During the past five years, the Canadian Atlantic Coast has become an important world petroleum province with: 1) production from world-class oil and gas fields: Hibernia, Terra Nova (together 55,000 m3 or 350,000 bopd) and Sable gas project (12.5 million m3 or 450 million cubic feet per day); 2) future developments at White Rose (projected 100,000 bopd) and possible at Hebron-Ben Nevis and Deep Panuke fields, and 3) committed future exploration in excess of $1.5 Billion Canadian dollars. An exciting and costly exploration race is now taking place within the Mesozoic basin trend for the discovery of Atlantic Canada’s new giant field.

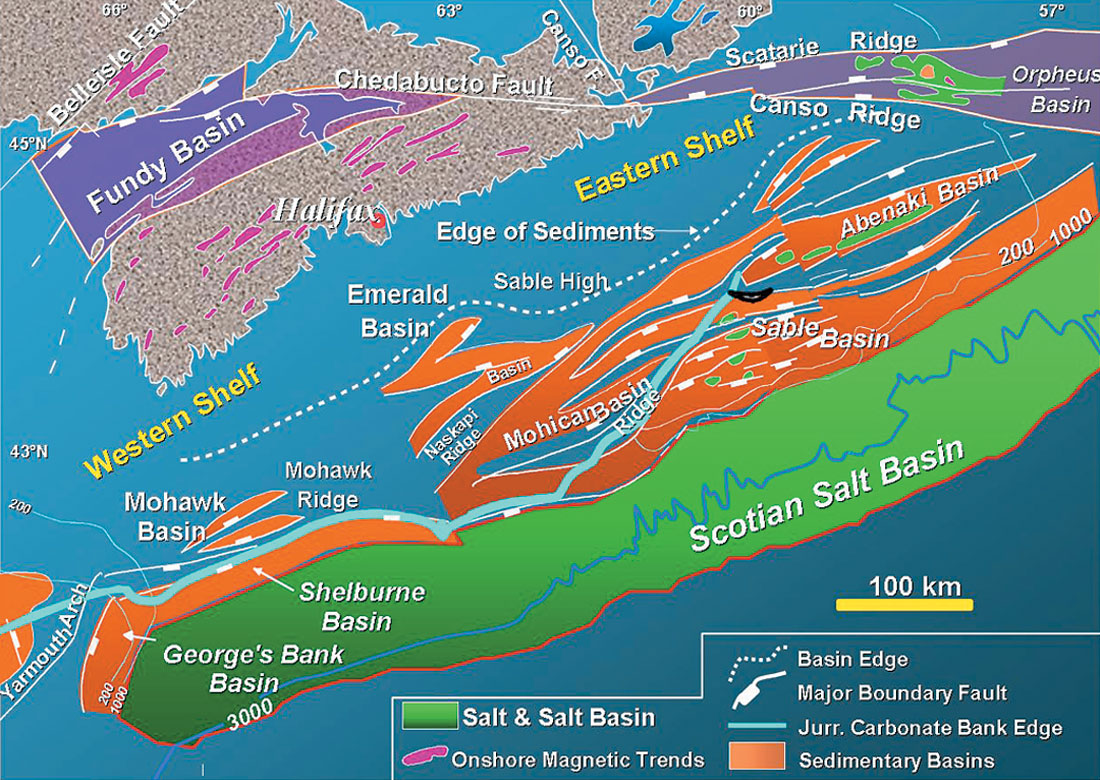

The continental margin of Atlantic Canada stretches on for more than three thousand kilometres from Georges Bank, at the Canada/United States border to the northern tip of Labrador (Figure 1). Exploration drilling on the Atlantic Canada margin began in mid 1960’s, and to date about three hundred fifties exploration wells have been drilled, almost equally divided between Nova Scotia and Newfoundland and Labrador waters. From a Frontier exploration point of view, all the basins along the margin can be considered to have hydrocarbon potential. Most of the basins are lightly explored; some remain unexplored by the drillbit. Up to now, world class discoveries have been made in the Hopedale (Labrador), Jeanne d’Arc (Grand Banks) and Sable (Scotian Shelf) basins (Hogg and Enachescu, 2003; Enachescu, 2004a and b; Enachescu and Fagan, 2004) (Figure 1).

Offshore Nova Scotia

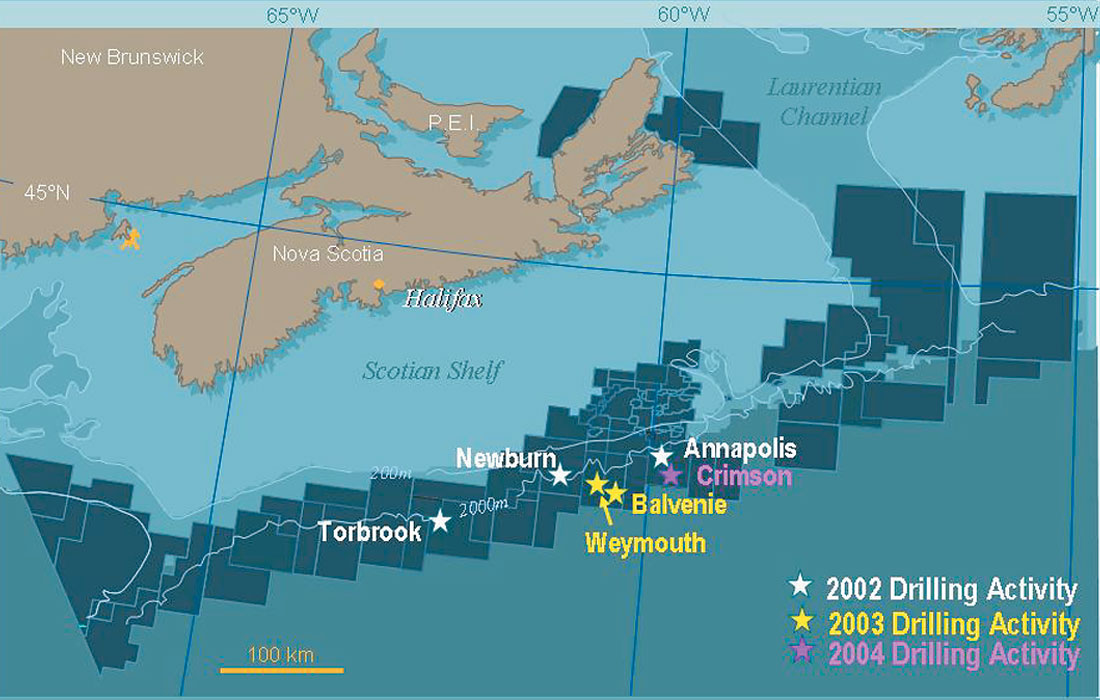

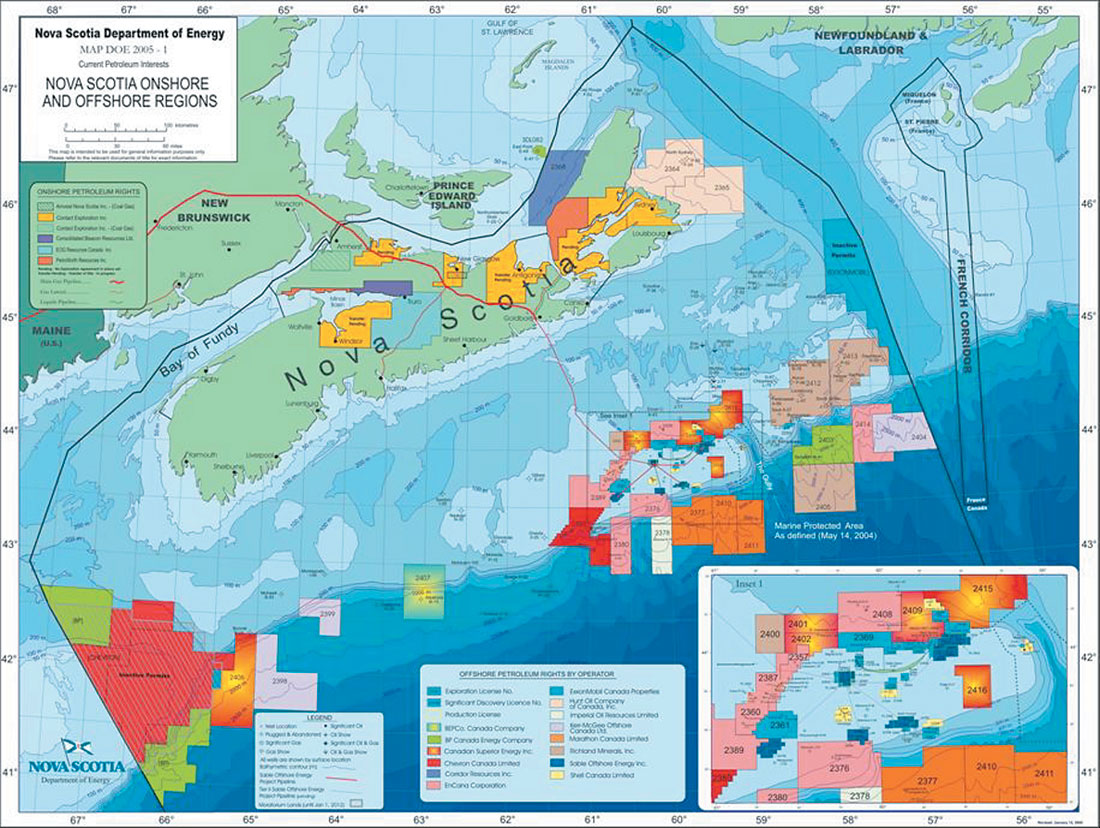

Since that first well in 1967 a total of 200 exploration, delineation and development wells have been drilled offshore in an a rea of approximately 120,000 km2. The Scotian Shelf and Slope area is divided into a series of geologically distinct basins and sub-basins (Hogg, 2002). Sedimentary basin formation occurred during the Middle to Late Triassic, in response to rifting and subsequent separation of North America from Africa. Basin development continued during Late Jurassic to Tertiary with creation of a large passive margin and deposition of carbonate platforms, fluvio-deltaic and shelf edge complexes and slope sedimentary wedges. Excellent reservoirs and source rocks are found in the post-rift and passive margin sequences. The major area of focus for exploration has been the Sable Basin, an area of 10,000 km2 in water depths of a few meters to 200 m where all but two of the significant discoveries have been made to date (Figure 2). The most active companies in the area’s exploration were Mobil (now ExxonMobil), Shell, ChevronTexaco, Petro-Canada, Husky Energy, Imperial, Union, PanCanadian and most recently EnCana Corporation, Murphy, Kerr-McGee, Marathon, Anadarko, Canadian Superior and Bass Petroleum.

Production

The only production at this time is from the Sable Gas Project operated by ExxonMobil on behalf of its partners (Enachescu, 2004). Production is from four gas fields: Venture, Thebaud, North Triumph and Alma, with additional fields to be onstream in the next few years (e.g. South Venture). Most of the gas fields have underperformed during production, due to more reservoir complexity then expected from the initial petrophysical modeling. The life of this project without taking into account new additions is estimated to stretch to mid- 2020s. Currently, Canada’s only offshore gas development delivers upwards of 450 mmcf/d of gas through the Maritimes and North Eastern Pipeline to the New England market.

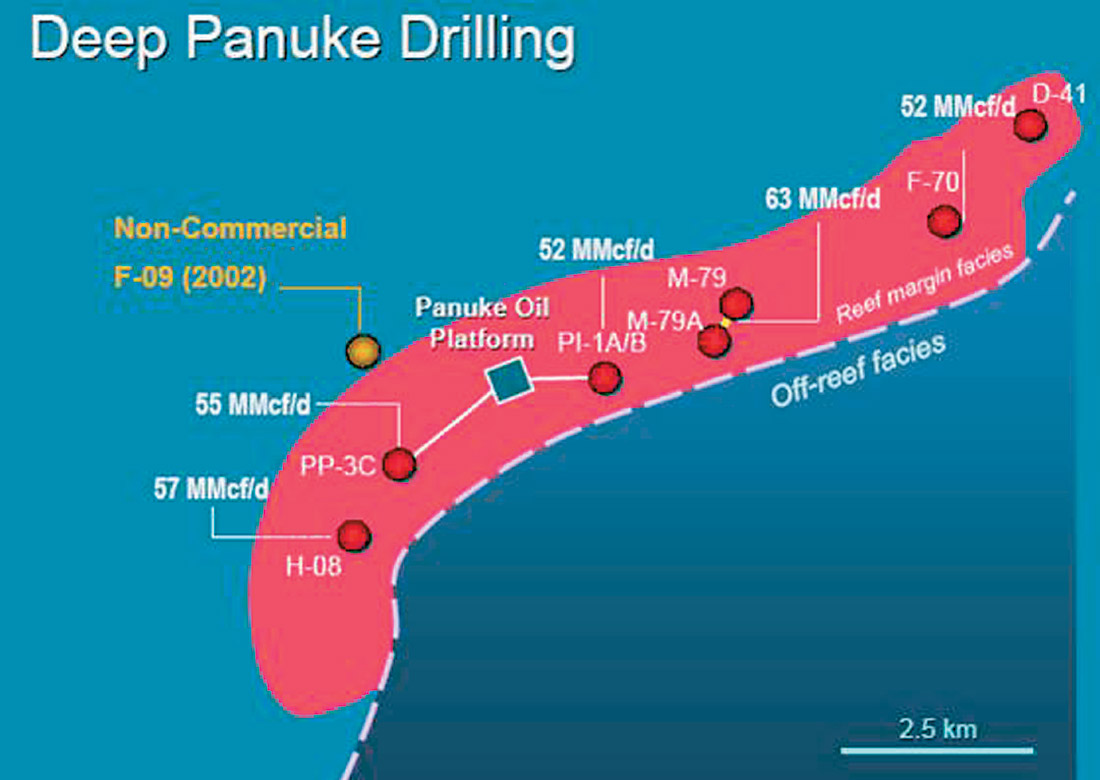

Deep Panuke, a large gas field discovered in the late nineties and subsequently delineated by six wells, is the only potential candidate for standalone development (Wierbicki et al., 2002; Hogg and Enachescu, 2003; Enachescu, 2004). Discussion with the Nova Scotia Provincial Government on development of the Deep Panuke gas field are interrupted, however the operator EnCana Corporation continues its reservoir delineation, with an upcoming well this spring and research into alternative field development design.

Exploration

In the Scotian Basin exploration recently took place on a number of distinct exploration trends: 1) on the Jurassic Carbonate Bank, exploration drilling followed-up the 1999 Deep Panuke discovery; 2) deepwater drilling targeting Scotian Slope Cretaceous and Tertiary turbidite reservoirs and 3) in the Sable Basin, exploration is ongoing on the existing listric fault trend targeting Late Jurassic-Early Cretaceous sandstones (Hogg, 2003; Hogg and Enachescu, 2003).

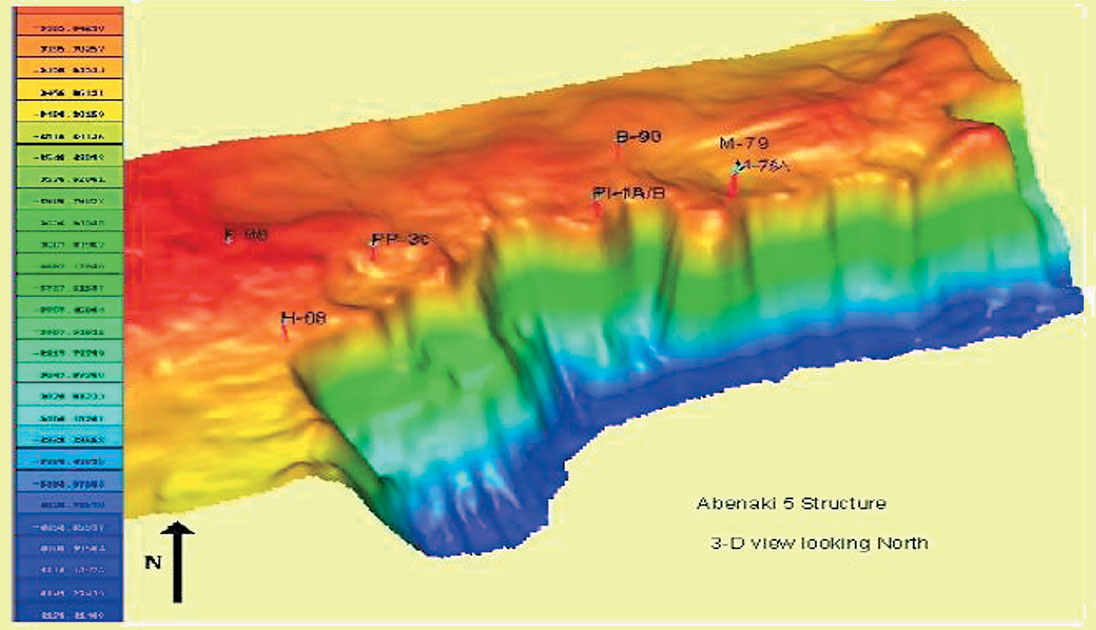

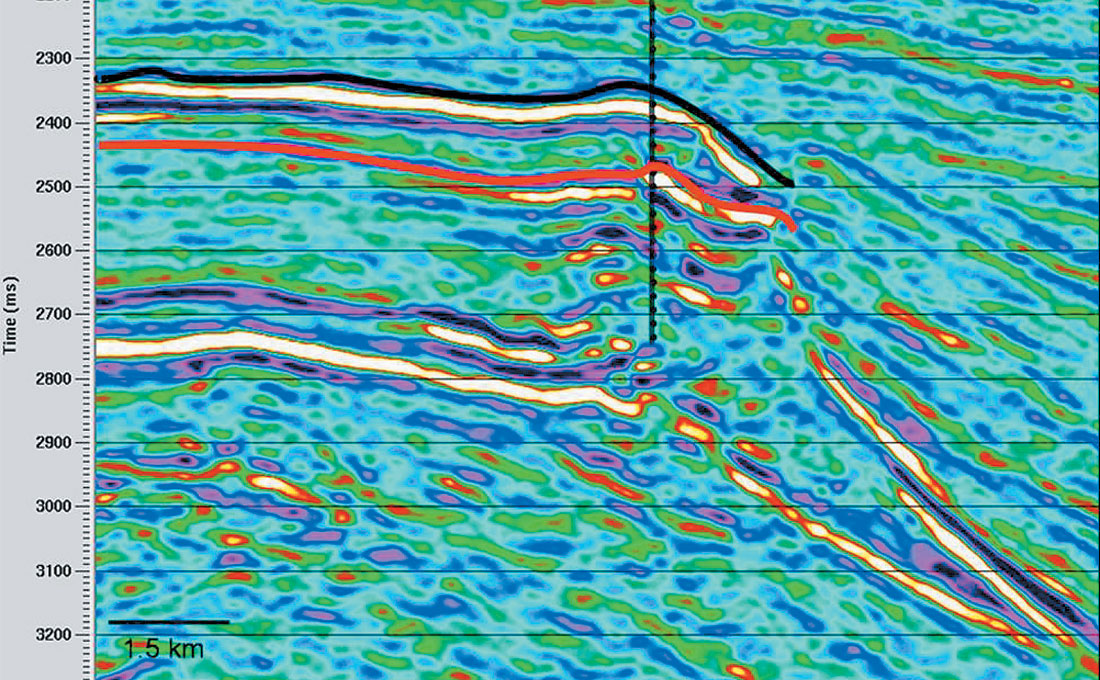

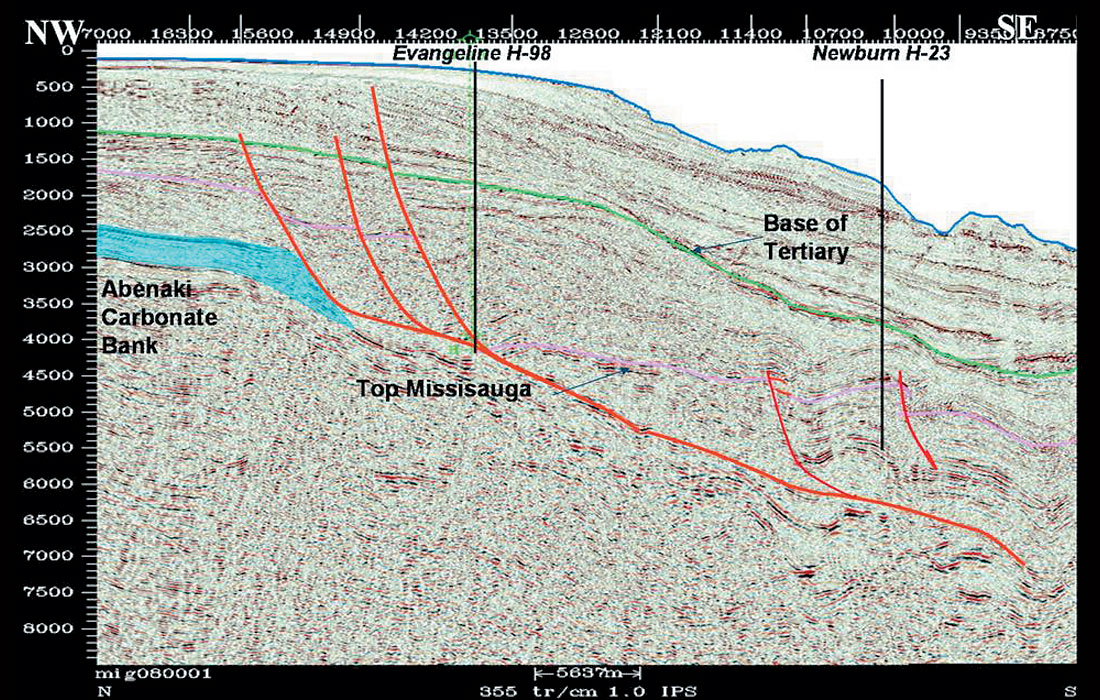

1. Abenaki Carbonate Trend. The most important discovery of the present exploration cycle in Atlantic Canada, the Deep Panuke shallow-water gas discovery, is the only Jurassic-aged carbonate discovery on the western Atlantic margin to date. While this “reef” play was tested offshore Nova Scotia by ten wells over thirty years and hydrocarbons are found in similar Jurassic play offshore Morocco, on the conjugate Atlantic Margin, success came only after intensive use of 3-D data, seismic amplitude mapping and reservoir fluid recognition studies (Figures 3 to 5 and Harland et al., 2002; Wierbicki et al., 2002; Tonn et al; 2004).

This discovery, under the existing and depleted Cohasset and Panuke oil fields, was made in 1998, and has been delineated by seven additional wells by PanCanadian and successor company, EnCana Corporation. The field is in a structural-stratigraphic trap. The latest wells testing this play were Margaree F-70 (flowed 53MMCFd) and MarCoh D-41 announced as successful delineation wells in the northern part of the field. It is estimated that Deep Panuke gas field contains in excess of 1 Tcf (Figure 5). The MarCoh D-41, (suspended gas well) drilled by EnCana and partners into the carbonate trend beneath the Cohasset oil field has intersected one of the thickest pay column in the field. The Late Jurassic reservoir is located at the platform margin and consists of deep reefal build-up and surrounding ruble limestone with porosity enhanced by karstification, fracturing, dolomitization and dissolution (Figure 4, Harland et al., 2002; Hogg and Enachescu, 2003; Tonn et al., 2004). The porosity ranges from 3 to 40% (vaggular), permeability varies from one millidarcy to several darcies and the pay zone ranges from 30 to 100 m (Harland and Harvey, 2003). Despite other recent wells that have chased this complex “reef” play, the Abenaki Carbonate Trend has revealed just one of its giant hidden treasures. A new well will be spud during 2005 by EnCana Corporation and Marauder resources on the Grand Pre block, just north-east of MarCoh well into the Jurassic carbonate platform.

2. Cretaceous and Tertiary deepwater turbidite reservoirs. Deepwater exploration offshore Nova Scotia is in its second round of drilling; to date, the industry has drilled ten deepwater wells (Hogg and Enachescu, 2004). Four unsuccessful wells, Albatross B-13, Shelburne G-23, Shubenacadie H-100, and Tantallon M-41, were drilled in the mid 1980’s when no reservoir development was found (Kidston et al., 2002). Seven deepwater wells drilled since the year 2000, were located in the Scotian Salt Province, an extensively disturbed area with numerous structural and stratigraphic traps that occupies the continental slope between 200 and 3000 m (Kidston et al., 2002; Hogg and Enachescu, 2004). Recent wells were located in water depths ranging from 700 to 1700 m, and were drilled for reservoirs associated with movement of Argo halite and possible lowstand deposition of turbidite sandstones (Figure 6). The new wells are: Annapolis B- 24 (early abandonment due to mechanical problems) and G-24 (gas discovery) targeting Early Cretaceous turbidites (Ryer et al., 2004); Newburn H-23 drilled for Early Cretaceous turbidite sandstones (Figure 7); Torbrook C-15 that tested a Tertiary fan, Balvenie B-79 targeting a mid-Cretaceous turbidite system, Weymouth A-45 that was drilled for several seismic horizons under the salt and Crimson F-81, the delineation of Annapolis G- 24 that failed to prove continuation of Cretaceous deepwater reservoir. While hydrocarbon shows were encountered in several wells, only one successful discovery was reported, Marathon et al. Annapolis G-24.

3. Sable Basin Listric fault trend. In the Sable Basin, active exploration is taking place in the listric fault trend around the present Sable gas development where other opportunity for gas discoveries exists. The Mariner I-85 well drilled in 2004 by El Paso and Canadian Superior was announced as a gas discovery but no tests were performed and the well was abandoned. A second delineation well is planed for the Mariner structure for the current year.

Earlier significant discoveries in the 100-200 Bcf range size are distributed close to the Sable Gas Project (e.g. Arcadia, Citnalta, Uniake, Olympia, etc.) and similarly, several adjacent exploration blocks are known to contain medium size fault dependent closures with Cretaceous and Jurassic sandstone play (e.g. Bell and Campbell, 1990). While no elephants are to be fund in the area, a “string of pearls”-fields in the range of 100 Bcf to 500 Bcf may provide the additional reserves for the existing pipeline infrastructure. Strangely, the value of the traditional listric fault/deltaic sands play has increased with failure to discover giant fields in the immediate slope setting. This was one of the initial targets in the basin and while tens of wells have been located on rotated fault blocks, many intermediate to smaller size feature are still to be drilled.

Discussion

No commercial discoveries were lately made offshore Nova Scotia either on the shelf or on the slope, except for the Deep Panuke gas field discovered under exhausted Panuke oil field. Annapolis G-24 was the only well that encountered significant gas in a slope fan play, but the delineation well has not been successful. While lack of quality thick reservoir has plagued this exploration round, the Industry has proved that drilling operations can be safely performed year round in the deepwaters off Nova Scotia targeting deep prospective horizons.

Based on interpretation of deepwater high quality seismic grids and evaluation of drilled source rock intervals offshore Nova Scotia, the estimated reserves by industry and government experts are 41 Tcf (unrisked number), distributed in twelve distinct play types (Kidston et al., 2002). Only three play-types were drilled in the most recent drilling round. If at one stage (2002/2004) all of the deepwater Nova Scotia lands had been licensed for exploration by the industry, recently half of the blocks were released back to the Crown, some without fulfilling the exploration commitments (Figure 8). More exploration drilling is expected for other blocks. While drilling results were disappointing, offshore Nova Scotia contains a very large, underexplored basin which holds significant petroleum potential. The key to future successful exploration should be a critical evaluation of the past drilling round, multidisciplinary industry-government- academia synthesis studies and synergetic scientific research using the accumulated regional and prospect data. Opening up of new exploration areas such as the George’s Bank after a thorough environmental assessment will also improve the petroleum potential of the province.

Offshore Newfoundland and Labrador

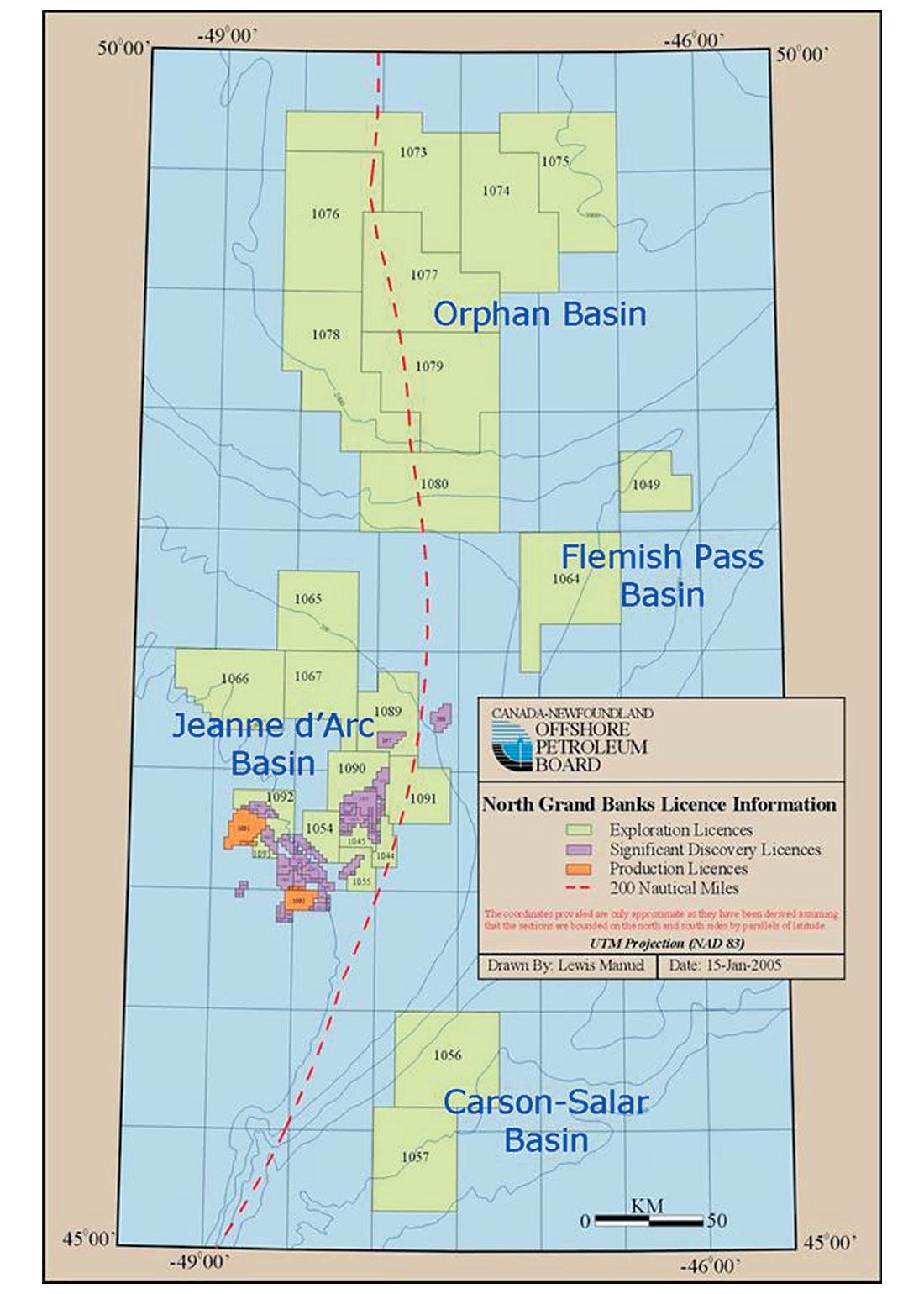

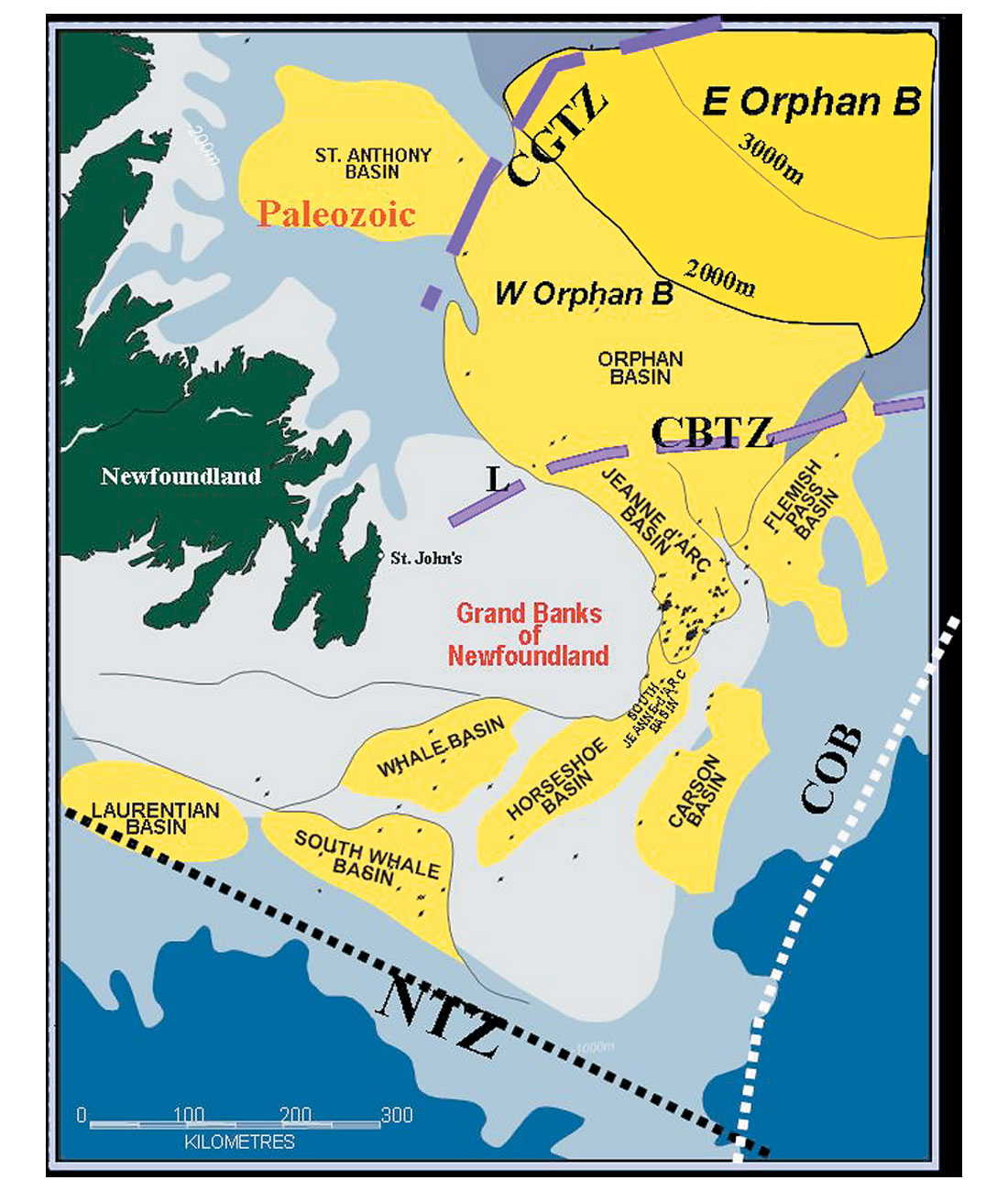

Although the first offshore drilling occurred in 1966, only 133 exploration wells have been drilled to date on the entire continental shelf around the Province of Newfoundland and Labrador. The area of jurisdiction includes a vast area of about 1.6 million km2 of which about half is considered to have petroleum potential. The well density is very low even on frontier basins standards. The prime exploration focus during the past three decades has been within the proven reservoirs and shallow waters of the Jeanne d’Arc Basin, but recent landsales and the locations of seismic surveys shows that the industry has expanded its efforts into untested areas, including the essentially untouched plays along the continental shelf of the Laurentian Basin, within the slope and deep water basins such as the Orphan Basin, Flemish Pass, Carson-Salar and deep water South Whale, or in long dormant areas such as the on-shelf South Whale and Labrador Sea (Figures 9, 10 and 11). All these basins are part of a widespread interconnected network of rift basins that formed during the Mesozoic continual break-up and Atlantic Ocean opening and contain world quality reservoir and source rocks (Figure 10).

The most active explorers of the past decades were Mobil (now ExxonMobil), Chevron (now Chevron Texaco), Petro-Canada, Husky Energy, Gulf (now ConocoPhillips), BP, Shell, Murphy Oil and EnCana. Many other companies involved have been long time gone through mergers and acquisitions. Just a handful remain active, usually companies that already have established production. Exploration commitments are spread over 36 licenses which have varying expiry dates spanning the next five to six years (Figures 9 and 11). As a result, the province could see as many as 10 shallow, intermediate and deep water wells drilled over the next 5 years.

Production

With production levels at approximately 350,000 bopd from two producing fields, Hibernia and Terra Nova, and a third field White Rose approaching first oil at a 100,000 bopd, the Canadian Province of Newfoundland and Labrador is establishing itself as a major oil player on the international oil and gas stage (Enachescu, 2004: Enachescu and Fagan, 2004). Four successive White Rose delineation wells tested oil and showed the southern extension of the oil and gas field while development wells at Hibernia and Terra Nova have proven the size and high productivity of the respective reservoirs. During 2003, ExxonMobil lifted an average 193,000 barrel/day from the Jeanne d’Arc Basin, the largest production among the partners of Hibernia and Terra Nova oil developments. Petro-Canada has a 20% or greater share in all four of the province’s major oil projects, and is involved in 22 out of the 23 significant discovery areas designated in Newfoundland and Labrador waters. Petro-Canada has obtained over 35% of its net earnings in 2003 from its Newfoundland producing properties and just recently has increased the recoverable reserves number for Hibernia oil field to 940 million barrels. Husky Energy is very close to production from its operated (72% interest) White Rose field and there are positive steps toward reexamination of development of Hebron-Ben Nevis asset.

Exploration

Basins with both proven and unproven economic size oil and gas accumulations are now the target of exploration. For the past few years the main area of exploration was the syn-rift sequence in the Jeanne d’Arc and Flemish Pass basins (Figures 9 and 10). However, no new major discovery was made after drilling 16 exploratory wells since the start of the present drilling cycle in 1995. Some of the deep water wells in the Flemish Pass Basin were costly disappointments, but they were testing completely new play concepts for the area with very little information on the nature and distribution of reservoir rocks. The seismic and drilling focus is now shifting toward two practically unexplored basins: the Laurentian and Orphan basins. Our hopes are that success will be experienced early in the exploration phase in these basins bringing in a new period of enthusiasm and re-evaluation of potential for the entire Atlantic Canada area.

The oil industry’s increased interest in this area is exemplified by the fall 2003 Landsale in the Orphan Basin in which a consortium that includes ExxonMobil, Chevron Canada and Imperial Oil bid Can $672.7 million in work commitments for eight large and very large parcels lying in water depths ranging from 2000 to 3000m (Figure 9). This was by far the most successful landsale in Canada’s exploration history, and included a record bid of CAN $251.6 million for a single parcel (EL 1079). The fall 2004 landsale was equally successful as several companies (Petro-Canada, Husky Energy, Norsk Hydro and HMDC) bid $71 millions for 5 smaller size parcels located within the shallow water of the Jeanne d’Arc Basin and environs and in the vicinity of known reserves (Exploration Licences 1089 to 1093 on Figure 6). Present active exploration areas are in the southern Grand Banks, Jeanne d’Arc Basin and Orphan Basin.

Southern Grand Banks. The basins of the southern Grand Banks, Laurentian Basin and South Whale Basin, have had a common structural evolution with the Scotian Shelf and Slope during most of the Mesozoic era. These two rift basins are therefore interconnected and show a strong imprint of salt tectonics, similar to their adjacent basins to the south and north (Figure 7). These basins are conveniently located approximately 200 km south of the east coast of Newfoundland, in shallow to intermediate water depths and are free of iceberg movement.

Laurentian Basin

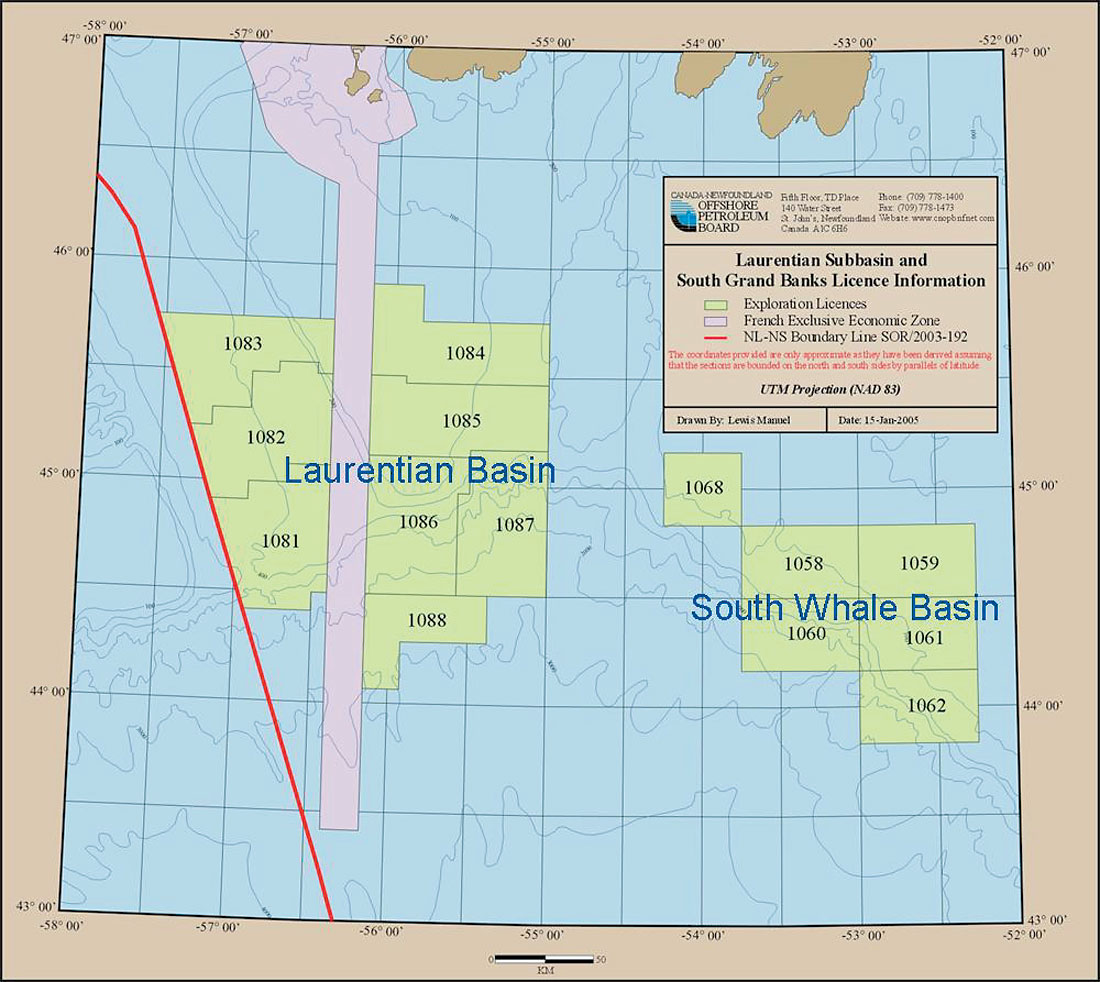

Covering an area of 60,000 km2 this is the southernmost Grand Banks basin (Figure 11) and is now in its first exploration round, as a result of a long lived moratorium due to international and provincial boundary disputes. First the international boundary with France (in 2001) and second the boundary between Nova Scotia and Newfoundland (in 2003) were set. Then in the summer of 2004, the existing federal permits were transformed into modern Exploration Licences (EL) attracting $13 Million dollars committed for new exploration, after some $18.4 Million already spent (Figure 8).

Early seismic mapping and reports by the Geological Survey of Canada (GSC) have indicated a 600 to 7000 million barrels and 8- 9 Tcf gas potential for the basin. A single well Bandol #1 was drilled during 2001 in the French territorial waters by ExxonMobil, Gulf et al., but it was abandoned and no results were released. The possible hydrocarbon plays, similar to those encountered on the Nova Scotia shelf and slope are the listric fault blocks, rollover anticline or salt anticlines with Jurassic/Early Cretaceous sandstone reservoirs, possible development of Abenaki limestone porosity or slope sandstone fans. Present Exploration Licence holders are ConocoPhillips, BHP Billiton, Murphy Oil and Imperial Resources.

South Whale Basin

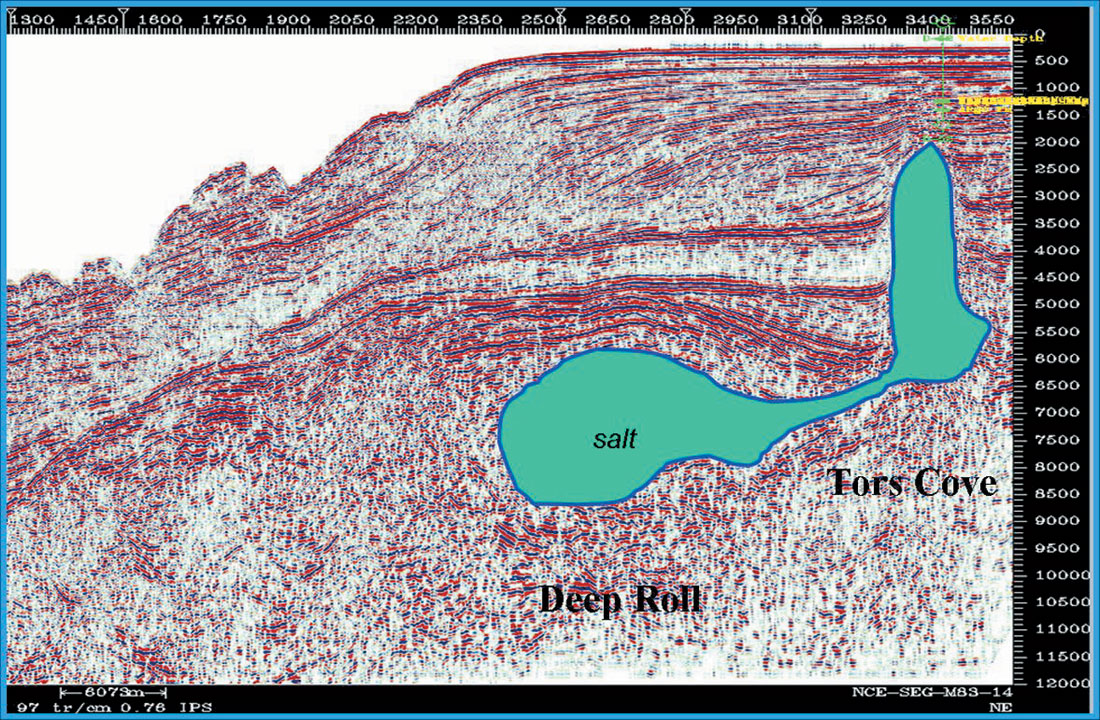

South Whale Basin is a Mesozoic sedimentary area situated mostly in shallow and intermediate waters in the southern part of Grand Banks, close to the Newfoundland Transfer Zone (Figures 10, 11 and 12). Proximal to petroliferous proven Sable and Jeanne d’Arc basins, the South Whale Basin was drilled without success during the sixty, seventies and eighties (14 wells). The 5 to 8 km deep basin contains synrift sediments, probably of Scotian Shelf affiliation. The favourite oil play of the early exploration efforts in the basin was the salt anticline, drilled generally crestal and at shallow depths, but all wells were abandoned with only minor shows encountered (e.g. Figure 12). Repeated dry wells brought an early condemnation of the basin for lack of oil source rock and breaching of the traps at the Avalon (Base Aptian) Unconformity level. Basin re-mapping projects using newly acquired seismic data and re-evaluation of potential plays with focus in the intersalt domains or on the slope, has revived exploration hopes and brought back several operators into the area (Figure 12). The Petroleum System of the South Whale Basin should include localized Kimmeridgian source rock (Verrill Canyon or Egret shales) in the several mapped sink-synclines and probably Mid-Late Cretaceous source rocks on the slope. Late Jurassic (Mic Mac sandstone and Abenaki carbonate) and Early Cretaceous (Logan Canyon sandstone) reservoirs will be targeted in large fault bounded roll-over anticlines and rotated fault blocks within deeper synclines (Enachescu and Fagan, 2005). Possibly sand-rich fans may develop on the basin southern slope. The future of the exploration in the basin is to be decided this year (2005) by an exploration well scheduled to be drilled by Husky Energy over the large Lewis Hill prospect. Besides Husky, EnCana and two smaller companies, Paramount Resources and Polaris Resources, have land interests in the area.

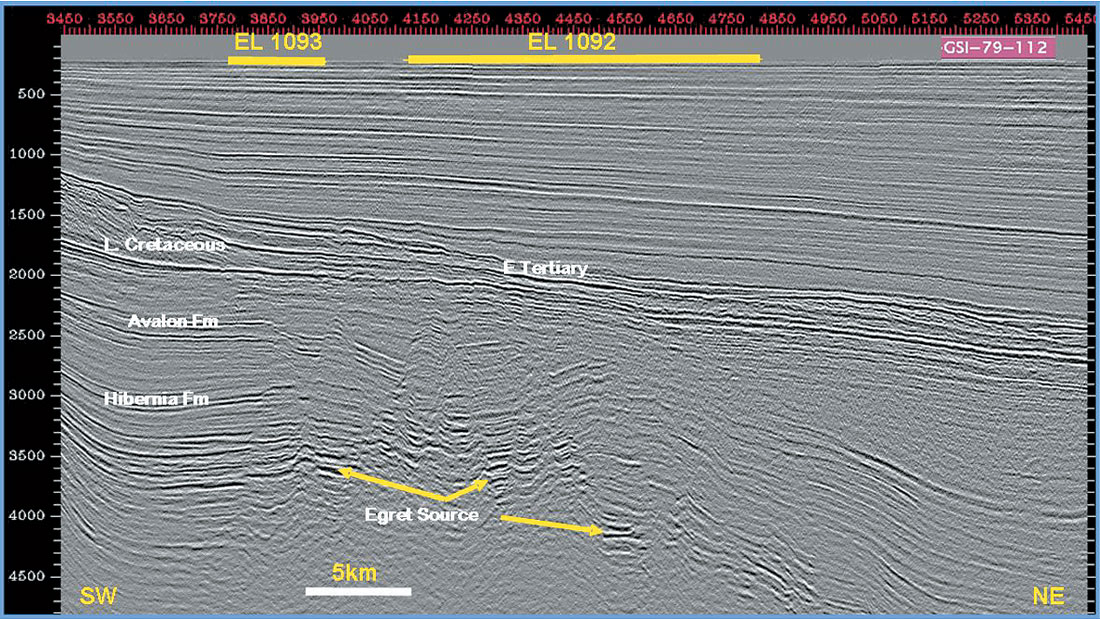

Jeanne d’Arc Basin

Jeanne d’Arc Basin is a fault-bounded Late Jurassic-Early Cretaceous reactivated sector of the larger Late Triassic-Early Jurassic rifted area on the Grand Banks (Figure 10). The basin was primarily shaped by repeated extension episodes and exhibits only minor inversion due to trans-tensional forces and salt diapirism. A proven rich petroleum system is present including a) Kimmeridgian source beds (Egret Member) and b) excellent reservoirs in Late Jurassic Jeanne d’Arc, Early Cretaceous Hibernia and Catalina, and Mid-Cretaceous Avalon and Ben Nevis formations (Hogg and Enachescu, 2003; Enachescu, 2004; Enachescu and Fagan, 2005).

According to Canada-Newfoundland Offshore Petroleum Board (C-NOPB), the discovered recoverable reserves, all located in Jeanne d’Arc Basin, are estimated to be: 2.1 billion barrels oil and 5.6 Tcf Gas with 324 million barrels of associated liquids, while potential recoverable reserves for this basin were recently estimated at 4.6 billion barrels oil and 18.8 Tcf gas. To date 56 exploration wells have been drilled in the basin, resulting in the discovery of 2.1 billion barrels recoverable oil and 5.4 trillion cubic feet of recoverable natural gas. This re p resents an exploratory well density of one well per 250 km2 within the Jeanne d’Arc Basin. All past exploration has been focused on the oil play, but this may change as investigations are currently underway toward bringing Grand Banks gas to market. The White Rose field alone contains almost 3 Tcf of recoverable gas, and Husky Energy the operator for this field recently issued a call for proposals on ways and means to monetize the gas. Among other engineering initiatives, CNG transportation solution is studied by private firms and Memorial University.

Within the oil prolific Jeanne d’Arc Basin retargeted by a recent landsale, potential for oil discoveries exists in deeper structural plays, stratigraphic traps in the southern part and combination traps in the eastern side of the basin, while gas plays are still to be tested. Smaller satellite fields and extension blocks of the producing fields are to be found in the future exploration drilling. Figure 13 shows fault blocks within recently acquired ELs that are located in the immediate vicinity of the Hibernia field and can be drilled as satellites of the field.

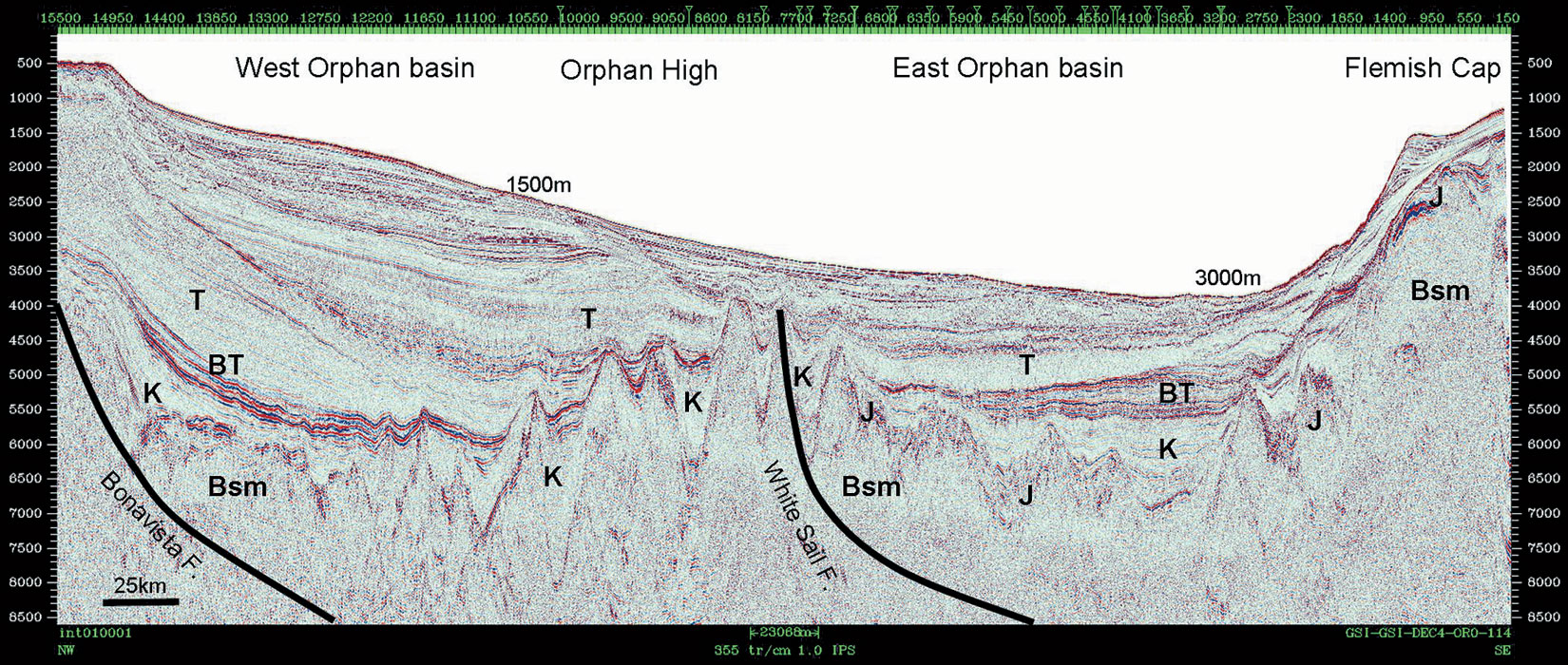

East Orphan Basin. The next focus of the Atlantic exploration is the East Orphan Basin, a highly attenuated Mesozoic-Tertiary sedimentary area situated north and northeast of the Grand Banks of Newfoundland in water depths ranging between 1500 and 3500 m. The Petroleum system of the East Orphan Basin should include: a) Kimmeridgian and probably Albian source rocks; b) Late Jurassic, Early and Late Cretaceous and Tertiary reservoirs; c) large roll-over anticlines, rotated fault blocks and submarine fans and d) source maturation, generation and short distance migration of oil and gas from large sub-basins into existing antiforms and submarine fans (Enachescu et al., 2004a and b). 3-D seismic acquisition and mapping is ongoing on several exploration blocks that contain large antiforms (200-400 km2) resulting from extensional roll over anticlines being modified by transtension and inversion.

This is a new and unexplored Mesozoic-Tertiary sedimentary area situated north and northeast of the Grand Banks of Newfoundland in water depths ranging between 1500 and 3500 m. The West Orphan Basin that lies westerly on the NE Newfoundland continental margin is a younger rift basin that contains seven dry holes drilled between 1974 and 1985 (Smee et al., 2003; Figures 10 and 14). While good reservoirs and very large structural traps were tested, no significant hydrocarbon flows were obtained and no Kimmeridgian source rocks were encountered in the West Orphan Basin. Connected to proven petroleum systems of the Jeanne d’Arc and Flemish Pass Basins, the East Orphan Basin contains a large petroleum potential (Enachescu et al, 2004a and b). Recently, longer streamer lengths during seismic acquisition and adequate migration algorithms during seismic processing were used to significantly improve imaging of large anticlines, rotated fault blocks and basin floor fans that form traps, and of half-grabens and intra-depressions that may contain Late Jurassic oil prone source rocks (Figure 14). Alternatively, the mapped Late Cretaceous and Tertiary thick shale intervals may generate gas, similar to the situation encountered on the Labrador Sea basins.

With a long intra-continental rift evolution, shallow marine interludes of possible source rock deposition and numerous synrift structural and stratigraphic trapping possibilities, the East Orphan Basin has recently attracted (2003) the highest land bid and the highest singular block bid (EL 1079 operated by ExxonMobil) in the Canadian oil exploration history, from an exploration consortium led by Chevron Canada, that includes ExxonMobil and Imperial Oil. The 8 parcels awarded cover an area of more than 5 million acres. This spring, Shell Canada has taken a 20% interest in the blocks through a farm in from ExxonMobil and Imperial Oil. According to recent published seismic studies (Smee, 2003; Enachescu et al, 2004b; Enachescu and Fagan, 2004), there are half dozen large structures in the basin, with each potentially holding several billion barrels of oilin-place. 3-D data seismic surveys, environmental assessment and sea bottom hazard work are presently ongoing and will continue during the next few years. A significant area with petroleum potential remains unlicensed by oil companies (Enachescu et al, 2004b). Situated on trend with other oil prolific basins on both sides of the Atlantic, the East Orphan Basin’s petroleum potential remains to be validated by future deepwater drilling, probably by 2007-2008.

Discussion

Recent offshore Newfoundland and Labrador exploration was concentrated in the Jeanne d’Arc Basin and the deep water Flemish Pass Basin. In the Flemish Pass Basin, source rocks and quality reservoirs were drilled but no commercial discovery was made. Two wells in the basin have intersected Jurassic source rocks with important consequences for elucidating this and neighbouring Orphan Basin, petroleum systems. Still to be drilled is a large, atypical structural trap in the South Whale Basin (Lewis Hill), on the Southern Grand Banks and several Late Cretaceous- Early Tertiary basin margin and floor fans within the Jeanne d’Arc Basin. Although no exploration drilling took place in 2004, according to the province’s off s h o re oil and gas regulator, CNOPB, over 10,000 km of 2-D and 1,900 km2 of 3-D seismic data was acquired during 2004. The 3-D survey was done in the Orphan Basin and will help locate one of the first exploration wells in acreage operated by ChevronTexaco. Two other 3-D surveys will be executed during 2005. Additional 2-D seismic acquisition will help evaluate new drilling opportunities on the Labrador Shelf and a 3-D survey will help delineate leads in Laurentian Basin, one of the latest Canadian basins opened for exploration.

Offshore Newfoundland and Labrador petroleum potential area extends outside of the prolific Jeanne d’Arc Basin over an enormous region running all the way from of the Laurentian Basin, across the Grand Banks basins, through the deeper waters of the Flemish Pass and Orphan Basins and northward to include several basins along the Labrador shelf and slope. Underexplored Paleozoic age basins in the Gulf of St. Lawrence on the west side of the island of Newfoundland also extend into the Province’s onshore area and into the Labrador Sea. Specific gas exploration has still to be conducted in a planned manner in this entire area where the gas endowment was accumulated by drilling intended for oil objectives. With a production of more than 350,000 bopd representing more than 10 million barrels a month, the province of Newfoundland and Labrador is producing at the level of the smaller OPEC producer members from only two large fields!

Recommendations

Despite the fact that there is a continuous high level of interest in the Nova Scotia and Newfoundland and Labrador offshore and about two dozens costly well shave been sunk, large hydrocarbon discoveries remain elusive. Also, the return to the regulators (CNOPB and CNSOPB) of many licensed blocks without drilling and the reality that no major oil discovery has been recorded since late eighties, have cast a shadow of concern for the future of the industry in the area. As exploration results during the National Energy Program (NEP) of the early eighties and the activity levels following major oil and gas discoveries has demonstrated, increasing the annual drilling rate is the single way to record new field discoveries and maintain a sustainable East Coast petroleum industry. Nevertheless high oil prices, the drilling rates of the Atlantic Canada Frontier basins are at its lowest point in a decade.

In periods of low level drilling and in basins temporarily downgraded or abandoned by oil companies, innovative ways of stimulating exploration activities are recommended. Significant changes to the present fiscal regime of exploration in Atlantic Canada are suggested, including a) royalty holidays for wildcats in high geological risk basins coupled with solid provincial benefits and b) limitations of the terms and duration given to medium and smaller size Significant Discovery Areas (SDA). Similar kinds of industry incentives were repeatedly used in areas such as the deepwater Gulf of Mexico, North Sea and the deep gas basin of Alberta.

Conclusions

Although the future hydrocarbon potential for the deepwater Scotian Basin looks less promising today, the area remains as an under-explored, trap rich, source proven, large offshore region in proximity of hungry markets. Only when the data from the modern seismic grids and recent exploration wells is publicly released and analyzed by multidisciplinary teams of geologists, geophysicists and geochemists in Canada and around the world, the information obtained will tell a more complete story of the deepwater basins and indicate where to put the drill bit next. Flemish Pass with proven source rocks and several large structures yet to be drilled will probably wait for a new exploration cycle. East Orphan Basin and Laurentian Basin, with large unproven prospects and leads, have still to be drilled and their secrets to be unlocked. With seismic data on hand they look like word class basins with significant indications that they may contain large oil and gas fields.

In spite of high commodity prices, a low level exploration activity is predicted for the Atlantic Canada during the next decade. In the quest for Atlantic Canada’s next giant discovery, exploration drilling, performed mostly in deep and ultra-deep water, will test large structural traps in the Orphan Basin and structural- stratigraphic traps (turbidites) in the Scotian Slope, Laurentian and South Whale basins. Shallow water exploration will continue on the Deep Panuke carbonate trend, Listric fault domain around Sable Island, and within structural-stratigraphic plays in the Jeanne d ‘Arc Basin, close to present oil field developments.

As in any Frontier area, exploration success will depend on improved seismic imaging technology, regional geoscience evaluation, quality of prospects drilled, long range commitment to the area and sustained tempo of drilling. There is no quick petroleum wealth for the companies involved in exploration or the inhabitants of the two provinces. Exploration is a notoriously tedious process including wild competition for better basins, false starts, big strikes followed by disappointing follow ups and total abandonment of various basins followed by unexpected activity revivals. Success comes with expertise, perseverance, patience a passion for the oil finding challenge, ever motivated by increasing world demand for energy resources. No doubt true exploration-minded companies and their geoscience and engineering professionals will be generously reworded with trophy fields in the unsettled waters of the Canadian North Atlantic.

Acknowledgements

Phonse Fagan, Dave Hawkins, Ian Atkinson, Dr. Jim Wright, Jerry Smee, Garth Syhlonyk, Hugh Wishart, Nancy Harland, Kevin Meyer, Dave Brown, Paul Einarsson, Sam Nader, GSI, CNOPB, CNSOPB, Husky Energy, TGS-NOPEC; EnCana, Petro-Canada, PPSC, Memorial University, Department of Natural Resources, Government of Newfoundland and Labrador, Government of Nova Scotia, Landmark Graphics.

Join the Conversation

Interested in starting, or contributing to a conversation about an article or issue of the RECORDER? Join our CSEG LinkedIn Group.

Share This Article