices stipulated in this Code of Practice are reproduced here with minor modifications from the IAGC website (http://iagcweb.nlw2k15.userarea.co.uk/default.asp):

- Licensed data is the property of the geophysical company owner and the ownership transcends any enhancement or transformation of format;

- Terms of data use are bound by a Data Licensing Agreement (DLA) and DLAs are not transferable;

- Seismic data may be shown to a third party if DLA stipulates so, but data cannot be used by the third party for purpose of exploration;

- If a group of companies have a joint exploration project in an area; each company must hold licenses for data used to map the area

- Any consultants or third parties working with licensed data are bound by the same confidentiality terms and conditions as the licenses;

- Any data reviews, inspections or analysis using seismic data that is not licensed are done either for a) quality control or b) general data assessments (equivalent to window shopping or browsing in a store);

- Licensed data may not be published or distributed in any form without the written permission of the data owner.

Outside the fully paid up, exclusive contract which is the pervasive business model in the seismic acquisition business, the data collection of speculative seismic is a traditional business segment in which seismic companies directly invest and risk their own capital in building up libraries of regional data in areas around the world. The lesser known, lesser active, lesser politically stable and more remote the basin, the higher the risk of not recovering the investment or making a profit. The best analogy demonstrating the risk associated with a speculative seismic survey and the prospects of simultaneously licensing the data to many companies in a remote area is equivalent to the hopes of renting out many copies of a movie made by an unproven director, unheard of actors, to various theatre chains and individuals!

The last condition from the above list is well known to me, as in the past I had on several occasions obtained written approval for publishing and presenting representative seismic sections contained within basins such as the Jeanne d’Arc, Flemish Pass, Orphan and Beaufort-Mackenzie basins. These are images that once approved by the owner for that one publication only, were repeatedly reproduced again and again in many scientific and professional publications, used as teaching aids and discussed by offshore exploration groups without authorization. With the passing of time these seismic sections have become illustrative profiles for the respective basins, indicating their structural and tectonic configuration. To be more accurate, the appro v a l received from seismic companies was limited for the dissemination of analog images (e.g. black and white cross-sections, page size journal figures, colored displays and slide shows, computer printouts or workstation dumps), while the raw digital information (SEG-Y) needed to generate the images has remained with the source (licensee oil company or university) and the commercial value, and intellectual property rights of the data remained at all times with the owners (seismic company).

This is the control over the ownership of digital data that seismic companies strictly want to maintain in an ever-changing oil and gas business climate, presently dominated by cost increases for manpower, fuel, and very expensive capital intensive specialized technical equipment. Today, the non-exclusive data business plays a preeminent role in the geophysical industry, representing approximately half of annual turnover, as it allows annual employment of seismic vessels and personnel. The majority of all marine 2D surveys acquired in less explored basins offshore Canada (e.g. deepwater Nova Scotia, Labrador Sea, etc.) are being collected on a non-exclusive basis.

Public release of seismic data

Under the present regulation, reports and data resulting from most offshore technical programs, including seismic surveys, cease to be confidential five years following the completion of the program. The C-NLOPB has, however, extended the confidentiality period for “non-exclusive” programs to ten years following program completion, to allow this segment of the business to survive in an erratic exploration cycle environment typical for the Canadian offshore. The CNSOPB has similar periods for these licence types.

It is a misapprehension in some circles (not among regulators though) that geophysical data acquired in the Canadian offshore, sooner or later, becomes the property of the provincial and federal governments and is ultimately made available to the public including other companies willing to explore. In reality the data remains the property of the owner and under the terms of the geophysical approval and the regulations, which seismic companies are aware of when they acquire the data, the government has only the right to release the information/data received after a period of confidentiality.

Traditionally, data was archived and manipulated as black and white films and paper copies; the quality of these significantly decreases over time, not all the data value is present (e.g. ulterior reprocessing, post stack analysis, etc. and further processing is not possible) and dissemination is expensive and tedious. A new drive toward storing the digital data and digital images with the government to replace the previous paper and mylars and allowing the potential of dissemination of the data in digital format has met strong resistance from geophysical contractors. They see these as an attack on their business model, intellectual property, ownership rights and dissemination of their only salable product generated from their investment, hard work and risk. Digital transmission and interpretation of seismic data is the routine now in the petroleum and seismic industries. Seismic data can be easily copied and circulated, without owner’s license fees being collected by the legal owners if a very secure system and sound policies are not put in place. There were already several lawsuits in the offshore seismic business related to illegal data copying and/or use by third parties who did not have a license.

It is understood that exclusive data (that is company data acquired as work commitment) is submitted to the government as a kind of “fee” for land rights, and hence should definitely be digitally released. This was the historical principle behind the whole land tenure system in offshore Canada: “work commitments for land”. Of course a problem arises when the seismic that is being credited is licensed spec data. Another problem arises when exclusive programs are acquired under the guise of speculative data. Each of these cases should be treated individually; all stakeholders must respect the regulations and act in good will.

There is still a great amount of controversy regarding the imposition by the Boards of term limits for non-exclusive surveys and consideration of various provincial governments to establish data libraries facilitating on-line access to seismic image files (pdf, tiff, jpg, etc.) and potentially digital data. SEG D and SEG –Y files file are the established international standard format for storing and transmitting raw and processed seismic data. To clarify this, the term limits for analog data was known to the seismic contractors at the outset as they have always existed in the regulations. It is the format of the data release that is in question!

The National Data Library model, largely adopted by countries such as Norway and China, has been discussed and embraced by some in Canada, especially in the government and research communities or by small oil companies that cannot afford large offshore expenditures. However, one must be careful to recognize a great differentiation within the global exploration and development (E&P) environment in the oil business. This is especially true in countries where national or partially national companies have been driving exploration and where the government had large investments and control on the entire energy business segment. This is in contrast with the free market – private business model in Atlantic Canada, where a limited number of offshore operators exist, competition for exploration acreage is generally low and the capital invested to acquire the data is private.

Offshore petroleum Boards and natural resources ministries are also increasingly reiterating that a part of the privately owned digital seismic data eventually becomes public. Their goal is obvious and progressive: attracting new companies to the off s h o re and onshore basins and promotion of exploration activity in their areas that might generate new wealth and jobs in their jurisdictions. This may be justified for oil company data because the bids are not cash bids (as in other jurisdictions like the Gulf of Mexico) but rather work commitments (including seismic work). On the other hand spec data is created by a geophysical company and is not part of a work commitment bid to explore for oil and gas but is simply an investment in the information to license to multiple users for a profit. The seismic data license fees are often the primary source of income for the seismic contractor. Further, the government policy goal of releasing data appears noble but in places contradicts the main points of global and Canadian seismic contractor association guidelines (discussed above). It does not go far enough to understand and recognize the significant difference between company (exclusive data) and spec (non-exclusive data). As well it does not state how far protection of ownership applies when data is released. For example, once analog data is made freely available by government agencies, can a different company than the data owner scan and digitize the data and start re-selling it without a license as has been occurring? Or, if digital data is made freely available, can a company reprocess (by adding value or content) the data and then resale it on the geophysical market without a license? Can a simple filter applied to the data change the ownership of a survey? The short answer is absolutely not! Any work products that contain any element of the data, or any direct measurements from the data (i.e. amplitudes, isochrones, velocities) are still owned by the Licensor and cannot be treated as if the Licensee owns it. These are common issues dealt with in nonexclusive seismic data license agreements.

The spec companies have all the motivations that are 100% in line with the goals of governments: to encourage the exploration of the basin (spec data lowers the costs and risks to entry), to ensure that lease sales are competitive (spec data is available for license to as many companies as possible), and to promote Canada as a great place to invest in the resource business. Spec companies promote their data investments in many ways around the world, in private meetings with various companies and at professional meetings and petroleum shows. I predict that imposing time limitations and giving this valuable information away will only be counter productive. Little or no new investment in this data will occur from geophysical companies and regional surveys in offshore Canada, and the long cost-recovery timeframes will not be attractive. Furthermore, oil companies capable of drilling 50+ million dollars offshore wells are not deterred by the very low cost of marine seismic (generally 10% of the cost of land seismic, both licensed as spec). The availability of “free” government-released seismic data, is not a big incentive for oil companies when one considers the real drivers of exploration such as favorable geology, the land tenure terms, royalties, taxes, regulations, drilling success, business friendly climate, infrastructure such as pipelines and terminals!

Seismic data owners feel that even the release of the existing paper and mylar seismic data submitted to the offshore boards has already infringed in their property rights. This feeling is heightened with the advent of very powerful scanning technology and the ability to scan and digitize the data so that it can be loaded on the latest very powerful workstations available at increasingly inexpensive cost to explorers. This technology was not contemplated when policies were first enacted (late 1970s and early 1980s), but the world has changed and it has negatively impacted the spec investors return as a result. Moving to a digital image release and in some cases the SEG Y processed tape itself would only make a bad situation worse. It is quite probable that very little is to be gained from this policy of giving the data away while promotion and investment from spec companies will decline or cease. It was repeatedly proven that multi-client business sector is the one that invests in almost all of the regional 2D surveys and many of the new 3D surveys and the spec companies are currently the best promoters of the offshore, bringing the majority of the new explorers to the area, and getting existing explorers interested in areas near where they are active to expand their involvement.

The seismic spec business is much more complex and has many facets unknown to others than professionals involved in exploration or regulation of the business. The key factor that drives the spec acquisition campaign is the ability of the geophysical company to pre-sell data before collecting it. Very few spec companies would go ahead and collect a program on the hope that they will sell it and recover the investment ten years down the road. As in any other businesses, some sales are gravy and some are poor. It is the attractiveness of the area and the skill of selling the spec data, but also the regional petroleum geology studies, presentations and publications that get big companies interested and wanting to pre-buy the spec data. Once that interest is created spec companies will put a survey together including also recommendations from their endorsing clients and only when a significant percentage of committed capital is reached will they go forward applying for a program permit from the Boards. Alas, the Atlantic and Northern Canada exploration is notoriously cyclical! It is proven that during downturns the only real activity is represented by spec data collection, often by domestic seismic contractors. During exploration lull usually created by low commodity prices, economic downturn, drilling disappointments or political problems, clients and investor are hard to come by. This is when seismic companies are committing large funds (own capital or moneys raised on the market) to collect data and keep their vessels and crews working. These are the surveys with questionable returns, and Atlantic Canada has seen a good number of them.

We cannot deny that for small companies, especially Atlantic-grown explorers, access to free or low-priced seismic data is critical for developing a business case and getting access to capital, and then to find larger partners and drill exploration wells. For example, in West Newfoundland offshore basins there will be no exploration going on right now if it wasn’t for released data (hardcopies as it may be). Junior companies would be totally out of the offshore exploration game. An accommodation must be found to allow these small players in less active, unproven yet exploration areas to get access to small fee licensing of analog or digital seismic data. By stimulating exploration activity in less known basins, these local companies have the potential to attract new business in the area including international oil companies and eventually, stimulate the need for new non-exclusive seismic data.

Now, a compromise is emerging. Individual contractors accept the fact that the geology and geophysics of a less known basins such as those in offshore Nova Scotia and Newfoundland and Labrador, must first be described and publicized using quality seismic sections. The petroleum systems often need to be explained and promoted internationally, and this attracts new players and investment in the Atlantic sedimentary basins. At the end of the day, seismic contractors also benefit from new companies exploring in the area since they will license existing data and require more data acquisition if they become “hooked on the basin”.

Will government use and release of digital data truly improve the chance of attracting new players to the area without alienating the spec survey investors? The issue is that imposed government release of seismic data is not necessary to achieve a better business climate. Seismic contractors already heavily and directly support research, small explorers, papers, publications, articles, and even approve of the use of seismic sections in government (provincial) and offshore petroleum board (federal/provincial) promotional reports for lease sales. However, regulators may argue that this is valid only as long as spec companies are interested and supportive of an area and from government’s point of view this is untenable that you can then only use the data at the whim and good graces of the companies. Our goal is to overcome this dilemma and find workable solutions for Atlantic Canada’s specific exploration conditions.

Shared Data Repository (SDR) in Atlantic Provinces

For the past five years the Atlantic Provinces have pushed for implementing local Shared Data Repositories (SDRs) or alternatively named Data Management Centers (DMCs), to store and provide digital seismic access via the internet using a Geographic Information System (GIS) front-end. The intention is to streamline both electronic filing of seismic information requested by the Boards and to facilitate access by the public to this information after the expiration of the relevant confidentiality period. A resolution to this issue of release policy has been of paramount importance to the seismic industry in Canada and abroad. First it can affect the hundreds of millions of dollars of investments in data that already exists and second it can affect the level of future investment in spec data and to a lesser extent company data.

Another participant to the SDR debate alongside regulators was the Canadian Association of Petroleum Producers (CAPP). But from the start we have to admit that oil producers and seismic companies occupy different segments of the Petroleum Industry and their interests are sometimes conflicting when debating access to cheap, easily available seismic data. Depending on the size of their past investment in seismic data, some CAPP members oppose the release of data and some are for it. Nevertheless, oil companies are commissioning a large number of exclusive seismic programs themselves and some companies are owners of large libraries of offshore data. They likewise are not willing to easily release their data, at least not for free!

Do we need permanent seismic digital Shared Data Repository? Undoubtedly! As someone who spent over 30 years working for all entities involved in this debate (oil companies, government geological survey, government agencies, consultants, seismic contractors, research consortia, academia and tax payers) I can clearly see all sides of the story and I feel for all the stakeholders. For many reasons, the Atlantic Provinces need easily accessible, good quality seismic information to illustrate the exploration potential of their basins (e.g. http://ns.energyresearch.ca/files/Carl_Makrides.pdf). The seismic data is critical to various groups carrying out fundamental and applied research in the Atlantic sedimentary basins such as the federal and provincial Geological Surveys (http://ns.energyresearch.ca/files/Phil_Moir.pdf), regulatory boards, natural resources ministries and universities (http://ns.energyresearch.ca/files/Andrew_MacRae.pdf). Also, if not properly stored and maintained, seismic data can be lost or deteriorate in quality. The replacement cost of the seismic data that now exists with various companies, some that have long since left these shores, went bankrupt or were merged into other companies, is in the order of billions of dollars! Furthermore, some areas (e.g., the Georges Bank Basin and Gully area of Nova Scotia) are prohibited or have very onerous conditions for seismic data collection, but are still important to understanding the rest of the regional geology. Therefore, access to existing “old” data across these areas is critical.

The problem is that a policy which devalues the data by giving it away will only provide less incentive for the owners (oil companies and spec companies) to continue to maintain at great expense this data in their private vaults. As mentioned, in the past no unambiguous regulations for providing the Boards with digital information were in force. The initial Act states that data can be released after the confidentiality period. It does not specify the format. When data release started the standard format was hardcopy which is what was then released. When the standard data format became “digital” this is what was received by the Boards, but the data continues to be released on the old hardcopy format, a non-sense in one of the world’s most advanced industry! And here is the crux of the debate! We are at a clear impasse, irresolvable as long as companies that acquired the data, be these oil or seismic companies consider the digital data as their property.

Some of the older data may never be recovered in digital form and a significant portion of this data is so obsolete that it is of little value for modern exploration. But we now have a clear policy in the Atlantic Canada moving toward digital copies of every seismic survey, a practice used by most countries with active exploration areas (e.g., Norway, UK, etc.) and an initiative to release some of this data in digital form. Most countries now have either government or privately administrated seismic data libraries, with data used for preliminary regional interpretation or for sophisticated geophysical investigation of its petroleum potential (various inversion, AVO, volume attribute, fluid factor studies). However, it must be recognized that their exploration licensing process is different (usually a cash bonus system) from the model used in Atlantic Canada, where a license is obtained based on the highest amount of work commitment, which typically includes new seismic acquisition and processing. A Shared Data Repository would incorporate other offshore data such as, bathymetry, potential fields maps, geotechnical surveys, well results, log library, site surveys, etc., but what ties it together is the large volumes of digital seismic data, to be made easily available for inspection, usually on-line (web access) or on demand.

It is no surprise that the discussion of digital seismic repositories has produced numerous points of view and major discontent from the domestic seismic industry whose business is to invest in this information and own it. Counter proposals were formulated by the CAGC** (https://www.cagc.ca/) and discussed by its president Mike Doyle in a paper published in the RECORDER& (https://www.cagc.ca/recorder/0405.pdf). In essence, the nonexclusive sector of the geophysical offshore business is defending its ownership of the seismic digital data and has staked clear lines of defense regarding the government’s intention of demanding and making widely accessible digital images and data from spec surveys in whole or in part.

The industry point of view is that storing “free samples” of digital data in a provincial data library is one thing, and unrestricted dissemination of the “government copy” of the exclusive or nonexclusive digital surveys to third parties as advocated by others is something else entirely. The only argument here is over the transition to a digital mode of distribution, and if that changes the principles. There is no breaking of conventional business practices or denial of ownership. By acquiring company data with work commitment funds dedicated to an Exploration Licence you are doing so with the understanding that this data will eventually be released after the confidential period expires. But companies have a window of opportunity to use the data to find petroleum and/or sell their data if they wish to do so. The question then becomes not so much “Should data be released?” as “How long should it be confidential?” and “In what format should it be released?” Spec or non-exclusive data is unique to the oil and gas industry and therefore should be treated differently. Hence the data release of multi-client (spec) after ten year period of confidentiality instead of the five for exclusive data.

Debatably, the spec companies believe that data release after 10 years will amount to confiscating assets from its rightful owners, violating basic concepts of intellectual property laws that no other industry is subjected to, breaking internationally recognized and enforceable business practices, ignoring the very successful spec business model which benefits the governments and taxpayers, and producing unwanted effects such as lawsuits, owners having to spend time and money defending copyright and intellectual property infringements, serious interference in the industry’s standard practices and contracts and license agreements associated with data, hard feelings and ultimately could chase away historic investors to other shores and this in an exploration area that already has a low investment climate (where did we hear that again and again?).

It is worth mentioning that our Canadian exploration model with large and very large blocks being awarded, which are hundreds of times larger than Gulf of Mexico and North Sea blocks, does not stimulate multiple sale of seismic data and fast recovery of non-exclusive survey investments. Some will even say that for the same reason there is very little competition for exploration acreage, as large blocks usually commend large work commitment dollars and this intimidates medium and small companies from participating in landsales. The reduced number of active oil companies in Atlantic Canada does not help either. In certain cases it may take a long time (from 5 to 20 years) to recover the investment and turn a profit on some of the surveys in remote basins.

As a result of the strong opposition from seismic companies the creation of the provincial digital data repositories remains unfulfilled, with discussions continuing with the hope for a modest start and gradual increase in the volume of stored data to be accessible online as pdf or tiff image files, after the expiration of the confidentiality period. Clearly the seismic companies will vigorously resist the dissemination of their precious SEG-Y files, the electronic files used by petroleum companies to interpret the data, map the subsurface and select drilling locations.

The “scientific use” group model

A compromise of using seismic data without paying license fees already exists and it is presently applied with good results by several groups. During the oil price “great depression” of early 1990s, many exploration companies had stopped exploring the Canadian offshore and the regions “North of Sixties” area. In fact, some companies drastically downsized or left those areas and many companies closed those departments involved in what they considered at the time as “very risky” exploration. A great amount of digital data was in danger to be forever lost (shelf life of a magnetic tape without loosing data integrity is about 10 years). Data from the Arctic Islands, Beaufort Sea, Mackenzie Valley, offshore Maritime Provinces and Newfoundland and Labrador was saved from the dump or permanent deterioration by the initiative of several individuals who obtained permission to donate the data to the Geological Survey of Canada (Atlantic)#. The data was collected by many companies (up to 30) during several decades of costly acquisition seasons. With the main donors - Husky Energy and Petro-Canada - this large volume of data has allowed GSC (Atlantic) to build a digital interpretation lab, interpret the data and publish numerous scientific papers on Canadian offshore basins. In the past years other companies such as EnCana, TGS-NOPEC and GXTechnologies have granted GSC (Atlantic) access to large data sets for scientific research. No doubt the GSC (Atlantic) is a leader in offshore geoscience data storage and has a new program in Earth Science Data Management, Archiving and Dissemination that include digital government data or released seismic data (http://ns.energyresearch.ca/files/Phil_Moir.pdf).

Another case of access to digital seismic data is through direct donation or access to universities for use in scientific research and training undergraduate and graduate students. For example, GSI of Calgary has donated a license to use their entire data base (1979-2006) from offshore Newfoundland and Labrador to Memorial University’s Department of Earth Sciences and the Pan-Atlantic Petroleum System Consortium (PPSC). Recently they have added data from Nova Scotia offshore. This gift is valued at more than $25 million dollars. Similarly, WesternGeco, one of the largest seismic contractors in Canadian offshore, has donated large 2D surveys around the Laurentian Basin and several large 3D data cubes from Jeanne d’Arc Basin, for a total value of over $10 million. WesternGeco has also recently made a large donation of data to Saint Mary’s University in Nova Scotia. These generous donations are bound by a confidentiality agreement and restrictions on use for research purposes only. This does not restrict students and researchers fro m carrying on and publishing regional and detailed studies on the structural setting, petroleum systems and play classification in various basins and advise government agencies based on their findings. It is clear that seismic companies are more receptive to deal with research groups, especially university consortia when entrusting their most recent data. Obviously the researchers cannot distribute outside of university the SEG-Y files used in their investigations. Likewise, all electronic files of seismic sections and subsurface maps have to be approved by the owner prior to any public display.

Where do we stand?

For the foreseeable future, I can see the development of four parallel groups with access to digital seismic data and a drive to promote exploration in the Canadian offshore area:

- The Geological Survey of Canada will continue to modernize their Earth Science Data Repository, including government-owned, licensed or donated digital seismic data and provide on-line access for free or for small fee on-line access to oil companies, other researchers and the public. However, the licenses of certain data sets preclude access by anyone other than GSC employees – some data is more flexible, some is more restricted;

- University based consortia will receive massive non-exclusive digital data donations from seismic and oil companies to be used for fundamental and applied research in Atlantic Canada basins and will disseminate the results generated from this valuable information through graduate thesis, reports, paper publications and conference presentations. It is proven that all these are positive forms of presenting the petroleum potential of an area and protecting data ownership, since no company would site an expensive well on the basis of a few published paper illustrations!

- Provincial governments and petroleum Boards will implement some kind of Digital Data Repositories (DDRs) to include government owned seismic surveys, industry released digital data and any data made available as samples by the seismic companies. Local research groups that might include a large spectrum of government, academic and consultant researchers will access these data and may benefit from additional data donations from the seismic industry for documenting the basins and provide information as reports and publications to interested exploration companies;

- Seismic and oil companies will defend and probably consolidate their ownership of non-exclusive and multi-client data. An exception might be made with exclusive seismic programs collected as work commitment surveys, that arguably, may be legislated to be transferred to the government Digital Data Repositories after expiration of the confidentiality period or when exploration blocks are abandoned. It is also possible that in their drive to promote offshore exploration and rouse interest, seismic companies will contract consultants or scientists to carry on and publish geoscience research utilizing their proprietary data.

But how do you have all these components together in an” ideal” working model to please all stakeholders in Atlantic offshore oil and gas industry?

Successful models in other jurisdictions

Based on researching internationally accepted models, discussions and feed back from geophysical and oil companies, I see three possible hybrid models for seismic data disclosure that does not damage the business model of the non-exclusive seismic industry. These models are either presently envisaged or successfully used in several jurisdictions with sustained oil and gas exploration activity:

- Pay per view. Disclosure of spec data would occur at the DDRs via viewing of data classified by basins but the precise location of the data or the specific line name would not be disclosed. Viewers of the seismic lines would then easily be directed to the owner of each relevant survey if they wish to license that data and could be licensed on the spot and taken away on a tape or ftp after signing a license agreement and making payment for license fees. This would facilitate easy access to digital data in a specific area through disclosure by viewing only, but will not undercut the business model, intellectual property rights, and investment made by the data owner. Spec companies would continue to work with researchers, small explorers, and government in a cooperative fashion not because they are forced to but because it is in their interest to do so as it has been in the past. A commission for data licenses (common in the industry) could be a mechanism to cover some or all of the DDR costs through the legitimate licensing of the data.

- Teasers and finder’s fee. It is widely known that Alberta and the US Gulf of Mexico are very successful areas where oil and gas industries flourish. Collection of high volumes of both company and non-exclusive seismic data characterize these regions. In these jurisdictions intellectual property rights are respected and the business climate created by government is business friendly rather than prescriptive and controlling. The investment promotion and trading of seismic data is a private enterprise free from the threat of confiscation by the government. If this model were adopted in the Canadian offshore representative teaser lines could be shown at the SDR without showing the location or line name and again a finder’s fee could be paid to the SDR for resulting data licenses.

- First cost recovery and then disclosure. In the UK offshore area the Department of Trade & Industry (DTI) is the repository for all spec data acquired in that jurisdiction and a reasonable agreement was reached in 2003 with industry data owners that preserves their intellectual property rights, business model and nurtures more exploration (http://www.iagc.org/news/view.asp?news=94). This proven win-win agreement in which recovering the cost of the spec investments is fundamental could be used as a basic model for a made in Atlantic Canada solution. Below are the basic components of the DTI (Energy)-IAGC agreement:

- Spec data owners may appeal to extend confidentiality periods beyond the 10 years if survey did not achieve profitability.

- Phased payments can be negotiated to relate to any one or a combination of the following: acreage applications, group memberships, acquiring equity, drilling, hydrocarbon discovery, production and are subject to individual contractor negotiations. This phased license scheme is designed to encourage new entrants to the UK offshore.

- Only the streamer acquisition and original post stack time migrated data would be subject to the release.

- The owners of the data would retain the exclusive rights for all enhanced, reprocessed, value added products, and field data under the terms and conditions of the owner’s individual license agreements.

- Ownership and all intellectual rights in all the above data and all derivatives reside exclusively and at all times with the data owner.

- All released data must be licensed directly from the respective owner and is subject to the terms and conditions of the owner’s individual license agreement.

- Owners would place the details (acquisition and processing specifications and teaser lines if any) of the released data on the DEAL website. Contractors would continue to promote data as before.

These very successful models even if slightly modified should not be ignored as possible options to emulate in the Newfoundland and Labrador and Nova Scotia seismic policy environment.

Several suggestions

It is historically proven that the offshore oil and gas industry in Canada needs the entrepreneurial spirit of spec seismic providers. Their contribution to maintaining a healthy level of activity and stimulating this activity in periods of downturn is essential. Geophysical companies have invested hundreds of millions of dollars in the creation of non-exclusive geophysical libraries covering various East Coast basins. These data sets have significantly improved the success rate in finding new petroleum reserves. Many surveys though, have not recovered their investment. For these reasons, the entire E&P industry, federal and provincial governments and their respective agencies must recognize the vast intellectual property value associated with digital seismic data.

Nevertheless, the desire for an easily accessible library of digital data from offshore basins exists in Canada as DDRs are proven effective in other jurisdictions. The four described groups with future access to digital data will surely provide both public access to seismic information and promotion of Canadian offshore basins. One of my recommendations is that governments use some of their petroleum royalties and/or funds generated through the forfeiture of exploration blocks (e.g. http://www.cnlopb.nl.ca/CallforBidsChronology) to acquire their own regional, research dedicated seismic and potential fields programs or at least buy a license of already existing but recently acquired proprietary data if they want to produce or commission basin studies or document petroleum systems. This again is a model repeatedly used by several countries (e.g. Australia and even Canada in the past).

Digital Data Repositories definitely have a role to play in the future of offshore exploration. No doubt provinces need to promote exploration in the offshore. If they lack supporting digital data but want to generate exploration efforts they should purchase digital copies, (maybe 25% of the dataset at say 50% of the original costs per km of acquisition) and then use these lines freely to decipher the complex subsurface geology and promote their basins (but not to transfer data to a third party).

Provincial and federal governments need an offshore Digital Data Base that includes all exploration and delineation wells and selected seismic lines from various basins. These data will be available to anyone for the simple cost of reproduction. This should include a regional seismic grid that is fine enough to allow people to assess basin geological setting and petroleum potential in a gross sense and to put together new plays. But where should this come from if we cannot use the regional spec surveys? For starters, it should include all data that was: a) paid for out of Petroleum Incentive Program (PIP) grants, b) acquired 100% by Petro-Canada when it was Canada’s national oil company; c) all data acquired by the GSC, universities, etc.; d) submitted in fulfillment of work commitments by various licensees; e) belonging to companies who no longer exist because of bankruptcy, or who are no longer active here and don’t care abou

Acknowledgements

I acknowledge my sponsors GSI and WesternGeco for data donation to Memorial University and Landmark/Halliburton for data displays. Manuscript was improved through long term discussions and advice from Dr. Andrew MacRae of Saint Mary’s University, Dr. James Wright and Ian Atkinson of Memorial University, Phonse Fagan, A.J. Fagan Consulting, Paul Einarsson of Geophysical Service Incorporated, David Hawkins of C-NLOPB, David Brown and Paul Harvey of CNSOPB, John Hogg of ConocoPhillips, Doug Bogstie and Steve Whidden of WesternGeco and many others from oil and seismic companies, data brokers, government agencies, universities, federal and provincial geological surveys, consultant companies, members of Canadian Society of Exploration Geophysicists (CSEG) and Canadian Association of Geophysical Contractors. I also thank my sponsors NSERC, PRAC, PPSC, Landmark Graphics, GSI and Western Geco. It is great to have friends that will help you through the years, strongly debate with you on a contentious topic such as this one, and still remain good friends! I am grateful to them all. Finally, I must emphasize that this paper solely reflects my opinions and suggestions on this controversial subject and that I am ultimately responsible for its content.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article