The role of geophysics in the industry is a robustly debated subject these days. As our industry continues to evolve in order to meet challenges brought on by unconventional resources, changing supply and demand factors, environmental drivers, and legislative and tax regime changes – just to name a few – all aspects of our industry are under scrutiny. Nobody wants to spend money or do anything that cannot be immediately assessed for the value it adds. It is under this scrutiny that geophysicists could perhaps be forgiven for periodic existential anxiety.

Geophysicists are an important part of the group of professionals who work together on the value adding process of looking for and producing hydrocarbon reserves. At the root of the issue, geophysics is deployed as a risk mitigation tool for selecting drilling locations and characterizing reservoirs. Whether this is done in an exploratory, exploitation or development mode, seismic has proven itself to heighten the chances of success and improve drill outcomes. Understanding and communication of our respective roles and contributions in that process is urgently required.

At its essence, geophysics has developed as the most cost effective method of sampling the subsurface. All of the key geophysical methods allow us to acquire the immense information about the subsurface for a low unit cost. Initial methods were focused on basin wide prospect assessment. Two dimensional seismic was acquired to illuminate large structures along very long regional lines. This proved quite successful, and the theme of cost effectively being able to learn relatively large amounts about the subsurface without direct measurement was proven out. Continued innovation in the geophysical science has held this premise to be true. Every time we advance the science, it allows us to learn more about the subsurface in the most cost effective manner possible. The nature of what we learn has continued to be more specific, accurate, detailed and now encompasses attributes of the subsurface that we never dreamed of previously, but nevertheless it all holds the same essential quality, that it could not have been learned in a more cost effective way.

Geophysicists currently contribute to asset teams and service companies in a wide range of ways. This is mirrored by the many uses that seismic has:

- Traditional 2D and 3D seismic is key for exploration and development workflows. Modern acquisition and processing techniques have enabled high quality illumination of subsurface with accurate depth conversion for conventional and unconventional reservoirs at much lower costs and with significantly reduced environmental impact than in the past.

- Digital and wireless acquisition systems have accelerated the collection of high density high fidelity seismic data, faster, more reliably and at a lower cost than ever before.

- Prestack workflows, such as Amplitude Versus Offset (AVO) and anisotropic velocity analysis are used to model different reservoir rock and fluid conditions, aid in predicting fluid properties in addition to localized stress and fracture orientations.

- Seismic inversion methods have brought us closer to quantitatively inspecting fundamental physical and geomechanical rock properties.

- Seismic attributes and quantitative geophysics can be used to predict localized stress regimes, fault distribution, and cap rock integrity, and can further be used to highlight statistical relationships with pay and reservoir quality through cross correlation.

- 3 component seismic is used to predict fluid distribution, rock properties and changes in lithology.

- 4D seismic analysis, a time-lapse snapshot of production related reservoir alterations, is routinely used to measure the effectiveness of enhanced recovery programs and provide guidance for future cost effective pad planning and development.

- Seismic acquisition can be used to offset rental payments on oil sand leases.

- Microseismic surveillance has allowed for imaging of hydraulic fracturing leading to improved fracture designs and well completions and optimizing the spacing and sequencing between offset wells as well as monitoring for casing integrity during steaming stages.

- Induced seismicity monitoring for regulatory compliance and mitigation of seismic risk associated with anomalous ground motion.

In an industry where producing companies are adopting decision tree and value of information analysis in an effort to objectify decision making, cost effective and highly accurate methods for reducing risk are very important. Lee Hunt (Hunt, 2013) highlights the measurable impact that geophysical methods have on reducing risk in an economical way, even in situations where risk is fairly low.

Geophysical data and analysis is good for all the things that companies are trying to achieve these days. It is cost effective, for the amount of data it supplies, it is environmentally friendly, it reduces risk, increases insight into the subsurface, and the insight that it provides has broad application across geology, reservoir engineering, well planning, and completions. So in the face of this, why is geophysics even perceived to be under threat? Often, the insights gained by geophysics only offers an increased chance of success, not definitive answers, something with which engineers and financial community often struggle with. These professions deal with absolute measurement and exactness; geology and geophysics does not. At university, students study for the final exam, hoping and anticipating that their efforts will lead to a better grade. Their efforts come with no guarantee, but just about all students studied to improve their chances. In most instances, this resulted in a better mark. Using geophysics enhances the chances of success, leading towards better drill outcomes, improved deliverability and enhanced reserves, yet it comes with no guarantee.

In times of tight financial cash-flows, dollars are invested in areas and opportunities that provide economic certainty. Every dollar must be invested wisely. In tough economic times, management teams are willing to forego building an inventory of drillable prospects for the future and then culling the better ones, as cutting all expenditures becomes critical to the corporations existence or a future. Hence, corporate survival trumps corporate building for the future and optimizing future well placement. Future investments in seismic data have become almost a discretionary luxury item for those companies that can still afford it. Those that do, have witnessed through their own past history and experiences with seismic data and have learned the accretive value of using geophysics in an integrated disciplinary analysis and teamwork environment. These companies are quite often the darlings of Bay Street and Wall Street because they use science wisely, do their technical homework and have lower finding and development costs than their peers as a result. Clearly these companies are benefitting from the value of using geophysics as part of this process.

We have seen in this latest downturn, unemployment or under-employment of geophysicists rumoured to be around 50 percent. Geophysicists are wondering if there is even a future in the Calgary oil patch anymore.

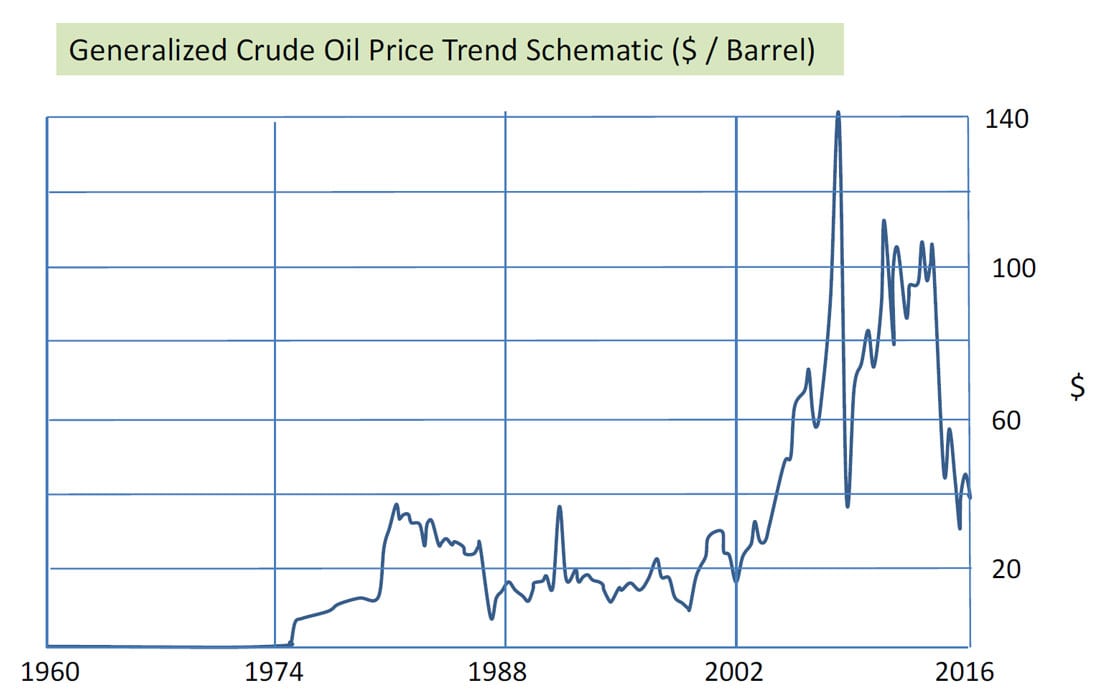

Some have now left the industry for good, or were forcibly retired, while some have left the country all together, thereby aiding and abetting the “Brain Drain”. It is clear that the oil industry is re-structuring. High cost play opportunities such as the oil sands and many of the unconventional plays that require expensive completion techniques such as fracking are still uneconomic at current price decks. Yet in the 1990s and early 2000s, Calgary’s oil patch was hopping and bursting with activity when oil and gas prices were last at these current levels! The focus was upon conventional plays as unconventional plays were not yet even envisioned. Calgary’s economy and that of the oil patch was quite successful during these times. Now that we are at these price levels again, all activity seems to be halted. 85 percent of our drilling fleet is still racked, sitting idle. This is in part due to the Canadian industry’s focus upon high cost unconventional plays that require fracking.

So is the answer to go back to conventional exploration again? In part, this is the answer but it will be difficult to do. The industry as a whole has been on a path to mitigate the risk associated with the presence or absence of a reserve. Conventional exploration resulted in dry holes but the successful wells more than covered the cost of the unsuccessful wells. As the basin matured, companies tried to reduce the number of dry holes by focusing upon plays with better metrics and financial outcomes, with fewer dry holes. As prices rose, oil sands opportunities became more attractive. The oil sands of course offered no risk towards the presence or absence of hydrocarbons, the oil was there. The issue was now extraction. Many of the unconventional plays also offer this allure. The hydrocarbons are known to be there, the issue is focused upon how to get the oil or natural gas out of the rocks at an economical cost. Whether we are talking about the Montney, the Duvernay, the Cardium, the Bakken or Viking, many of these rocks possess less than optimal reservoir quality and require fracking to improve permeability for better deliverability and economic success. Keep in mind, thirty years ago, the Duvernay was classified as a source rock, not a reservoir rock! The Duvernay play today is essentially drilling out the source rock directly. The focus of the play is where the higher reservoir pressure and better reservoir rock exists. CCoal bed methane was another trend where the risk of the presence or absence of the hydrocarbon was mitigated. Pete Rose has made a huge contribution to the oil and gas industry worldwide by offering his economic insights regarding risk analysis for oil and gas reserve opportunities. The practical result of his teachings and that of his peers has been to reduce risk and classify plays with less or higher risk. Focusing upon plays that reduced the risk for the presence or absence of hydrocarbons meant that one did not have to rely upon geology and geophysics to reduce the risk as much. Dry holes were reduced substantially in number by getting into unconventional plays.

Public companies, held to scrutiny on a quarterly basis, have to deal with longer cycle times for developing a resource or a reserve. It can take years to discover and develop an oil or gas field. The financial community has moved towards not risk mitigation but risk aversion. Public capital is less patient than the more informed or knowledgeable private capital. Public capital is less likely to understand and appreciate risk. Financial institutions want a guaranteed rate of return on their investment, yet nothing comes with a guarantee! Hence we find the oil industry starved for investment capital these days as there is always a more certain bet somewhere else in another sector of the economy for the financial community to pursue.

Some unconventional plays are becoming economic again as commodity prices improve. With the re-structuring that is occurring, smaller companies have emerged, many of which are focusing upon conventional plays that do not require the high costs of fracking. Instead the focus is about the rocks and getting into the better quality reservoir rocks. This requires the sub-surface disciplines of geology and geophysics to reduce drill risk again. Hence, geophysicists need to focus their efforts in helping these firms succeed. For the unconventional players and those involved in the oilsands, geophysics can be used to characterize reservoir properties and high-grade regions with better rocks, thus optimizing horizontal well interval and reducing fracking stages. This will lead towards better drill outcomes and economic success.

The current state of the industry for geoscientists may not be solely the result of the path that industry has taken, geophysicists may share some of the blame themselves.

The Chief Geophysicist Forum (CGF) is a subcommittee of the CSEG, and meets quarterly. Among its current priorities is an effort to understand and discuss the factors that are contributing to a reduced focus on geophysics in the industry. Its 65+ members comprise a cross section of the industry and include leading geophysicists from large and small producing companies, service providers, consultants and academics.

As it relates to improving the utilization of geophysics and increasing the benefits to oil companies, the group identified two themes: the need to better integrate asset team communication and workflows, and the need for higher levels of business acumen from the geophysicists themselves.

Geophysical data and analysis has broad application across producing and service companies. The utility of the data and analysis is dependent on integrating that data properly in the context of the entire asset team. Integrated communications are needed in order to ensure this happens properly both within our companies and also between all producers/service companies/regulators and universities. Communication between all members of an asset team needs to be constant and consistent, and not depend upon the discipline of the team member. Regular discussions must take place between the geophysicist, geologist, reservoir engineer, drilling operations team, and land person. This is necessary in order to properly utilize geophysically derived data – especially where that data is easily confused because of similar or identical terminology that is borrowed from other disciplines (Fox and Reine, 2014). Although intuitively obvious, the observations of the CGF indicate that this does not happen enough.

Integration is further facilitated by an approach to technology that enables easy sharing of team members’ output. This encourages constant engagement as opposed to a more traditional linear approach to tasks. Asset teams that are highly integrated are able to utilize geophysical data across the lifecycle of the asset. This enables important subsurface understanding at the point of planning wells and surface facilities, integrates geology and engineering data while planning completions (seismic derived pore pressure prediction for example), and allows for real-time well steering. The key point here is not the emphasis on geophysical data but rather the presence of all disciplines’ data and interpretation at all points in the asset lifecycle. Again, while the benefits of this are intuitively obvious, it is also clear that it is not widely adopted.

The requirement for business acumen is higher now because of reduced netbacks across all our industry. It is no longer sufficient simply to be highly technically proficient. All geoscientists need to put their work, analysis, interpretation, requested additional work, and suggestions in terms of the business value it creates for the asset. This is the language that should be used. Companies have adopted the previously mentioned decision tree and Value of Information (VOI) analysis as a method of establishing this type of protocol within an industry that has been guilty at times of pursuing ‘data for data’s sake.’ This is both important infrastructure, and a strong message to employees, that investment of any form needs to be articulated in terms of return on that investment. The cost of deploying geophysics can often be assessed in terms of projected well outcomes. Geophysics, properly used, maximizes the extraction of resources and appreciably reduces finding and development costs. Placing horizontal wells too close together can appreciably affect a drilling budget. Placing wells in sub-optimal orientations and positions can severely affect P10, P50 and P90 outcomes, resultant deliverability and ultimately reserves. While geophysics seldom provides a concrete answer, it does mitigate drill risk and heighten the chances of success. A lot of value has been destroyed by the engineering and financial professions by not using geophysics. Many fields or reservoirs have been over capitalized by placing wells too close together, building facilities too large for the field to support, or placing wells in sub-optimum orientations or positions, all because of a lack of insight associated with the sub-surface. This has led towards too many dollars spent to extract a reserve or a reserve that could ultimately disappoint in terms of size. The darlings of the investment community have learned these lessons and use science to improve well outcomes, deliverability and characterize the reservoir and its reserve. It seems simple to make sure you study for the final exam!

Geophysical technology also needs to evolve and keep current with the latest industry business needs. A prime example is microseismic, which has evolved into a key geophysical tool to optimize unconventional reservoir exploitation. Microseismic however is not cheap, rather quite expensive and can cost upwards of $500,000 per well in some cases. Similarly, recent concerns around induced seismicity and questions about the associated seismic risk have led to imposition of regulatory required seismic monitoring for certain hydraulic fracturing and waste water disposal wells. The public needs to become more educated about fracking and its effects. Not all fracks are designed alike as there are variations that span things like the amount of sand used, the number of stages, and the hydraulic pump pressures deployed which all affect the “size” of the frac. While some fracking operations have resulted in earthquakes being felt by the public at surface, most fracking operations result in microseisms of plus 2 to minus 2 on the Richter scale. A minus 2 on the Richter scale is roughly equivalent to a 10 lb. bag of potatoes hitting the kitchen floor. Surely your neighbor is not concerned about that! The Richter scale is of course a logarithmic scale where a 2 on the Richter scale is an event that is ten times stronger than a 1.

Environmental agencies and social groups have created much ado about the practice of fracking, often appealing to the emotions of the public with selective fact reporting and emotional hype. Clearly the industry has to do more to promote fact based information within public purview to provide concrete evidence regarding risk and exposure of the public. The industry and the government has to hold these environmental organizations accountable for their assertions, requesting fact based reporting and chastising emotional hype as a tactic to engage public support.

During economic challenging times, finding cost effective technical solutions requires a thorough understanding of the geophysical technology against a backdrop of the industry’s social license to operate. New business models are now allowing for operators to “sign-up” to participate in multi-client Induced Seismicity Monitoring (ISM) nodes as a cost effective way to mitigate liability associated with fracking. Geophysics in this form is being used as an insurance policy against potential public scrutiny over fracking and perhaps preventing the shut-down of field operations by regulatory agencies when a frac operation might result in an earthquake greater than +4 on the Richter scale. While these business models are focused upon shared participation and hence reduced costs result, ISM activities are yet another additional cost associated with the extraction of a reserve. When is it going to get cheaper to chase the good quality reservoir rocks, the “good” rocks that are conducive to conventional exploration and development, the ones that do not require fracking or ISM techniques, the ones that are economic at today’s price decks? To go down this path will require educating and convincing the engineers and financial types that geophysical work is part of a good investment! The challenges that our industry is facing are indeed difficult. Consensus is growing that we will adapt to these challenges – as we have always done – but look and act differently when all is said and done. A fundamentally different industry isn’t necessarily a bad thing, if it means that we continue to become smarter and more efficient (by all definitions of that word) as a result. As it relates to geophysics, integrated, well communicated, and properly articulated geophysics can be a great enabler in the future – and will clearly increase value. This has to be done within industry circles amongst the engineers and the financial community and with the public.

The value associated with deploying geophysics is one associated with describing the sub-surface and characterizing the rocks. After all, the key is that it is about the reservoir, especially in light of today’s commodity prices.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article