You Know That You Know!

Imagine you’re at the controls of an airplane. From movies and games, we all know how very easy it is to take off. You simply taxi to the end of the runway, line up, push the engine throttles forward, pull back gently on the stick and there you are, flying. With just a little guidance, we could all get off the ground on the first attempt… right?

Many excellent technical papers and books have been written about how to “pilot” 2D and 3D seismic surveys, such as Ongkiehong et al. (1988), Vermeer (1990, 2002), and Cordsen et al. (2000). This discussion follows a different line of inquiry, following Kerekes (1998) who questioned why thousands of people regularly expect the electronic flash on a pocket camera to illuminate sporting events that are taking place hundreds of feet away, at night. In short, we’re taking a fresh look at the role that human nature plays in the seismic survey design process.

During a business management seminar many years ago, one of the authors was given an insight into human nature, an insight that has proven extremely useful during the design phase of our seismic surveys, something we know all about… right?

You Know That You Don’t Know...

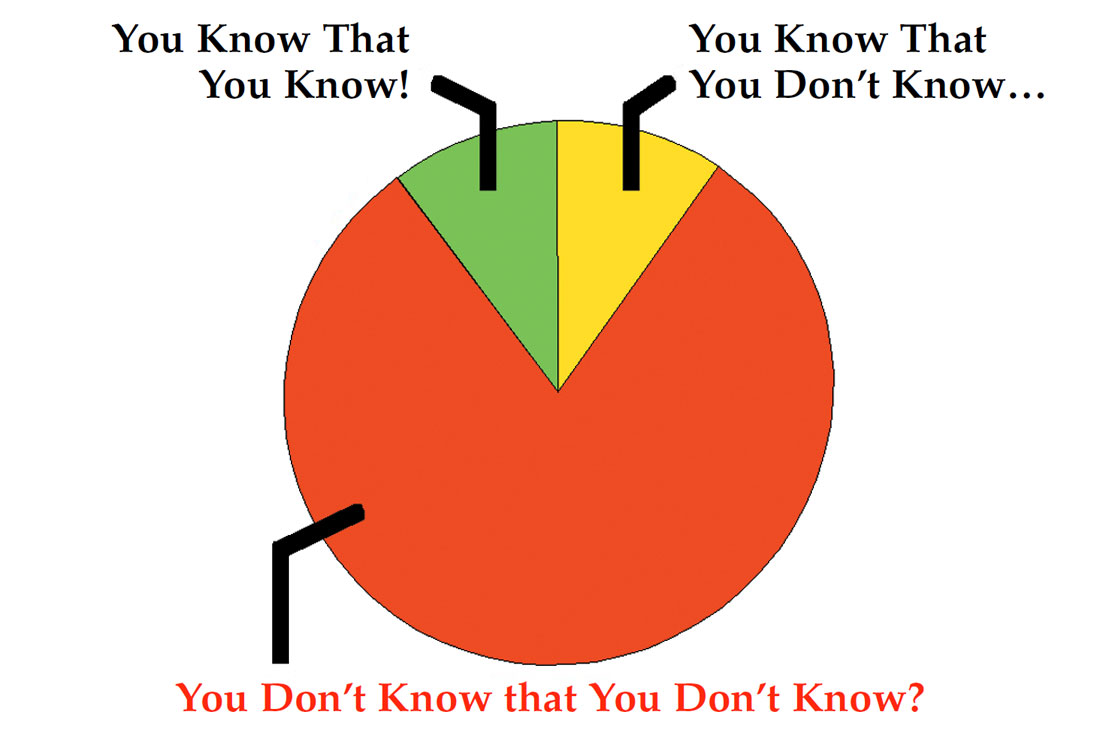

The seminar leader asked everyone to imagine a circle, a circle that held the Sum of Human Knowledge. He suggested that a group of technical specialists would understand some of this knowledge very well indeed and also would recognize several other disciplines where their degree of understanding was incomplete… right?

He represented these two areas of knowledge as small segments within the Sum of Human Knowledge and labeled them “You know that you know” and “You know that you don’t know,” as shown in Figure 1.

You Don’t Know That You Don’t Know?

After provocatively labeling the rest of the circle “You don’t know that you don’t know,” the seminar leader outlined how some famous business failures had been the result of people being unaware that they were operating within this vast segment.

People taking flash photographs in a sports stadium at night should also fall into this category. Paraphrasing Kerekes (1998), “After all, they pushed the right button. What else is there… right?”, which sums up perfectly the very essence of working in the “You don’t know that you don’t know” segment. The photograph of a floodlit stadium may serve as a memory trigger, but few can interpret the fuzzy, shadowy details to determine who actually kicked the ball. If the stadium lights went out, just how much value would a flash photo image have?

Seismic Images

Clearly, any catastrophic failure to pilot a large airplane is readily and immediately apparent to most sentient observers, especially the passengers. Similarly, a photograph taken without adequate illumination tends to stand out, even to an untrained eye. Can we say the same about a seismic image? Unfortunately no, we can’t.

A seismic survey, no matter how well or how poorly it has been designed, acquired and processed, will always result in the delivery of a set of seismic sections or a 3D volume. This guaranteed delivery of data, regardless of quality, is the main reason why seismic data often has been perceived as a commodity that can be bought on the open market at the lowest possible price. Thankfully, this perception is changing, largely due to unsuccessful wells that have been traced back to unsuccessful seismic surveys.

Clearly, nobody deliberately tries to take an unsuccessful photograph or ever sets out to acquire seismic data that is unsuccessful or “inadequate”. We all try to deliver the best we can, within budgetary and time constraints. But who defines what is “adequate”? That’s right, we do. Humans. How do we define how much quality is needed? “Ay, there’s the rub.” Perhaps unsuccessful seismic surveys are simply the result of people straying (unwittingly) into the re d segment of the Sum of Human Knowledge: “You don’t know that you don’t know.” Human nature is such that it’s difficult to admit that we don’t know that we don’t know.

So, let’s examine the Top 5 risks when working within the “You don’t know that you don’t know” segment of seismic survey design, before we examine how best to manage these risks.

Risk 1: Survey Location

“We don’t need to check the location… right?”

Hand-held GPS receivers are cheap and readily available, so topographic survey expertise is now superfluous… right? Surprisingly, this continues to be one of the most common examples of “You don’t know that you don’t know.” Numerous anecdotes tell of either an inappropriate geodetic datum or an incorrectly applied datum transformation parameter. The belief that longitude and latitude alone can define a unique surface location is also surprisingly persistent (Rayson, 1998) and still wholly erroneous.

One geologist confided that a one kilometer error in the location of both the seismic and the (dry) well meant that the prospect remained untested. But, he added, management firmly believed the dry well to have been a failure of the geological model. How many similar prospects are still out there waiting to be discovered, masked by simple positioning errors?

Risk 2: Survey Size

“These lines’ll cover the edge of the structure… right?”

Well, yes, but single-fold unmigrated data went out of fashion about the same time as flared pants (the first time, kids). Sadly, 2D and 3D survey definitions are sometimes constructed without taking into consideration (or fully understanding) migration apertures, low-fold margins, ray-paths, illumination criteria, etc. The result: lines are too short, the sub-surface coverage is too low and the final migrated stack at target depth has too little data to be geologically meaningful.

Risk 3: Survey Cost

“The survey’ll cost this much… right?”

Well, yes, if all goes well the budget will match the size of the survey. However, sometimes the budgets are set by geoscientists, engineers or managers who don’t know that they don’t know the size of the migration aperture. This problem can be compounded if budgets are based upon historical rather than current market costs. Marine 3D seismic acquisition costs have more than doubled over the last two years and are set to double again, until supply and demand balance.

As the size of a 3D seismic surveys falls, so the impact of budgetary foresight rises. The full-fold migration aperture often doubles the size of a survey and can force geoscientists to choose between several bad options:

- acquire a survey that produces an image that is too small to be useful;

- reduce the source and receiver density to illuminate the required sub-surface area;

- postpone the survey until all becomes clear;

- increase the survey budget.

Although the latter two are never popular with management or partners, the first two tend to result in sub-optimal surveys, inappropriate well locations and thus unsuccessful wells.

Risk 4: Survey Geometry

“We can shoot this recording geometry with this equipment, within budget… right?”

Most geophysicists know that there’s more than one unique design that will achieve the business objectives of a seismic survey. Only a few have the means to field-test them all, so we tend to stick close to that which “we know that we know”, which tends to be that which appeared to work well last time, in similar circumstances. But isn’t it amazing how fast things change? If not the technology or the technique, then the field environment in which a seismic crew must operate. Nowadays, it’s rare when the same crew, technology and techniques can be put to work successfully in the same area two years running!

Hornman et al. (2000) conducted an interesting exercise in land 3D survey design. Five internationally respected 3D design experts were asked to propose survey designs for the same “client” specifications, in a similar fashion to a competitive tender process. Even taking into account the clear intent of some of these experts to propose unusual or exotic solutions to the problem, the resulting six designs showed wide variations in many of the most basic survey parameters. Sub-surface bin sizes ranged from 12.5m through to 30m, fold from 25 to 108 and prestack trace density from 35,000 to more than 600,000 traces per square kilometer. Given the technical credibility of the individuals involved, it is very likely that all six proposed designs would have delivered “adequate” data quality, but time and budget plans would have varied significantly.

Six years on, it seems strange that many geoscientists insist on inviting and evaluating bids using a single, pre-determined geometry. True, Tender Boards often require a single model for cost comparison purposes, but in this tight market, one cannot possibly know every seismic crew’s constraints (availability of equipment and personnel, operational and safety constraints, environmental and stakeholder issues, cost and schedule imbalances, etc., etc.), so it would be unrealistic to expect all bidders to be able to field “the” optimum geometry. Besides, some seismic contractors design hundreds of surveys each year, so may well have a smarter, more practical approach using technology that is readily available to them and techniques that are more appropriate to the location. Whilst errors here may not lead to a technical failure, they can easily lead to sub-optimal efficiency and cost, even if the lowest bidder is awarded the work.

Risk 5: Technology and Technique

“This new approach will solve all our problems… right?”

Kerekes (1997) criticized the arbitrary use of innovative technology by saying, “Great, but that is engineering! What about the science of setting the acquisition parameters?” Will innovative technology and techniques resolve all issues or simply increase the size of the “You don’t know that you don’t know” segment? For example, digital 3-componant receivers spaced too far apart caused some to conclude that this innovative technology was unsuccessful; this apparent “failure” lead to premature rejection by those affected, to the detriment of both contractor and client alike.

Kerekes examined several cases that used “historically proven” field parameters. Some appeared to be based upon the assumption that someone in the past had had the right rationale, an assumption that is sometimes high risk. A good example of this is Vibroseis. Although vibrators have become increasingly powerful and reliable over the last 20 years, the sweep parameters – number of vibrators per group, number of sweeps per VP, sweep length, frequency range and drive levels – have remained essentially unchanged. The end result is that some Vibroseis surveys are undoubtedly “over shot”, resulting in sub-optimal efficiency, cost and of course signal-to-noise ratios.

What Can We Do?

“We don’t know that we don’t know… right?”

True. In practice, the business must move forward. We must keep on making decisions on the basis of imperfect information. Whilst it is of vital importance to recognize our own human nature and our limitations with respect to knowledge, we daren’t risk paralysis through such self-awareness. Some individuals have already recognized these risks. Some companies are already implementing practical solutions, but it takes lots of determination and bags of self-confidence to maintain an objective point of view when under pressure. Here are four ways to get the best from our frail human nature:

E Expertise

T Training

T Testing

C Communication

Expertise

We can best manage the risks presented by complex technologies and techniques by seeking appropriate expertise and applying specialist skills and experience before (rather than after) committing to an inappropriate, sub-optimal survey design. Perhaps the best way to begin is by recognizing that other specialty areas of knowledge are, at the very least, as complex as our own. Once we admit to that, we stand a better chance of knowing that we don’t know that we don’t know… if you get our drift.

Training

There will never be enough time to fill all the gaps in our knowledge, but if we don’t begin to learn then we’ll never fill any! There are literally thousands of in-house and external training courses vying for our attention and our time. However, our human nature encourages us to learn more about that which we already understand or enjoy, which carries an inherent risk of evolutionary blind alleys. The best way we can manage the risk of becoming narrow specialists is by cross-training in other disciplines. The CSEG’s annual Doodletrain is a great way to shrink the “You don’t know that you don’t know” knowledge segment and to augment the other two. Other professional associations such as the CSPG and CAGC help enormously by disseminating public-domain information in efficient ways that are relatively easy for us to absorb.

Testing

We can best manage the risks associated with tried and tested, yet sub-optimal, recording geometries and parameters by incorporating field testing into our routine operations. Field testing can not only build confidence in the strengths and weaknesses of a tried and tested approach, but also can help to improve inappropriate or impractical innovations. In seismic, as elsewhere, innovative strategies are more often evolutionary, seldom revolutionary. We can often improve quality whilst saving time and money simply by improving our operations a little every day.

Here are a couple of practical examples. If relying upon deephole dynamite sources to illuminate the sub-surface, why not scatter a few test shots across the survey area, replacing standard shots with alternative charges at different depths, analyze the outcome with a view to drawing meaningful conclusions and recommendations that save time and money or improve data quality. With Vibroseis, testing a little beyond the preconceptions of the “optimal” could yield similar benefits as the vibrators move across the terrain. Now the proof of the pudding is in the eating, so such tests ought to be witnessed and the results processed and analyzed by geophysicists in the field.

Communication

We can best manage the risk of miscommunication simply by communicating, but we all know that timely, accurate and precise communication is extremely hard to achieve. Within a single organization, it’s difficult for people to use or even understand another’s specialist terminology, so how can we all understand all the issues all of the time?

One example. Seismic field crew managers tend to focus on running safe and efficient operations, within very tight budgets. On the other hand, some geophysicists like to explore innovative geometries. Field personnel may not understand the oil company’s business objectives. Office staff may not understand operational and fiscal constraints. Either may emerge from a short conversation with a long-term negative view of their “opponent”.

Sure, the more we communicate, the more we’ll understand, but we haven’t got all day to chit-chat. The solution then is to communicate more effectively. Some people are particularly good at this, able to explain different points of view in different ways to the various specialists involved in successful seismic surveys.

The End (or The Beginning).

All of this is, of course, nothing new. In the dialogues of Plato, Socrates says: “If you know that you don’t know, that is a great beginning. Then it is possible for you to know” and also concluded, “I know nothing except the fact of my ignorance” (Laertius, circa 225).

Rest assured, we’ll continue to scan through “The Reservoir” and “The Source”. Whilst we may not become successful pilots overnight, we hope that it will help us to avoid the risk of crashing!

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article