This article is reprinted with permission from Canadian Discovery’s CEO review series (Spring/Summer 2007 Northern Canada Onshore & Offshore Regions). For information on products offered by CDL, please visit www.canadiandiscovery.com or call 403-269-3644.

Reduced Recent Exploration Activity

This past winter no new drilling or workover efforts were licensed in this area of the Central Mackenzie Valley. Operators are still waiting to see what happens with the long delayed and still uncertain Mackenzie Gas Pipeline Project (MGP). This spring, it was announced that the cost estimate for the entire project had ballooned to $16.2 billion. The last hearings into environmental, socioeconomic and cultural impacts of the project led by the Joint Review Panel (JRP) will not conclude until November this year, a year behind schedule. Once the JRP has filed its report, the National Energy Board (NEB) can complete its own report and final recommendations. The project proponents, led by Imperial Oil, will hopefully get to sit down in 2008 at the earliest, once the NEB report is handed down, and decide if this project has economic value. There are also other issues that could make or break this pipeline (see separate review of the MGP).

The clouds of uncertainty regarding the immediate future of the gas discoveries in this and other areas of Arctic Canada does not seem, however, to have stopped explorers from acquiring exploration licences (EL) and carrying out geological and geophysical exploration field work.

Successful Call for Bids

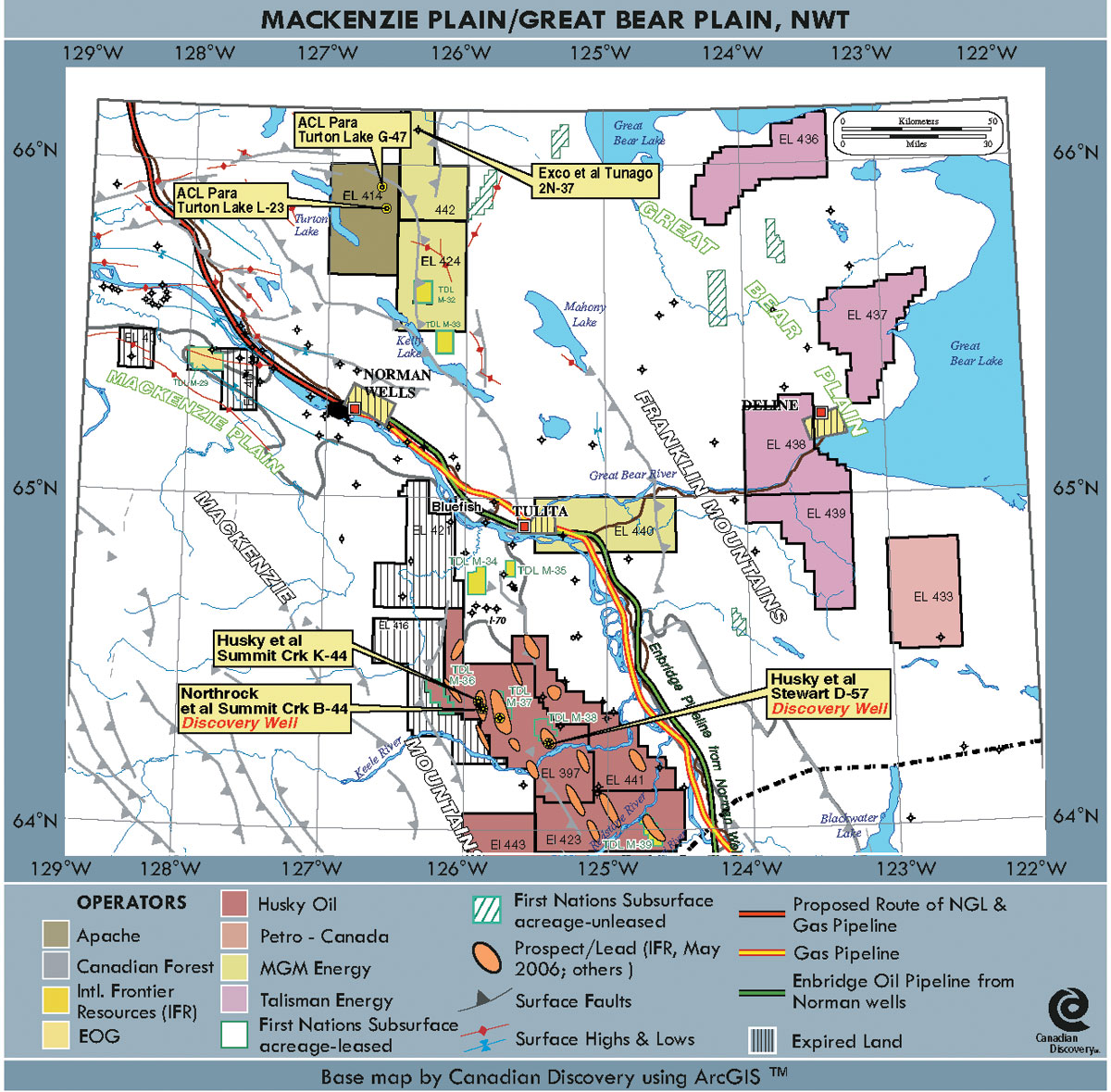

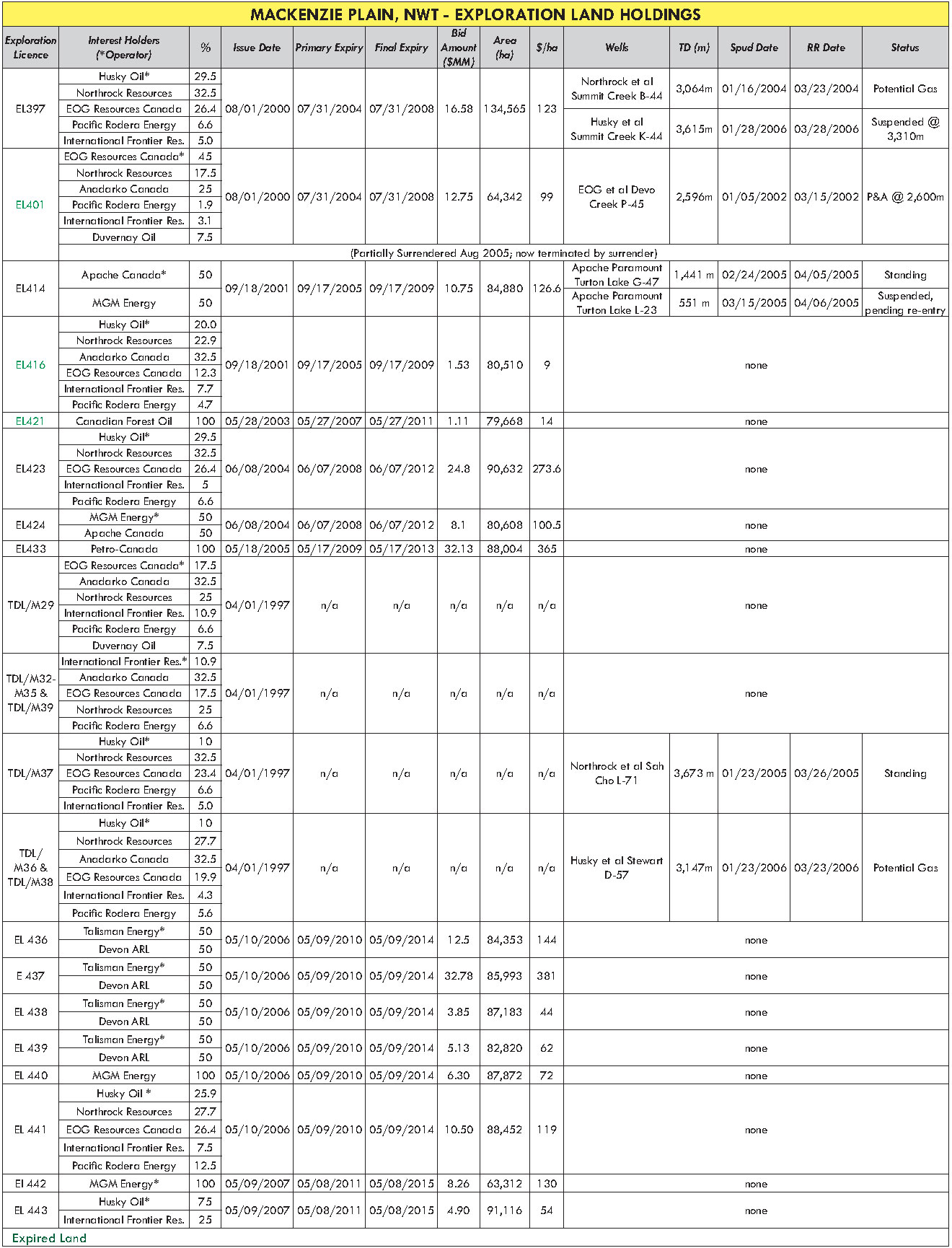

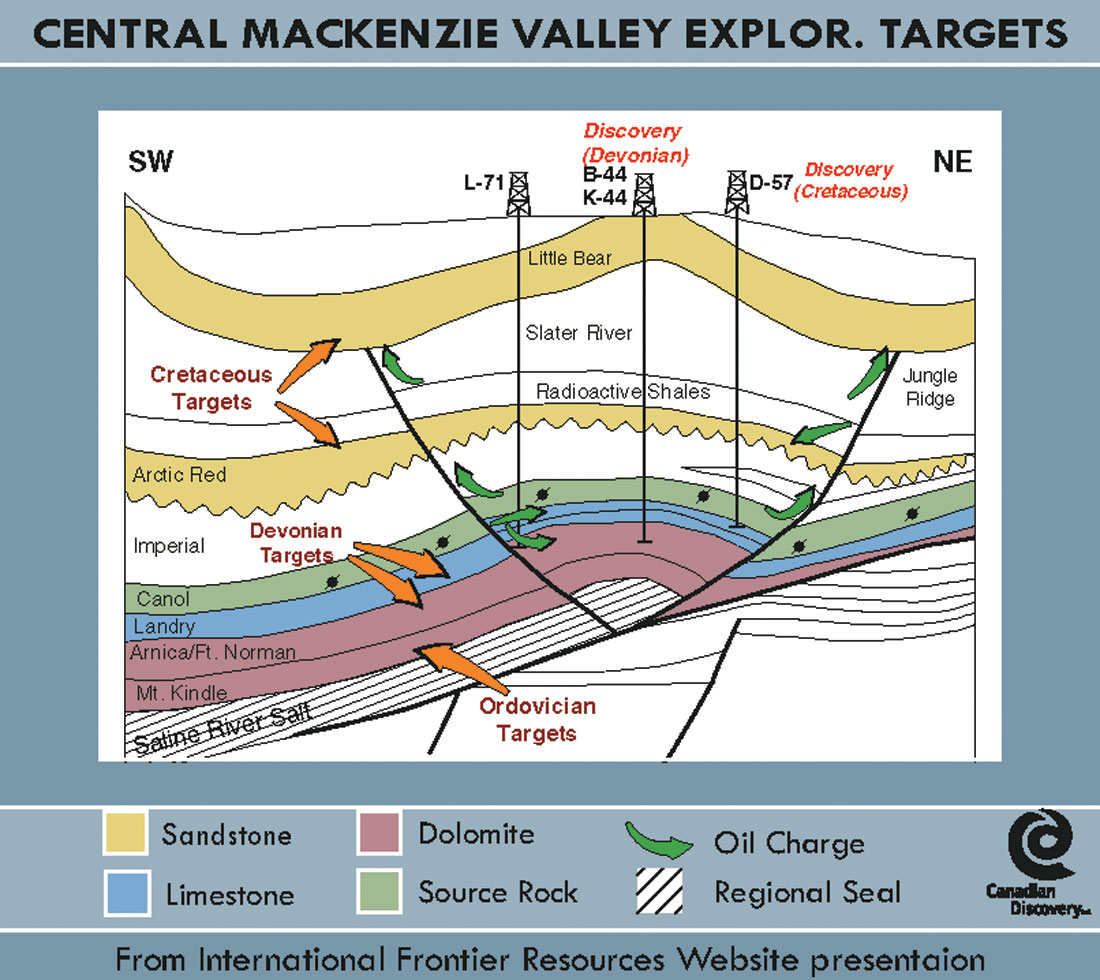

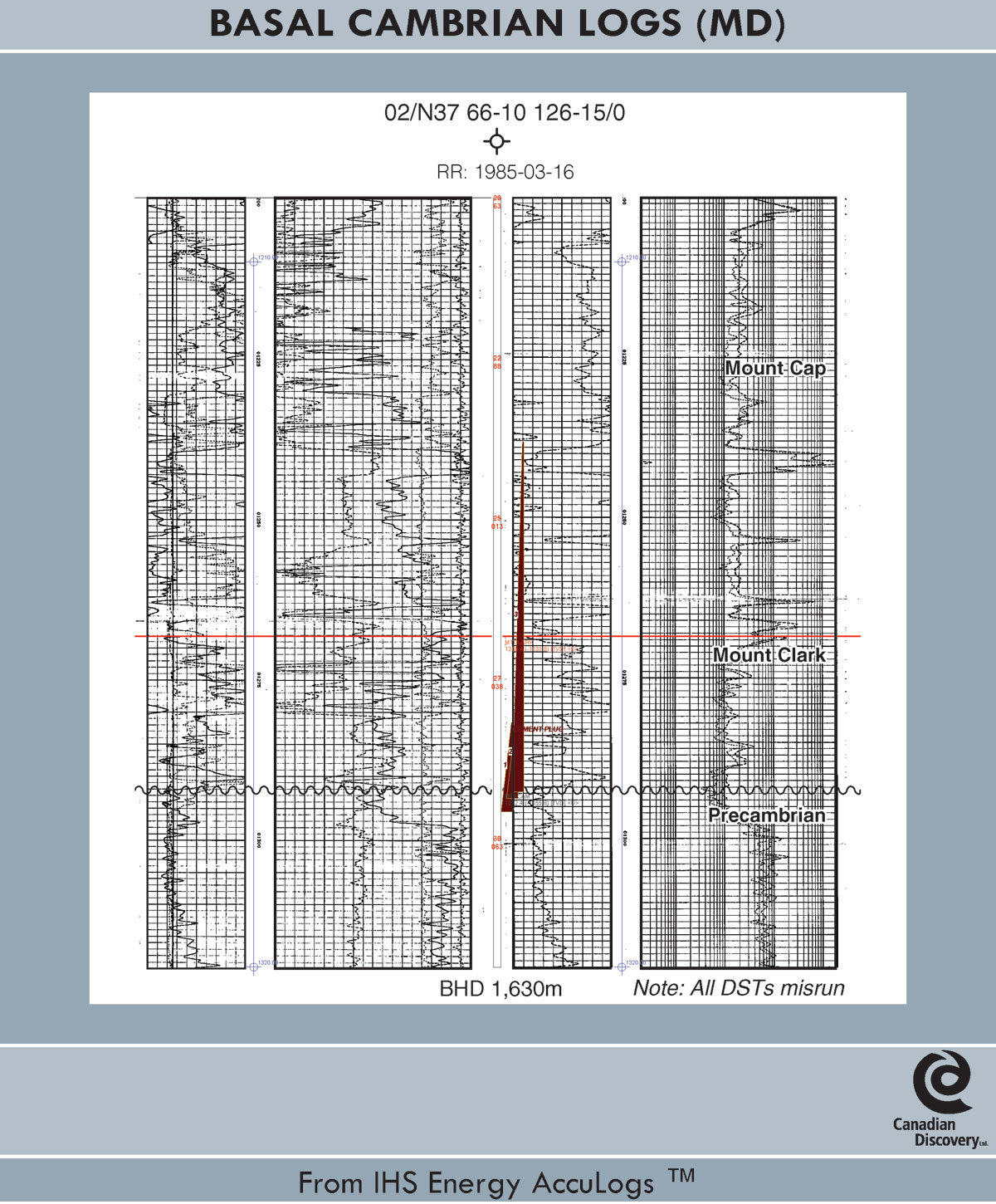

This year’s Call for nominations by Indian and Northern Affairs Canada’s (INAC) was followed by a successful Call for bids with a deadline of May 8, 2007. Four licences were awarded, two in nearby Colville Hills (see separate review) and two in the Mackenzie Plain/Great Bear Plain. MGM Energy was top bidder and was awarded EL 442 (formerly CMV-1) totalling 63,312 ha. The company bid $8.26 million in work expenditure or the equivalent of $130/ha. This acquisition complements contiguous ELs 414 and 424 acquired by MGM (was Paramount Resources until January 11, 2007) and partner Apache Canada in 2001 and 2004, respectively. In 1Q 2005, the partners, with Apache as operator, drilled two wells on EL 414 at Turton Lake. Latest reports list both wells as standing. Turton Lake G-47 was drilled to 1,441m in the Precambrian. Located nearby, Turton Lake L-23 has been initially drilled to 551m (Ordovician Franklin Mountain Formation) and tested, but had to be suspended due to spring break-up. Future plans might include deepening this well to the Precambrian, the well’s original depth target. Only one well sits on new EL 442 ( Tunago N-37/2N-37 – see logs). Drilled in 1Q 1985 by Exco Energy to 1,620m, this Precambrian NFW tested a Cambrian prospect and was abandoned.

The second and last parcel is EL 443 (formerly CMV-2) totalling 91,116 ha, which was leased to a partnership of Husky Oil (75%, operator) and International Frontier Resources – IFR (25%) for a work commitment of $4.9 million or $54/ha. That new acquisition is on trend with three ELs (397, 441 and 423 totalling 313,649 ha) held by Husky (operator) and partners Northrock Resources, EOG Resources Canada, Pacific Rodera and IFR (see Exploration Land Holdings table). Between July and September 2006, Veritas shot 235 km of seismic data in what the National Energy Board (NEB) calls the Summit-Redstone Project, including prospects on ELs 397, 423 and 441. EL 397 has already been validated through drilling of several wells including discoveries Summit Creek B- 44 and Stewart Creek D-57 and stepout Summit Creek K-44. EL 423 expires in 2008, and it will be interesting to see if a decision is made to drill this winter. EL 441 does not expire until 2010. EL 416, which was also held by the same consortium, expired in 2005. Husky also has land holdings with Paramount Resources in the Cameron Hills oil field area, while IFR also has exploration licences in the Colville Hills area.

Northrock Resources

One of the members of the Husky et al partnership is Northrock Resources, initially an operator (see EL table). That company has a history of recent ownership change (Unocal Canada [2000], Pogo Producing [2005]). In early March this year, rumours circulated that Northrock was to be sold again, with Pogo in midst of a strategic review. At the end of May it was announced that Northrock, with assets in Alberta, Saskatchewan and the NWT, had been sold to Abu Dhabi National Energy Company PJSC (TAQA) for US$2.0 billion cash. Abu Dhabi is the first Middle East state to get involved in the Western Canada Sedimentary Basin. The sale is expected to close in 3Q 2007.

No information has been made public on significant discovery applications for the two recent important hydrocarbon discoveries (Northrock et al Summit Creek B-44 and Husky et al Stewart D-57) made in the Mackenzie Valley.

Great Bear Plain

On the western side of the area in the Great Bear Plain, which recently attracted top bids from Petro-Canada (EL 433 in 2005) and Talisman Energy/Devon ARL (ELs 436, 437, 438 and 439 in 2006), no postings were requested this year. As of yet, no exploration plans have been made public specifically for Petro-Canada’s EL 433. This past winter, Veritas acquired 153 km (was initially 355 km) of 2D seismic in the Great Bear Plain area for operator Talisman Energy. That survey was begun January 29 and completed March 24. A geochemical survey was also completed for Talisman in the area (Deline district) between March 12 and 26. In October/November 2005, a 7,793-km2 aerial gravity survey in the Sahtu region was acquired by Devon Canada, likely in anticipation of the 2005/2006 sale where the company partnered with Talisman in winning the four aforementioned parcels. Two geophysical surveys were initiated and apparently completed during Q1 2006 in the Deline District of the Sahtu Settlement Area. There, ExplorData acquired 138 km of 2D seismic and 208 km of gravity data.

It would appear that companies with holdings in the Great Bear Plain are poised to find and drill prospects in that region, perhaps once there is more certainty about the proposed Mackenzie gas pipeline, hopefully in 2008.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article